Stocks Plunge in Worst Day Since Financial Crisis

The overnight oil price crash and ongoing concern over the coronavirus sent markets plummeting on Monday.

The overnight oil price crash and ongoing concern over the coronavirus sent markets plummeting on Monday.

Stock trading halted after S&P crashed 7 percent.

The Dow Jones Industrial Average managed to end a chaotic day in positive territory for the week.

U.S. stocks and bond yields dropped Thursday, erasing most of the previous days’ gains and signaling renewed anxiety of the coronavirus outbreak. The Dow Jones Industrial Average plummeted by more than 970 points, or around 3.6 percent. The S&P 500

Healthcare stocks surged higher as Super Tuesday’s results suggest Sanders is less likely to win the Democratic nomination.

Stocks tumbled and Treasuries surged in volatile trading on Tuesday as investors worried that an emergency rate cut by the Federal Reserve would not be enough to stem the economic damage of the coronavirus outbreak. The Dow Jones Industrial Average

The largest percentage gain since 2009 and the largest one-day point gain ever.

After sinking sharply, stocks recovered late in the day after the Fed said it may intervene to support the economy.

The only Dow stock that did not fall today was 3M, which makes surgical masks and respirators. All three major indexes plunged into correction territory.

Stocks dropped sharply for a second day on heightened fears over the impact of the coronavirus on U.S. companies.

Shares of big airlines, cruise line companies, hotels, casinos, and luxury retailers were among the biggest decliners in Monday’s coronavirus selloff.

Stocks in the U.S. fell sharply as new coronavirus outbreaks raise fears of deeper economic impact.

Bernie Sanders win in New Hampshire is seen as making a Trump victory in November more likely.

Let the good times roll.

Investors, unbothered by the caucus chaos in the Democratic Party, sent stocks flying high on Tuesday

The sell-off would likely have been worse if Chinese officials had not intervened with added liquidity and a short-selling ban

The market is showing some signs that the coronavirus is taking its toll.

Stocks were down in New York, London, Europe, and Asia amid rising concerns over the spread of the viral infection from China.

The Dow Jones Industrial Average crossed the threshold of 29,000 for the first time ever.

The message from financial markets matches that of President Trump: “All is well.”

The moves in stocks, energy, and bonds show no signs of acute concern following the news of the killing of Iran’s top military leader.

Dec. 26 (UPI) — U.S. stocks surged higher Thursday as a year-end rally stoked by bullish economic news pushed the Nasdaq Composite index to 9,000 for the first time in its history.

The U.S. stock market shrugged off the impending impeachment vote Wednesday morning, pushing major U.S. stock indexes to record highs. The S&P 500 moved up to 3198 to set a new high in the first hour of trading Wednesday morning.

Investors see the impeachment hearings as a purely partisan political show with no real chance of the president being removed.

Stocks moved higher despite impeachment inquiry, China trade deal worries, and Fed chair Powell standing pat.

Search results plummet, forcing companies to buy advertising space from Google.

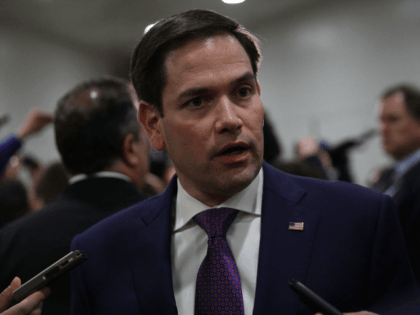

Sen. Marco Rubio (R-FL) said that he will introduce legislation to prohibit federal government pension plans from investing in Chinese stock.

Fears of a recession have largely abated as consumer spending has remained robust and corporate earnings outperformed expectations.

The Trump administration is considering delisting Chinese companies from American stock exchanges, according to reports from Bloomberg, Reuters, and CNBC. Bloomberg reported that the administraton is also considering a ban on U.S. pensions from investing in Chinese stocks. Unnamed sources

Trump’s tweet promising to release the transcript of his conversation with Ukraine’s leader sent stocks up from their lows.

The market appeared to take Wednesday’s inversion in stride. The major stock indexes ended the day in the green.

A huge batch of economic data sent economists scrambling to raise their forecasts for U.S. growth.

Economic data showed the German economy contracted and China’s industrial production slowed, sparking huge sell off.

Stocks opened lower to start the day and the sell-off accelerated in the final hours of trading.

As China backed away from the threat of a currency war, stocks recovered some of the losses suffered on Monday.

Stocks suffered their biggest sell-off of the year Monday Chinese retaliation against new U.S. tariffs escalated.

Fed chair Jerome Powell’s Capitol Hill testimony sent stocks climbing once again on Thursday, pushing the Dow to a record high close.

The Dow Jones Industrial Average had its best June since 1938 and the S&P its best first half since 1997.

The Dow added more than 200 points on Tuesday as investors recovered from their tariff jitters. Tech stocks performed best.

The major stock indexes all declined on Monday as the market digested the news that China would retaliate against U.S. tariffs.