White House Adviser Gary Cohn Faces Pressure to Deliver on Tax Reform

Former Goldman Sachs COO Gary Cohn faces a big first hurdle as the White House economic adviser as he helps launch an ambitious overhaul of the tax system.

Former Goldman Sachs COO Gary Cohn faces a big first hurdle as the White House economic adviser as he helps launch an ambitious overhaul of the tax system.

In her first interview since becoming the spokeswoman for the Republican National Committee (RNC), former CNN contributor Kayleigh McEnany talked to Sirius XM host Alex Marlow on Breitbart News Daily on Tuesday, during which she stressed the importance of Republicans unifying behind President Trump’s agenda.

With the failure of the healthcare repeal-and-replace effort behind them and mindful of that survive-so-as-to-fight-again-and-win ethos, GOP leaders on both ends of Pennsylvania Avenue have been making what’s been described by one insider as “a hard pivot to tax reform” and other Trump agenda items with a better chance of #winning.

It was even vaguer than the White House’s April proposal.

Former Speaker of the House and bestselling author Newt Gingrich spoke about the future of tax reform with Breitbart News Editor-in-Chief Alex Marlow Monday.

SiriusXM host Alex Marlow asked Rep. Ron DeSantis (R-FL) for his thoughts on the Republican healthcare bill on Friday’s Breitbart News Daily.

Higher rates do not always mean tax hikes.

The conventional wisdom in the media, and even among many conservatives, is that President Donald Trump’s tweets are frustrating his policy agenda. But the opposite is true: his most controversial tweets are helping him.

Congressional Republicans do not seem too unhappy that there may not be an August recess this year.

Now that Karen Handel has won — and won decisively, stunning the pollsters and pundits once again — the road is wide open for Trump’s legislative agenda.

Focus group guru Frank Luntz, during an appearance on CBS This Morning on Monday, noted that he senses a rebellion against House Speaker Paul Ryan brewing among supporters of President Donald Trump nationwide.

Speaker of the House Paul Ryan (R-WI) turned his attention to tax reform Tuesday as he addressed a meeting of the National Association of Manufacturers (NAM).

Republicans in Congress, having largely failed to enact any big money items of the agenda on which they were elected, are reportedly considering scrapping the August recess in an effort to pass some parts of their agenda.

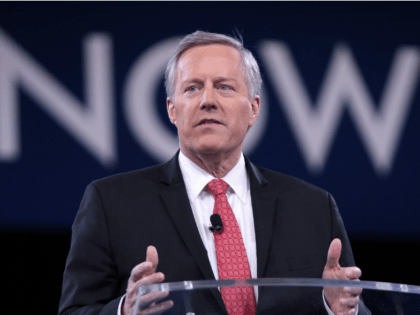

Freedom Caucus Chairman Mark Meadows (R-NC) told Breitbart News in an exclusive interview that the Senate health care bill is a “non-starter.”

Job Creators Network and Freedom Works, two of the nation’s largest grassroots organizations, have launched a nationwide campaign to force lawmakers to pass tax reform legislation that will spur small business job creation and give American taxpayers an economic boost.

An op-ed by Alfredo Ortiz, President and CEO of the Job Creators Network, points out that “small business expansion is negligible” in the U.S., and “there has been a decades-long slowdown in new business creation.”

House Freedom Caucus chair Mark Meadows (R-NC) says that if Congress fails to introduce a tax reform package by the end of July leadership in the House and Senate should call off the August recess.

The White House will meet with business leaders to discuss tax reform.

WASHINGTON, D.C. — On Tuesday evening, President Donald Trump will host a handful of Republican congressional leaders at the White House for a dinner centered around the President’s first trip abroad. He will also preside over an afternoon bicameral Republican leadership

In an interview that aired Sunday on New York AM 970’s “The Cats Roundtable,” House Speaker Paul Ryan said Donald Trump’s tax reform will come by the end of 2017. “[T]he crown jewel of our economic growth plan is tax

Now that President Trump has submitted his plan to Congress to reform our tax system, Congress needs to act and be bold.

In this week’s exclusive clip for Breitbart News, Jackie questions why lawmakers can’t seem to get the three things Americans want most — health care, tax reform and the continuing resolution — passed once and for all.

No, Trump has not achieved everything he said he would. And yes, he has broken a few promises. But on most substantial issues, he is delivering what he offered.

President Donald Trump will renegotiate NAFTA rather than terminate it, after a day of chaos sent top business interests and members of congress scrambling.

Plan slashes taxes on individuals, small businesses and corporations.

Details of the Trump Administration tax reform plans began trickling out ahead of the Wednesday announcement, revealing plans to massively simplify the tax system, adjust tax rates for individuals and businesses, and eliminate several taxes including the AMT, inheritance, and specific Obamacare taxes.

Cut tax rates, create cash flow, “You’ve got to allow people to make money,” Rep. Roger Williams (R-TX) told Breitbart News this week in an exclusive interview on tax reform.

President Donald Trump, posed the question whether he would choose to pass healthcare reform or government funding through Congress next week, said he wants both.

This week Treasury Secretary Steven Mnuchin blamed a delay in healthcare reform for likely pushing the “aggressive timeline” for President Donald Trump’s tax reform back until after congress’ August recess.

Autry Pruitt, board member of FAIRtax.org spoke with Breitbart News Daily SiriusXM host Alex Marlow on Friday regarding tax day rallies planned to take place across America, including in front of Trump Tower in NYC.

President Donald Trump defended his political agenda after media reports highlighted a pivot to a more centrist agenda.

Tuesday on Fox News Channel’s “Fox & Friends,” Trump senior adviser Kellyanne Conway said the Trump administration was going to work with Congress on the passage of tax reform and urged Democrats to listen to their constituents on the issue,

Pete Sepp, president of the National Taxpayers Union, talked with Breitbart News Daily SiriusXM host Alex Marlow on Tuesday about tax reform and infrastructure, two pending President Trump initiatives.

Monday on MSNBC’s “Morning Joe,” Rep. Jim Jordan (R-OH) was asked by co-host Mika Brzezinski to look ahead to other campaign promises President Donald Trump had made beyond the repeal of Obamacare, including tax reform and border security. Jordan argued

One day after the American Health Care Act (AHCA) vote was canceled for a second time, Vice President Mike Pence told West Virginians at Foster Supply Company in Charleston that 100 percent of House Democrats and a handful of Republicans were to blame for standing in the way of President Trump’s health care bill, but a report has surfaced that in the final days before passage of the bill, Pence pushed to label the bill “Ryancare.”

The White House tried very hard Friday to send a clear message that the success of President Donald Trump’s tax and infrastructure agenda does not turn on the fate of the Obamacare replacement bill.

During Friday’s Weekly Address, President Trump stated, “we’re in the process right now of working on a major tax reform that will massively reduce taxes on our workers and businesses.” Transcript (via NBC News) as Follows: “My fellow Americans, this

President Donald Trump met with airline executives on Thursday, providing them with an update on his overall tax reform plan.

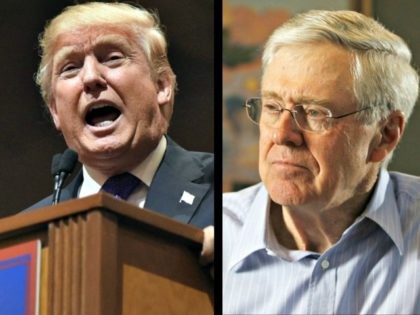

The pro-jobs tax plan being developed by establishment Republicans, including House Speaker Paul Ryan, is now being opposed by the Koch brothers’ advocacy group, Americans For Prosperity.

Treasury Secretary nominee Steven Mnuchin’s confirmation hearings on Thursday will feature a robust call for pro-growth tax reform, debt reduction, an America-first trade policy, and dramatic cuts to overbearing federal regulation.