TAX CUT WIN: AT&T Announces $1 Billion in Capital Spending and $1000 Bonuses for More Than 200,000 U.S. Employees

AT&T says that if President Trump signs the tax bill before Christmas, employees will receive a special $1000 bonus over the holidays.

AT&T says that if President Trump signs the tax bill before Christmas, employees will receive a special $1000 bonus over the holidays.

The House passed the final Tax Cuts and Jobs Act, sending the historic tax cut legislation to President Donald Trump to sign. The president said that the tax reform bill would ensure a “Merry Christmas” for the country.

Although the tax bill cuts taxes on most Americans and raises taxes on very few, one-third of Americans think their taxes are going up.

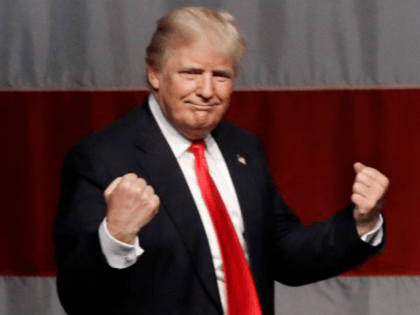

President Donald Trump praised Senate Majority Leader Mitch McConnell for helping Republicans pull the tax cut bill across the finish line.

While Congress is engulfed in a year end fight to fund government programs into next year and historic tax reform is being ushered to the president’s desk, there is another issue that is sliding under the radar – government surveillance authority.

“I’m staying,” Gary Cohn said shortly in an interview with Axios reporter Mike Allen, after celebrating the successful push for tax reform.

The U.S. Senate voted to open the Arctic National Wildlife Refuge (ANWR) to oil and gas exploration and drilling early Wednesday morning, as it passed the Republican tax reform bill on straight party lines, 51-48.

The Senate passed the historic Tax Cuts and Jobs Act on Tuesday, sending the bill to the House, and soon to President Donald Trump to sign.

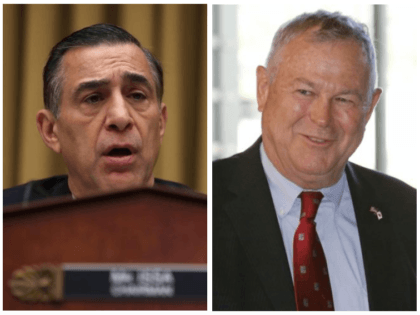

Two California Republicans, Darrell Issa (R-CA) and Dana Rohrabacher (R-CA), voted against the tax reform bill on Tuesday.

Grassroots conservatives and populists cheered the Tax Cuts and Jobs Act’s passage through the House on Tuesday.

The House passed the most sweeping tax overhaul in three decades, cutting taxes for American households and businesses.

Middle-class Americans will get $122.6 billion in tax cuts in 2019 under the Republican tax plan likely to win Congressional approval this week, according to an analysis released Monday by the Joint Committee on Taxation.

Conservative Rep. Dana Rohrabacher (R-CA) is still voting “no” on the Republican party’s new tax reform bill, even though party leaders have attempted to make adjustments to bring reluctant members from California and New York on board ahead of a vote on the final bill in the House of Representatives on Tuesday.

An incredible 50 percent of Americans have come to believe the lie that the GOP tax bill will raise their taxes.

“Economists had been penciling in a boost of about a third of a percentage point next year. Now that is looking way low,” the WSJ reports.

President Donald Trump and Republicans will score an historic victory by likely passing the Tax Cuts and Jobs Act this week, the largest tax cut legislation in decades.

Republicans came together Friday to craft a tax cut bill that appears to have the backing of all 52 GOP Senators.

Sen. Bob Corker (R-TN) announced that he will vote for the Tax Cuts and Jobs Act, presumably giving Republicans enough votes to pass it.

Rep. Kristi Noem (R-SD) suggested that the final version of the Tax Cuts and Jobs Act will include an expanded child tax credit to appease Sen. Marco Rubio (R-FL).

Sen. Marco Rubio (R-FL) will oppose the Republican Tax Cuts and Jobs Act unless it includes an expansion of the child tax credit.

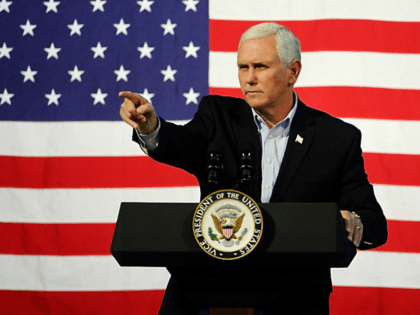

US Vice President Mike Pence’s visit to Israel has been delayed by several days due to Congressional votes on tax reform, The Times of Israel confirmed on Thursday.

The Fed dramatically raised its forecast for economic growth in 2018 while saying it will not stand in the way of tax cut driven growth.

The House and Senate reached a deal for the Tax Cuts and Jobs Act on Wednesday. Republicans hope to pass the tax bill before Christmas.

The loss of the Senate seat that once belonged to Attorney General Jeff Sessions will not stop Republican tax reform efforts. To the contrary, those efforts will likely be accelerated.

While government forecasters say tax cuts will barely generate economic growth, private forecasters are much more bullish.

Treasury’s new report shows that boosting GDP growth to 2.9 percent would generate more revenue than is lost to tax cuts.

European ministers complained to Steven Mnuchin in a letter on Monday that the Republican Tax Cuts and Jobs Act will favor American trade.

Much of the public falsely believes that Republican tax reforms will raise their taxes. That is pushing down consumer expectations.

It is astonishing how American voters have come to be misinformed about tax reform.

Far more Americans will get a tax cut under Republican reform proposals than polls show the public expects.

A professor at Kutztown University in Kutztown, Pennsylvania, offered to give extra credit to students who participated in an anti-GOP tax bill activism event.

The National Association of Realtors warned that the Republican tax reform bill could cause real estate prices to fall in every state, led by a California with up to a 12 percent crash.

The Republican tax overhaul will not be the punishment expected by many residents of high-tax, Democrat-voting areas. Many of those who have the most to lose from the elimination of state and local tax deductions will actually come out ahead under either the House or Senate versions of the bills.

Sen. Jeff Flake (R-AZ) is “quietly” working with Democrats on new legislation to dole out amnesty to nearly 800,000 to 3.5 million illegal aliens, a new report reveals.

Former Bill Clinton Treasury Secretary Larry Summers argued in an op-ed for the Financial Times on Monday that thousands will die because the Republican Tax Cuts and Jobs Act will repeal Obamacare’s individual mandate.

Tax cuts will blow up the deficit. They’ll all go to the wealthy. Grad students will be bankrupted. Sounds scary. Except none of that is true.

A slightly higher rate could create room in the tax bills to expand some other tax cuts or restore state and local tax breaks.

Going all the way back to 2009, it was obvious Obamacare would end up looking like a Rube Goldberg machine powered by totalitarianism. Who would have ever guessed, though, it was such a fiasco that the mandate would actually cost the government money — a delicious irony that would result in its undoing.

Sen. Jeff Flake (R-AZ) has revealed that he’s been promised an amnesty for nearly 800,000 illegal aliens by the Senate Republican leadership so long as he votes in favor of a year-end tax reform bill. In a statement, Flake —

Live updates on the landmark Republican tax overhaul under consideration by the U.S. Senate.