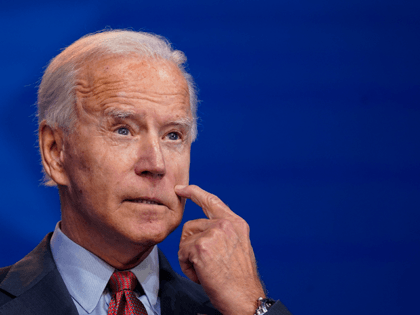

Joe Biden Says He’ll Get Infrastructure Deal with Republicans ‘Easy, Just Snap My Fingers’

When asked by reporters about how compromise with Republicans was achievable, Biden replied wryly, “Easy. Just snap my fingers. It will happen.”

When asked by reporters about how compromise with Republicans was achievable, Biden replied wryly, “Easy. Just snap my fingers. It will happen.”

Locals in Cali, Colombia, responded to an influx of hundreds of protesting indigenous people into their residential complexes with firearms and machetes on Sunday, a testament to widespread civilian discontent with the government’s handling of left-wing riots nationwide last week.

On Friday’s “PBS NewsHour,” New York Times columnist David Brooks stated that while raising the corporate income tax will probably result in companies leaving for places will lower corporate tax rates, “But it seems to me the Biden administration has chosen the

The president spoke about negotiations with Republicans over his planned $2.3 trillion jobs bill and his $1.8 trillion plan to expand entitlements.

Tuesday, Rep. Madison Cawthorn (R-NC) predicted President Joe Biden’s tax hikes to help pay for his spending plans would “lead to a recession.”

The president spoke at Tidewater Community College in Virginia on Monday, highlighting his plan to raise taxes significantly on corporations, investment income, and Americans making more than $400,000

Prominent Silicon Valley billionaire and investor David Stewart tweeted President Joe Biden’s capital gain tax, proposed to be raised about 20 percent, would make it harder for startups to recruit employees because “the tax system will punish their employees.”

That really is where the guy is coming from. In his eyes, the federal government is “we the people” and you stupid suckers out there need to just shut up and pay your taxes. He will spend your money for you.

The Hungarian government of national conservative leader Viktor Orbán has scrapped income tax for under-25s as part of its efforts to aid a post-pandemic recovery, discourage emigration, and help young people to form families.

Business owners said President Biden’s first 100 days in office represents a “war on small business” with higher taxes and worker shortages.

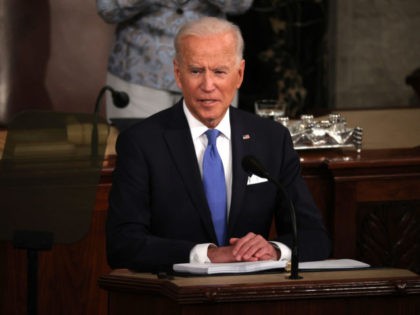

President Joe Biden used his first address before a joint session of Congress Wednesday evening to talk about the “American Families Plan” for low- and middle-income families.

President Joe Biden spoke to a joint session of Congress Wednesday, touting tax increases from two initiatives as a way of “guaranteeing fairness and justice.”

President Joe Biden spoke to a joint session of Congress Wednesday to propose a $1.8 trillion “human infrastructure” proposal that comes with a myriad of tax increases, including expanding the death tax.

President Joe Biden reintroduced the $2.25 trillion American Jobs Plan or “infrastructure” proposal Wednesday that would drastically alter American business.

President Joe Biden will reportedly propose a $200 billion initiative to provide free preschool for five million three- and four-year-old children in a speech to a joint session of Congress Wednesday.

President Joe Biden is planning to ask for an additional $80 billion in the “American Families Plan” for the Internal Revenue Service (IRS) to boost their audit capabilities in order to crackdown on tax evasion by high-earners and large corporations, according to reports.

Stocks fell on the news that Biden plans to nearly double the tax on capital gains for wealthier Americans.

President Joe Biden and his administration have already outlined their next big spending bill, The American Families Plan. A basic outline of the second bill was revealed by the Washington Post on Tuesday citing “two people aware of internal discussions.”

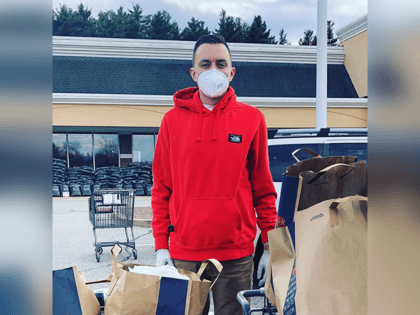

In April 2020, middle school teacher Louis Goffinet of Mansfield, Connecticut, started grocery shopping for elderly neighbors hesitant to enter a store when the coronavirus pandemic began.

The United States Justice Department filed a civil lawsuit against Roger Stone and his wife on Friday in federal court in Fort Lauderdale, Florida, and accused the couple of owing about $2 million in federal income taxes.

New York nixed state tax breaks for real estate developers who invest in low-income neighborhoods — or opportunity zones — across the U.S.

Senate Minority Leader Mitch McConnell (R-KY) slammed the Democrats on the Senate floor Tuesday for an “Orwellian campaign” that seeks to relabel many progressive policies as “infrastructure.”

On Friday’s “PBS NewsHour,” New York Times columnist David Brooks predicted that President Joe Biden’s infrastructure package won’t be paid for since Democrats will keep all the spending in the bill, but will compromise on the tax increases in the plan. Brooks

A study conducted by Rice University economists John W. Diamond and George R. Zodrow found raising taxes similar to President Joe Biden’s tax hike to 28 percent would kill American “economic activity” and one million jobs in the first two years.

President Biden’s tax hike plan will cost the American economy one million lost jobs in the first two years, according to a study from the National Association of Manufacturers.

In a March 25 letter to the president, Republican Study Committee Chairman Rep. Jim Banks called out Joe Biden’s tax avoidance “hypocrisy.”

New York City’s wealthiest earners will likely pay the highest state and income tax rates in the U.S., according to a budget deal among New York lawmakers that would raise taxes among this bracket.

Sen. Joe Manchin (D-WV) came out in opposition of President Joe Biden’s $2 trillion infrastructure proposal, citing the bill’s raising of the corporate tax rate to 28 percent.

President Joe Biden’s infrastructure proposal is facing GOP criticism over divergent line items unrelated to classical infrastructure investment.

Joe Biden argued the tax hikes were necessary to help pay for his dramatic spending proposal.

In a Thursday interview on MSNBC’s “Stephanie Ruhle Reports,” Secretary of Transportation Pete Buttigieg discussed President Joe Biden’s $2 trillion infrastructure plan.

President Joe Biden’s infrastructure proposal will ramp up the Internal Revenue Service (IRS) activities on business, where each business may be audited like “A decade ago… annually by the IRS” so they “pay their fair share.”

President Biden’s $2 trillion infrastructure plan, dubbed the American Jobs Plan, is not sufficient and “needs to be way bigger,” Rep. Alexandria Ocasio-Cortez (D-NY) said on Tuesday prior to the proposal’s formal unveiling.

President Joe Biden proposes to tax American business at a higher corporate tax rate than Communist China charges American business.

Moderate House Democrats are pushing back against potential tax hikes intended to fund President Joe Biden’s $3 trillion infrastructure package.

Senator Elizabeth Warren clashed publicly with Amazon on Twitter Thursday night after she accused the company of not paying its “fair share” of taxes. The battle is the latest example of rifts in the coalition of the left that brought

Transportation Secretary Pete Buttigieg said Friday on CNBC’s “Squawk on the Street” that to fund President Joe Biden’s infrastructure bill, a tax on mileage traveled looks promising.

During an interview aired on Thursday’s “MSNBC Live,” White House Press Secretary Jen Psaki reacted to concerns that corporations will raise prices if taxes on corporations are increased by stating that President Joe Biden believes people “know that corporations do

As a candidate, His Fraudulency Joe Biden pledged not to raise taxes on “anybody” making $400,000 or less. On Wednesday, the White House basically announced Biden had lied. Akshually, the number is more like $200,000.

Over 100 House members have signed a bipartisan letter asking the IRS on Tuesday to delay the April 15 tax filing date.