Negotiation 101: Why Republicans Capitulate on Budget — for Now

There is a simple reason Republicans lost the budget battle: they were willing to accept almost any deal, and Democrats knew it.

There is a simple reason Republicans lost the budget battle: they were willing to accept almost any deal, and Democrats knew it.

Bruce Springsteen once told his audience that it matters not “which side of the 99 percent you’re on but on which side of history you’re on.” But the one percenter confessed to Tom Hanks this weekend that he long stood on the wrong side of the IRS.

“If I had been asked by the White House to assert a proposition as demonstrably false as the claim that this plan would produce revenue, I would have resigned,” Summers said.

The head of a leading economic think tank has savaged the Conservative Party’s election platform, questioning the party’s commitment to lowering tax and cutting state spending.

The Trump administration on Wednesday proposed a wide-ranging tax overhaul that would slash taxes for businesses and simplify income taxes for individuals and households. The proposal is a barebones outline rather than a detailed plan, leaving many things to be worked out in negotiations with Congress.

Plan slashes taxes on individuals, small businesses and corporations.

Real men (as well as pull-no-punches women) cut taxes. The lesser mortals that tend to inhabit Washington wring their hands and get all weak in the knees when it comes to cutting taxes. Rumors are President Trump will propose a real tax cut. I certainly hope so.

Asked if the plan would be revenue neutral, meaning any reductions in expected revenue from tax cuts would be offset from increases in revenue or spending cuts elesewhere, Mnuchin instead said the plan would “pay for itself” through economic growth.

The average tax rate for married filers was 16 percent, as opposed to unmarried filers, who paid 13 percent on average.

President Donald Trump on Sunday took to Twitter to call for an investigation into “who paid for the small organized rallies yesterday” – referring to the anti-Trump Tax Day March held Saturday in Washington and at least 60 other locations.

While Americans are scrambling to meet the 2016 tax filing deadline, the number of illegal immigrants submitting their returns in the present climate are reportedly down significantly. Also, a Treasury Inspector General for Tax Administration (TIGTA) report exposing significant refund fraud has “most certainly contributed to it,” says the taxpayer advocate department within the IRS.

President Donald Trump said he prefers the term “mirror tax” compared to “border adjustment,” a controversial provision of his tax reform bill.

Nearly 75 percent of Americans approve of Trump’s infrastructure improvement plans, with just around 10 percent disapproving. More than 60 percent of the public endorse plans to cut individual taxes, with just over 20 percent opposing. Renegotiating trade deals is favored by 58 percent of the public, and opposed by just over 25 percent.

Federal prosecutors have recommended a 7.5-year jail sentence for former Chicago Public Schools chief Barbara Byrd-Bennett who pleaded guilty to corruption charges in 2015.

“I don’t know if it’s August or not,” Cohn said in an interview Friday morning on Bloomberg TV. “Getting it done well and getting it done right is more important than getting it done soon.”

The administrative state gone wild! IRS agents targeted the innocent because it was easier and quicker than going after real criminals.

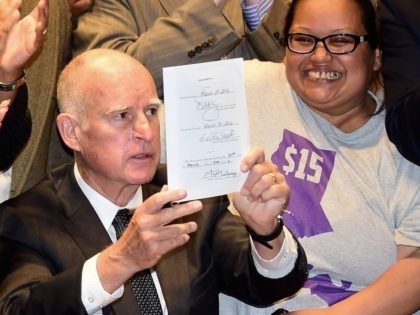

Governor Brown is on the eve of a self-appointed April 6 deadline to push what he has titled the Road Repair and Accountability Act of 2017, which seeks to impose new gasoline taxes and car registration fees to bring in an estimated $52.4 billion in increased tax revenues over the next decade alone.

Once hailed as an answer to both traffic jams and global warming, Seattle’s troubled bike-sharing system, Pronto, is now slated for dismantling, city officials say.

Rep. Mo Brooks (R-AL) told SiriusXM host Alex Marlow of Breitbart News Daily on Friday morning that he expects a vote on the House Obamacare replacement bill, the American Health Care Act (AHCA), the same day. Brooks is opposed to the bill.

Many of the wizards of Wall Street predicted stocks would slump if Donald Trump won the presidency. Now they’re worried that stocks could be vulnerable if President Trump’s agenda stalls in Washington, D.C.

Key elements of his economic program—tax, regulatory and trade reform—are delayed by the considerable distraction of replacing ObamaCare.

The Wall Street Journal checked county land records, and found that President Donald Trump accepted generous tax breaks offered by state governments during his previous career as a real-estate entrepreneur.

A New York Times columnist is soliciting IRS employees to commit a felony by leaking President Donald Trump’s tax returns to the paper.

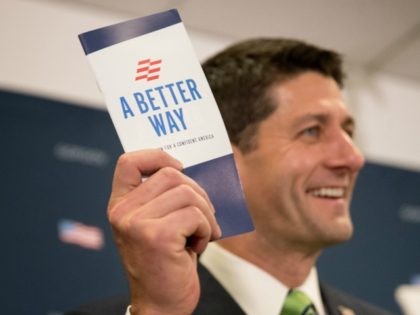

Ryan’s plan is based on the theory that under the BAT plan the dollar will immediately appreciate by 25%. You read that right – Paul Ryan is betting the federal tax system on a market prediction.

According to a new report by the Internal Revenue Service, a record number of American citizens have given up their U.S. citizenship for that of another nation.

Representative Doug Lamborn, R, CO, has introduced a pair of bills to eliminate the federal tax dollars that fund the budgets of National Public Radio (NPR) and the Corporation for Public Broadcasting (CPB).

The Texas county judge in the state’s fourth most populated county is demanding that the federal government reimburse it after spending $22.3 million jailing criminal illegal aliens. He also wants money to cover future costs.

Last June, House Republicans and the Ways and Means Committee unveiled our blueprint for bold, pro-growth comprehensive tax reform.

President-Elect Donald Trump may not be well-liked in the deep blue state of California, but he is seeing growing support for his proposal to enforce federal immigration laws.

Last week Senator Elizabeth Warren introduced a bill that would require President-elect Trump and future presidential nominees to release their last 3 years of federal tax returns. This bill is a partisan ploy — the only co-sponsors are Democrats – and it is clearly meant to shame President-elect Trump, who did not release his. And there are demands for Trump Cabinet nominees to disclose their tax returns, which will inevitably be leaked. But it is worth pointing out that the idea that releasing tax returns somehow promotes rational discourse in election campaigns or confirmation hearings is nonsense.

“The devil is in the details,” Bernie Sanders said. “We’ve got to see what these regulations are. It’s very easy to blame Barack Obama for everything, by the way. Some of those regulations may be state, may be local,” the Vermont senator said.

Donald Trump’s election as president has made many small business owners more upbeat about 2017.

I’m just old enough to remember when Republicans used to be for tax cuts. Oh sure, many of them will make noises about lowering some taxes, but too often they are caught up in the trap of so-called “revenue neutral tax reform”. This is especially true of Congressional leaders.

Tax-free tampons is the clarion call of six Texas lawmakers–five Democrats and one Republican–all intent on proposing legislation that would exempt feminine hygiene products from state sales tax by reclassifying these items as necessities.

Eight brand new GOP legislators will be sworn into office today. Fleischman offers advice to newbies, and to their 30 other GOP colleagues in the legislature.

There are 17 propositions on the California ballot next month. They range from good, to bad, to downright ugly.

At a rally in Harrisburg, Pennsylvania, Hillary insisted she was going to “create more fairness” in the nation but spent a lot of time reiterating her attacks on Donald Trump’s taxes, again claiming he “rooted for the housing collapse.”

Donald Trump talked about America’s complex tax code during his campaign rally in Pueblo, Colorado on Monday, following a recent New York Times report that the real estate mogul benefited substantially from tax laws and suggested that he may not have paid taxes for more than a decade.

Monday on the Fox News Channel, “MediaBuzz” host Howard Kurtz said revelations from over the weekend revealed in a leaked copy of GOP presidential nominee Donald Trump’s 1995 taxes returns isn’t having the effect that the media are portraying it

AUSTIN, Texas — Local firefighters are pushing back against a lawsuit alleging they are spending a significant amount of time engaging in union activities when they should be answering calls.