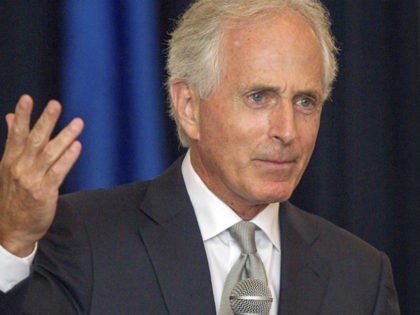

Live: Now It’s 51 Votes for the GOP Tax Cut Bill! Bob Corker is the Only GOP No Vote

Live updates on the landmark Republican tax overhaul under consideration by the U.S. Senate.

Live updates on the landmark Republican tax overhaul under consideration by the U.S. Senate.

The Joint Committee on Taxation says the tax bill works! GDP growth is expected to be 38% higher after tax cuts.

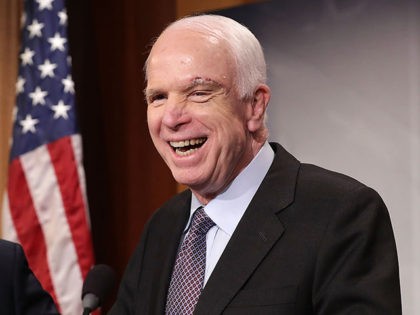

The GOP tax overhaul looks increasingly likely to win enough votes to pass in the Senate after Senator John McCain said he supports the bill.

The Senate agreed to move forward on the tax reform legislation on Wednesday, setting the stage for a tax reform vote later this week.

Why it is a good thing when corporate executives distribute cash to shareholders who can reinvest in economic growth.

The proposal would allow the credit to be fully refundable against payroll taxes, making it more valuable to lower-income taxpayers.

The failing New York Times editorial board urged their readers to call lawmakers to oppose the tax reform legislation.

President Donald Trump reportedly told Republican senators on Tuesday that he supports the Alexander-Murray bipartisan stabilization bill, which may help bolster support for the tax reform vote later this week.

The committee meeting was a dramatic moment for the tax bill, as the votes of at least two GOP senators were uncertain until they were cast.

Secretary of Agriculture Sonny Perdue talked about tax reform with SiriusXM host Alex Marlow on Tuesday’s edition of Breitbart News Daily. Perdue was particularly enthusiastic about lifting the tax burden on small businesses and eliminating the “death tax” on inherited property.

Senate Republicans are pushing to pass their tax overhaul legislation this week. On Tuesday, the Senate budget committee will consider the bill.

Republican leaders in Congress are putting the economy and their political future at risk by breaking two fundamental rules of politics with the tax reform plan they’re trying to force on the people.

The GOP tax bill would boost economic growth and generate smaller deficits than budget officials project, nine economists argue.

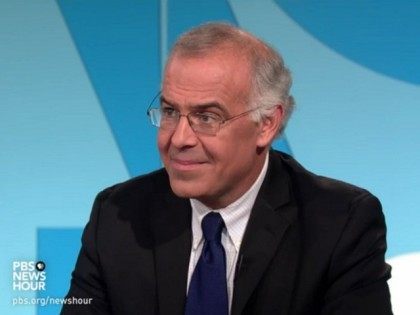

On Friday’s broadcast of “PBS NewsHour,” New York Times columnist David Brooks slammed the Republican tax bill by saying it’s hard to be as incompetent as the writers of the bill. Brooks stated, “Now, to me, the big story was the University

During Thursday’s Democratic Weekly Address, Senator Michael Bennet (D-CO) criticized the Republican tax plan, saying it benefits the wealthy at the expense of others, and “even more stunning is that it does this while adding at least $1.5 trillion, and

President Donald Trump tweeted on Thursday that Republicans will repeal and replace Obamacare after they pass a tax reform package.

Tax cuts are in the headlines and may very well find their way into your Thanksgiving get together.

Tax reform remains a hot topic for many Americans, particularly as the Senate will vote on their reform legislation next week.

Sen. Lisa Murkowski (R-AK) revealed in an op-ed on Tuesday that she supports a repeal of Obamacare’s individual mandate.

Top Trump administration officials indicated that while the president still backs repealing the Obamacare individual mandate, the administration would accept a tax reform package that left the mandate in place.

During Friday’s Democratic Weekly Address, Representative Suzan DelBene (D-WA) slammed the tax bill passed by Republicans in the House as a bill of “callous decisions and missed opportunities.” And one that will harm families if it’s passed. Transcript as Follows:

Wall Street Journal columnist Kimberley Strassel is applauding California Republicans, who largely held the line on tax reform, voting to pass the House bill this week when party members from other high-tax blue states, like New York, did not.

The big challenges facing the Senate tax bill: winning over the deficit hawks, healthcare worriers, and small business advocates.

When is a tax cut considered a tax hike? When you work for Congress’s official tax scorekeepers apparently.

Left-wing billionaire Tom Steyer has launched his second $10 million advertisement campaign calling for President Donald Trump to be impeached.

Thursday, November 16 marked 300 days since President Donald Trump took office on January 20. And the Trump administration seems, at last, to have found a rhythm.

The House passed the Tax Cuts and Jobs Act 216-205, a tax reform bill that features massive tax cuts for middle-class families and small businesses.

Senator Tom Cotton deserves credit for bringing Republicans around to a daring, controversial, and politically brilliant idea: repealing Obamacare’s individual mandate through the Republican tax overhaul.

Rep. Ron DeSantis (R-FL) spoke with Breitbart News Daily SiriusXM host Alex Marlow as the House prepares to vote on a tax reform bill Thursday. He also discussed the prospect of Attorney General Sessions launching an investigation into Hillary Clinton and Uranium One.

History teaches a very clear lesson on taxes: there is no such thing as either a permanent or a temporary tax cut.

Senate Majority Leader Mitch McConnell’s (R-KY) future rests on the Senate passing a tax reform bill after failing to pass an Obamacare repeal bill.

Senate Majority Leader Mitch McConnell is walking back his claim that the middle class would not see tax increases.

Yes, the Obamacare issue is ba-a-ack. Congressional Republicans could, in fact, be voting on the fate of the program — formally known as the Affordable Care Act — within days.

Wall Street fund managers are fighting back against a provision meant to make calculating gains from investing simpler for most taxpayers.

If the proposal to end the state and local tax deduction (SALT) remains in the final bill when it is passed, it could trigger a political revolution in the liberal coastal “blue” states.

Raising the child tax credit to $2,000 and eliminating the individual mandate makes this a tax bill populist conservatives can support.

During a town hall on Fox News on Tuesday, House Speaker Representative Paul Ryan (R-WI) stated that under the House tax bill, the average taxpayer in every single income group and state will get a tax cut, but people, ” especially

President Donald Trump will speak before the House Republican conference Thursday morning as the GOP tax reform platform continues to gain momentum.

Senate Republicans will add the repeal of Obamacare’s individual mandate to the tax bill.

Rand Paul Tuesday took up President Donald Trump’s challenge to Republicans to include the repeal of the Obamacare individual-mandate in their tax overhaul legislation.