Goldman Sachs Launching Trading Desk for Bitcoin

Goldman Sachs may become the first big Wall Street firm to fully embrace trading bitcoin. What could go wrong?

Goldman Sachs may become the first big Wall Street firm to fully embrace trading bitcoin. What could go wrong?

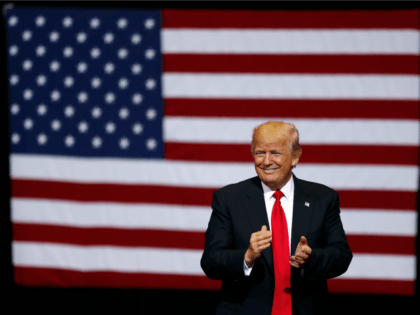

Thanks to a rapidly expanding economy, a booming stock market, real job growth, and the optimism that comes with all of that, President Trump’s approval rating jumped to 42 percent, according to CNBC.

The price of one full Bitcoin, the original decentralized digital currency, officially hit 10,000 U.S. dollars early Tuesday morning, according to data from CoinMarketCap.

America’s unemployment rate is already very low. Goldman Sachs says it will go even lower.

Wall Street fund managers are fighting back against a provision meant to make calculating gains from investing simpler for most taxpayers.

State Street Corp., the bank behind the installation of the “Fearless Girl” statue on Wall Street, has reportedly settled more than 300 gender discrimination allegations within the company.

The fate of Gary Cohn is a big topic at New York’s biggest Wall Street conference Tuesday. That’s hardly surprising.

Sunday’s North Korean nuclear test makes it all too clear that U.S. sanctions on North Korea and pleas with China for assistance have failed to rein in the rogue regime.

In a series of tweets on Friday after the news broke that President Donald Trump’s chief strategist Steve Bannon had stepped down, author and conservative pundit Ann Coulter praised Bannon and offered some advice to the president.

President Donald Trump should abandon his merit immigration reform and simply let employers import cheap workers to ensure profitability, the Wall Street Journal recommends.

The resistance has been commercialized.

Regulation does not reduce risk. It just moves it around.

Goldman’s deposit-taking and lending operation is tiny compared to its investment banking business.

Sen. Elizabeth Warren (D-MA) attacked former President Barack Obama for the second time in two weeks, this time over his handling of the economy.

President Donald Trump is open to the idea of breaking up giant Wall Street banks, separating consumer lending and investment banking.

New York Times readers are deserting in droves in protest that its new columnist, Bret Stephens, thinks incorrect thoughts about man-made global warming.

On Friday’s “Overtime” segment of HBO’s “Real Time,” host Bill Maher weighed in on President Obama’s Wall Street speech by saying, “It kind of looks like, when he’s on our team, we’re OK with it. … So isn’t the best

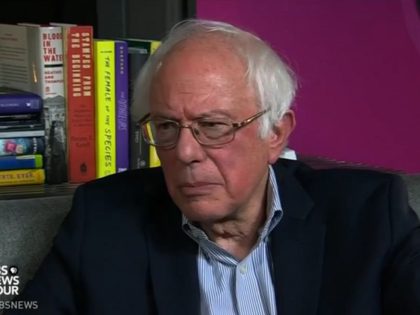

On Friday’s “CBS This Morning,” Senator Bernie Sanders stated that he thinks it’s “unfortunate” President Obama is speaking at a Wall Street investment bank for $400,000, “and I would have hoped that the president would not have given a speech like

During an interview on SiriusXM 102 Radio Andy’s program “Alter Family Politics” on Thursday, Senator Elizabeth Warren (D-MA) said she was “troubled” by President Obama accepting a $400,000 for an upcoming speech to Wall Street firm Cantor Fitzgerald. Warren said, “I was

Less than 100 days since leaving office, the former president has already arranged for a big Wall Street payday.

A Wall Street IT engineer has been arrested following accusations that he installed malware on his employer’s computer in order to discover if he was going to be fired.

Vice President of Business and Culture at the Media Research Center, Dan Gainor, joined Breitbart News Daily SiriusXM host Alex Marlow to discuss a number of topics from news including the best and worst cases of media bias this week, as well as the Vanity Fair hyping of Chelsea Clinton.

Goldman Sachs first-quarter trading results fell far short of Wall Street’s expectations even as rivals reported a strong quarter.

A battle is brewing in the heart of New York City’s financial district and it’s not about money. It’s a conflict between the artist who created the iconic three and a half ton bronze bull as a symbol of American strength and perseverance, and a four-foot high bronze girl planted in his path by an investment company.

In a press conference on Wednesday, the Italian-born artist behind Wall Street’s famous “Charging Bull” statue, Arturo di Modica, argued that the recently installed “Fearless Girl” statue was tantamount to a violation of copyright. Mr Di Modica’s attorney, Norman Siegel,

Wall Street pension management companies are protesting a decision by agency officials to preserve a 2016 regulation which supporters say will protect retirees’ savings from self-serving sales managers.

President Donald Trump was warmly welcomed by union workers attending the 2017 North America’s Building Trades Union legislative conference, as he promised to restore American jobs.

John Carney, Breitbart News finance and economics editor, joined SiriusXM host Alex Marlow on Thursday’s Breitbart News Daily to talk about the Dow’s hitting 21,000 for the first time after President Trump’s address to Congress.

“I screwed up the economy, your jobs and your mortgages so – hey – I’m just the guy you can trust to tell you what to do about climate change!”

Despite investor confidence and soaring stock prices, Amazon’s fourth-quarter earnings in 2016 fell below expectations.

Veteran financial journalist John Carney made his debut appearance as a Breitbart News commentator on Thursday’s edition of Breitbart News Daily to discuss the historic rise of the Dow Jones average above 20,000 points.

Snapchat’s social media parent, Snap, Inc., seemed headed for a $5 billion IPO until a former employee alleged in a conveniently timed lawsuit that the company misrepresented its financial position and pressured him for proprietary secrets about his former employer, Facebook.

President-elect Donald J. Trump’s incoming administration is girding for battle with corporatists, globalists, and special business interests over his core policy objective of bringing U.S. manufacturing jobs that have been shipped overseas back to the United States, several senior advisers to Trump tell Breitbart News.

During an interview on Monday’s “PBS NewsHour,” Senator Bernie Sanders (I-VT) argued that a party can’t take money from Wall Street, “and then tell working families that you’re on their side. People see through that. So, I think the Democratic

CNN Money made no bones about crediting the incredible post-election surge in the stock market to a “Trump rally,” as Wall Street hit the rare “superfecta”: all four major indexes closing at record highs on the same day.

Stephen K. Bannon (or, for those who want to maximize their SEO, Steve Bannon) — president-elect Donald Trump’s pick for White House chief strategist — made his pet issues known long before joining Trump’s insurgent presidential campaign. Now, Americans can reflect on what issues Bannon may take on within a Trump White House — and it does not look good for the culture of corruption in Washington, DC.

“U.S. stocks opened higher on Monday, with the Dow Jones Industrial average hitting a record high, as Donald Trump’s unexpected victory in the U.S. presidential election continued to lift the market,” Reuters reported on Monday morning. The Dow opened at 18,914.78.

About 40 people have occupied Sen. Chuck Schumer’s (D-NY) Capitol Hill office to protest his ties to Wall Street as he prepares to lead Senate Democrats in the 115th meeting of Congress, the Associated Press reported.

Peter Morici, University of Maryland business professor and former director of economics for the U.S. International Trade Commission, appeared on Monday’s Breitbart News Daily to discuss his weekend column for the New York Post, “Trump Can Get Us the China Deal We Deserve.”

From CNBC:

U.S. equities closed mostly higher on Friday, with the three major indexes posting their best weekly gains of the year on the back of a surprise Republican sweep.