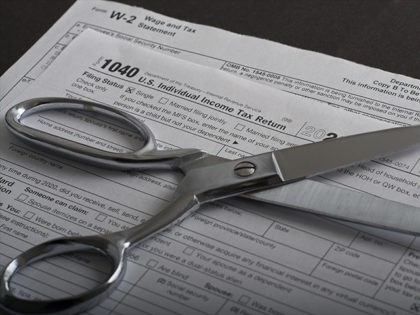

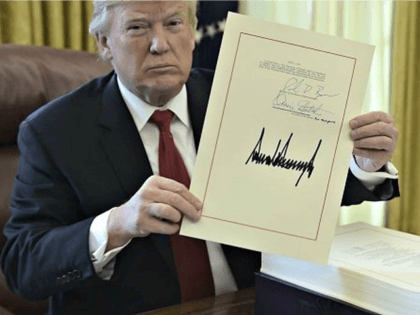

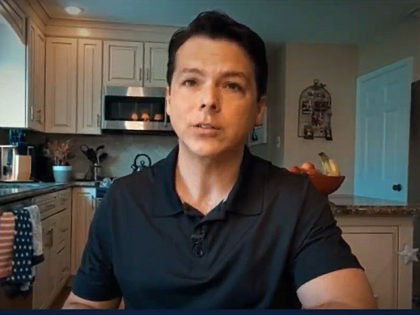

Exclusive: Treasury Secretary Scott Bessent Explains How Trump Will Provide ‘Certainty’ to Economy with Tax Relief, Deregulation

Treasury Secretary Scott Bessent told Breitbart News that President Donald Trump intends to bring “certainty” to the U.S. economy with tax relief and deregulation efforts.