Senate Tax Bill Delivers Its Largest Tax Cuts to Middle Class

Donald Trump’s claims to truckers are vindicated by a new analysis of the Senate tax plan put out by the Joint Committee on Taxation.

Donald Trump’s claims to truckers are vindicated by a new analysis of the Senate tax plan put out by the Joint Committee on Taxation.

A coalition of liberal and labor groups named “Not One Penny” began airing a series of television ads on Saturday targeting five of California’s Republican members of Congress over the GOP’s tax reform plan.

Republicans can turn their political prospects around in time if they deliver on at least some of their promises, allow insurgent campaigns to flourish, and warn voters about “Speaker” Nancy Pelosi.

The Senate tax reform bill differs in many important ways from the House bill, including the size of child tax credits and mortgage deductions.

The stock market is the closest thing America has to an instant gauge on economic news. Even if it is an often fickle judge, the stock market bears watching when economically relevant news breaks.

Steven Bannon is backing a House proposal to limit the ability of hedge fund and private equity managers to take advantage of the carried-interest tax break.

Rep. Matt Gaetz (R-FL) joined SiriusXM host Alex Marlow on Thursday’s Breitbart News Daily to talk about tax reform, which he called a “work in progress.” He also discussed his call for the removal of Robert Mueller as special counsel in the investigation of Russian influence on the 2016 election.

During an interview Wednesday’s edition of Fox News Radio’s “Brian Kilmeade Show,” House Speaker Representative Paul Ryan (R-WI) reacted to the Virginia Gubernatorial election by stating that his takeaway is Republicans have to “get our job done,” and cited tax

Rep. Darrell Issa (R-CA) said Tuesday that he will not support the current version of the Republican congressional leadership’s tax reform plan, the Tax Cut and Jobs Act.

Republicans should simplify the tax proposal, focusing on the reduction in the corporate tax rate, while repealing Obamacare’s individual mandate and ending tax benefits for employers who hire illegal aliens.

Rep. Steve King and eleven of his House colleagues are calling on the Ways and Means Committee to include King’s “New IDEA (Illegal Deduction Elimination Act)” in the Republican tax reform plan for an estimated $254 billion increase in tax revenue over the next decade.

Republican Congressman Ken Buck is calling on Congress to restrict the ability of companies to deduct sexual harassment settlements from their taxes as Hollywood continues to reel from a widespread sexual misconduct scandal.

Rep. Andy Biggs (R-AZ), a member of the House Freedom Caucus, wrote a letter to Speaker Paul Ryan and House Ways and Means Committee Chairman Kevin Brady (R-TX) that Republicans should retroactively cut taxes starting on January 1, 2017.

Jill Vogel, the Republican nominee for lieutenant governor in Virginia, joined SiriusXM hosts Alex Marlow, Raheem Kassam, and Steve Bannon on Tuesday’s Breitbart News Daily on the morning of the election.

The carried-interest loophole will remain open but have a holding period twice as long.

While the Republican tax bill unveiled Thursday is undoubtedly business-friendly, there is one set of American companies that come in for a new and costly tax: the big banks.

Ivanka Trump created her own paparazzi following as she arrived in Japan on Thursday, instructing staff to film her as she deplaned.

Bernie Marcus, co-founder of Home Depot, spoke with Breitbart News Daily SiriusXM host Alex Marlow on Friday about his Job Creators Network and how tax reform can benefit American businesses.

Republican efforts to enact tax reform face a serious challenge.

Even before the House bill was released Thursday, 60 percent of Americans said the plan favored the wealthy, according to a poll by ABC News/Washington Post. The poll was taken between October 29 and November 1, the day before the Tax Cuts and Jobs Act was released.

Rep. Ron DeSantis (R-FL) spoke with Breitbart News Daily SiriusXM host Alex Marlow on Thursday regarding a proposed Mueller amendment to limit the special counsel investigation to between March 2015 and the present. He also discussed tax reform in the House.

Rep. Ron DeSantis (R-FL) spoke with Breitbart News Daily SiriusXM host Alex Marlow on Thursday regarding a proposed Mueller amendment to limit the special counsel investigation to between March 2015 and the present. The two also discussed tax reform in the House.

Rep. Ron DeSantis (R-FL) spoke with Breitbart News Daily SiriusXM host Alex Marlow on Thursday regarding a proposed Mueller amendment to limit the special counsel investigation to between March 2015 to present and also tax reform in the House.

House Republicans unveiled their bill to overhaul the U.S. tax code Thursday morning. We’ll follow along with the news and analysis of the bill all day. Refresh this page for the latest updates.

Senate Minority Leader Chuck Schumer (D-NY) told a rally of people opposed to the yet-to-be-disclosed Republican tax bill that stopping the legislation is the first step to taking back the country.

“Only an idiot would trust the government’s promise not to tax these things again,” Trump campaign economic adviser Stephen Moore said.

House Republicans delayed the release of their tax bill Tuesday night, a sign that the GOP leaders still have not resolved disputes between its members over tax breakers and how to pay for tax cuts.

Plans to release the text of a tax reform bill on Wednesday were delayed, with a new goal of releasing the Republican bill on Thursday.

Alfredo Ortiz, the president and CEO of the Job Creators Network, defends President Trump’s tax cut framework from critics who seek to discredit it by comparing the Republican federal tax cut effort to Kansas state’s 2012 tax cuts.

Despite news reports saying GOP lawmakers are considering a phase-in of tax cuts, the White House says that is not the plan.

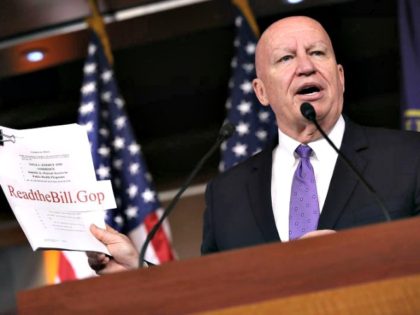

House Ways and Means Chairman Kevin Brady (R-TX) announced that the Republican tax plan will include the state and local tax (SALT) deduction, a measure that will that will smooth the Republicans’ rollout of tax reform later this week.

During Friday’s Democratic Weekly Address, Senator Ben Cardin (D-MD) stated that in an increasingly “shameful, highly partisan process,” Republicans have cut Democrats out of any discussion on tax reform. Transcript as Follows: “Hi. I’m Senator Ben Cardin of Maryland. I’d

California Gov. Jerry Brown warned fourteen Republicans in the state’s congressional delegation Friday that it would be “morally” wrong for them to support President Donald Trump’s tax reform plan.

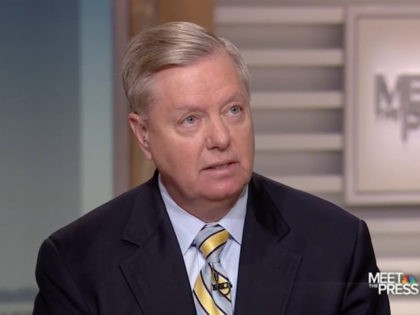

During an interview with Brian Kilmeade on Fox News Radio on Friday, Senator Lindsey Graham (R-SC) argued that if there isn’t meaningful tax reform, “that’s probably the end of the Republican Party as we know it.”

Some Republicans may create a roadblock in tax reform through their opposition to the repeal of the state and local tax (SALT) deduction.

All 14 California Republicans in the U.S. House of Representatives voted Thursday to pass the Senate’s version of a new budget bill that prepares the way for tax reform.

Although Republicans in the nation’s capital claim they want to cut taxes for the middle-class, top GOP officials keep coming up with ways to hike taxes that would fall hardest on middle-income Americans.

The House GOP’s top leader on tax reform said Wednesday that changes to a popular tax break for retirement savings are still under consideration.

“His poll numbers in Arizona are so low, that he couldn’t win,” Trump said. “And I don’t blame him for leaving. I think he did the right thing for himself.”

Doubts abound about whether the GOP will manage to come together on tax reform, something they could not do with Obamacare.

“The meeting with Republican Senators yesterday, outside of Flake and Corker, was a love fest with standing ovations and great ideas for USA!” Trump wrote on Twitter.