Tax Cuts Will Drive So Much Investment into the U.S. that Other Countries’ Tax Collections Will Fall

The cuts in corporate taxes will likely drive so much investment back into the U.S. that other countries will find themselves will less to tax.

The cuts in corporate taxes will likely drive so much investment back into the U.S. that other countries will find themselves will less to tax.

According to a disclosure filed this week, Amazon paid less than £4.6 million on taxes in the United Kingdom last year — dropping by almost half from 2016 — even as profits in the country tripled.

A group of San Francisco residents are calling for illegal aliens to have the same voting rights as American citizens, according to a video released Wednesday.

Leading pro-Brexit Tory MP Jacob Rees-Mogg has slammed Theresa May’s government for seemingly breaking an election promise and moving towards tax hikes to fund the UK’s socialised healthcare system.

GOP leaders are betting their House majority on voters’ supposed gratitude for the 2017 tax cut, but GOP candidates are betting their seats on public opposition to more cheap-labor immigration in 2019.

Illinois is losing more citizens than nearly every other state, and according to reports, the biggest reason citizens are leaving is that they can no longer afford to live in the Land of Lincoln.

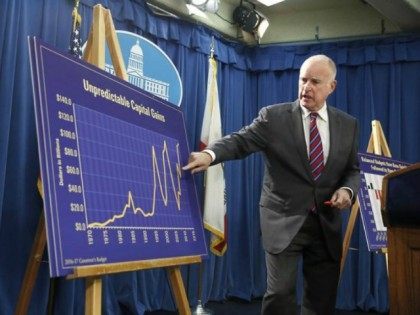

California Gov. Jerry Brown has submitted his May revised 2018-2019 budget, which indicates he will leave office in January with the maximum $13.5 billion rainy-day fund. Brown, a liberal Democrat, has complained that no politician should face the type of

House Minority Leader Nancy Pelosi (D-CA) said Thursday that Democrats would raise taxes if they win the 2018 midterm elections.

In an interview during a Politico Playbook Live event on Tuesday, House Minority Leader Nancy Pelosi (D-CA) told Politico’s Anna Palmer and Jake Sherman that it would be “accurate” to say that she would seek to raise taxes if her party under

The World Bank is allowing Kabul to use the Afghanistan Reconstruction Trust Fund (ARTF), financed by American taxpayer money estimated in the billions, to pay for “dysfunctional” projects and possibly even “ghost workers,” a U.S. watchdog agency announced Wednesday.

California’s tax revenues are up sharply as the rich pre-pay 2017 income taxes before the Trump tax cut starts limiting the amount of state and local taxes the wealthy can deduct.

President Donald Trump’s new tax cut, which limiting state and local tax deductions, will cost rich Californians $12 billion more in federal taxes, with $9 billion coming from those making $1 million or more.

A former eye surgeon and president of Oregon Health and Science University (OHSU) is reportedly receiving a monthly taxpayer-funded pension of more than $76,000 a year.

Credit scores for some consumers will jump by as much as 30 percent, starting this month, due to changes in how credit companies report consumer debt and payment history.

In a Saturday morning tweet, President Donald Trump wrote that the far-left Washington Post should register as a lobbyist for the online mega-retailer Amazon.

The United States gained 700,000 new millionaires in 2017 due to increases in stock prices and housing values, according to a report released Wednesday.

California’s bullet train appears to have released a “High Case” estimate of $98.1 billion to prepare the public for much higher tunneling costs.

Democrats claim the key to flipping the House of Representatives in November is targeting four GOP seats in California’s Orange County, formerly the “Most Republican County in America.”

The “Base Case” estimated cost to build California’s bullet train from San Francisco to Los Angeles has doubled to $77.3 billion, and could almost triple to $98.1 billion.

Christian church officials reopened the Church of the Holy Sepulchre in Jerusalem Wednesday, after Israeli officials announced suspension of a plan to impose new taxes on church properties in the holy city.

More than 35,000 U.S. retailers trafficked more than $1 billion in food stamp benefits a year over a period of three years, a report from the U.S. Department of Agriculture (USDA) found.

Vice President Mike Pence thrilled the assembled throngs at CPAC near the nation’s capital in a speech addressing the full range of conservative issues, declaring that “2017 was the most consequential year in the history of the conservative movement,” and that President Donald Trump’s administration is just getting started on judges, the economy, and empowering American families.

Job Creators Network, one of the nation’s largest pro-jobs grassroots organizations, released an ad this week slamming House Minority Leader Nancy Pelosi (D-CA) for calling the $1,000 tax cut bonuses being doled out to millions of working Americans ‘crumbs.’

A new bill passed in the Arizona Senate will allow residents of the state to pay their taxes in bitcoin.

Lt. Governor Gavin Newsom seems to be trying to rescue his collapsing Governor campaign by leveraging his Chairmanship of the California Lands Commission to fight the Trump administration’s plan to open up offshore oil drilling. One of the positions that

A subsidy that died at the end of the Obama era was surprisingly revived by the budget bill, albeit as a strange, undead beast.

Lowe’s confirmed on Thursday that it plans to give its workers bonuses of up to $1,000 as a result of tax reform.

Democrats promise more of other people’s money as the answer to health care costs, and they are winning in Oregon and elsewhere. Republicans, so far, promise nothing.

Barbra Streisand weighed in on the newly-signed tax reform law Thursday, explaining that she believes the GOP-led effort was deliberately set up to harm blue states, athletes, Hollywood, and the middle class.

Recreational use of marijuana is officially legal in the State of California as of New Year’s Day — provided that consumers can find someone to sell it to them at licensed dispensaries, which are still in short supply.

New York Governor Andrew Cuomo told CNN’s New Day on Thursday morning that President Donald Trump’s new tax reforms are “a dagger in the heart of New York and California” because they cap the state and local tax (SALT) deduction.

How can the Tea Party movement, which campaigned on balancing the budget and paying down the debt, tolerate a massive tax cut that is only going to be followed by demands for more federal spending?

The tax reform bill, which passed on Tuesday and Wednesday, has a number of unheralded benefits — including tax credits for large wineries, brewers, and distillers in California.

Former Bill Clinton Treasury Secretary Larry Summers argued in an op-ed for the Financial Times on Monday that thousands will die because the Republican Tax Cuts and Jobs Act will repeal Obamacare’s individual mandate.

Hollywood stars jumped on social media late Friday night and into early Saturday to fume and forecast the end of America after the Senate passed the Tax Cuts and Jobs Act on Saturday.

Newly released presidential travel records from the U.S. Department of the Air Force and the Secret Service show that former President Barack Obama’s family vacations and campaign expenses cost taxpayers $114 million.

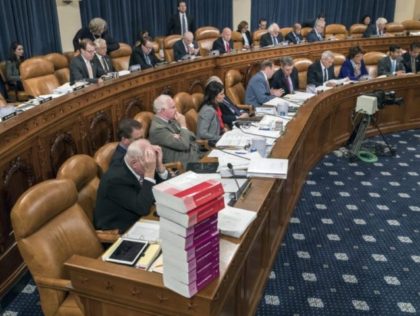

The Republican tax bill under consideration on Capitol Hill would add $1.7 trillion to budget deficits over the next decade, the Congressional Budget Office said.

The NFL is not a big fan of recent Republican tax reform proposals that cancel the billions that teams get in tax subsidies to build and operate sports stadiums across the country, a report says.

Bernie Marcus, co-founder of Home Depot, spoke with Breitbart News Daily SiriusXM host Alex Marlow on Friday about his Job Creators Network and how tax reform can benefit American businesses.

President Donald Trump praised the tax bill released by House Republicans, calling it a “historic” moment for American families and urged Congress to pass it by Christmas.