Report: Nancy Pelosi Weighs Banning Congressional Stock Trades Before Midterms

House Speaker Nancy Pelosi (D-CA) has reportedly begun weighing whether to ban congressional lawmakers from stock trading, flip-flopping from her December position.

House Speaker Nancy Pelosi (D-CA) has reportedly begun weighing whether to ban congressional lawmakers from stock trading, flip-flopping from her December position.

Democrat Rep. Jamie Raskin (D-MD) allegedly violated the Stop Trading on Congressional Knowledge (STOCK) Act by failing to disclose his wife’s $1.5 million stock payout, according to Business Insider.

House Speaker Nancy Pelosi’s (D-CA) stock trades have reportedly become of great interest to those in January looking to beat the market.

President Joe Biden’s energy secretary, Jennifer Granholm, reportedly violated the Stop Trading on Congressional Knowledge (STOCK) Act, according to a Business Insider analysis of her financial disclosure documents.

Congress beat the market, on average, with its millions of dollars of trades in 2021, according to watchdog organization Unusual Whales.

House Minority Leader Kevin McCarthy (R-CA) may ban lawmakers from holding or trading stocks if he wins the speaker’s gavel in November.

Democrat Sen. Jeff Merkley (D-OR) on Monday admitted House Speaker Nancy Pelosi’s (D-CA) husband’s stock trading activity sways her legislative judgment.

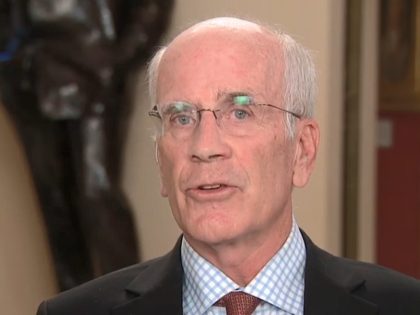

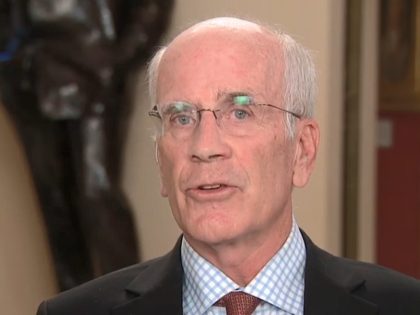

Rep. Peter Welch (D-VT) reiterated his 2020 pledge to stop trading stocks after violating the STOCK Act when he disclosed his wife’s ExxonMobil trades a week late and received an ethics complaint stating he knew about the trades days before grilling the oil company’s CEO

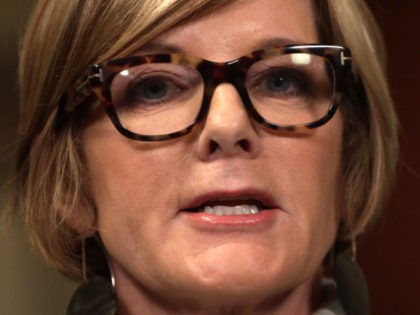

The Foundation for Accountability and Civic Trust (FACT), a non-partisan ethics watchdog organization, demanded an investigation into House Energy and Commerce Committee member Rep. Kim Schrier’s (D-WA) stock transactions after she allegedly failed to adequately disclose up to one million dollars in Apple stock sales, allegedly violating federal law.

The Foundation for Accountability and Civic Trust (FACT), a non-partisan ethics watchdog organization, demanded an investigation into Rep. Peter Welch’s stock transactions after he allegedly failed to adequately disclose his wife’s ExxonMobil stock sales while just days before grilling the CEO on Capitol Hill.

House Speaker Nancy Pelosi said members of Congress and their spouses should not be barred from trading individual stocks.

Democrat Rep. Kim Schrier (WA) allegedly violated the STOCK Act by failing to properly report a more than $500,000 investment in Apple.

New Jersey Democrat Tom Malinowski (D-NJ) reportedly did not properly disclose nearly two million dollars in stock transactions, possibly resulting in a fourth STOCK Act violation.

The House Ethics Committee announced on Thursday, the committee will further investigate Rep. Tom Malinowski’s (D-NJ) hundreds of stock transactions that allegedly violated the federal STOCK Act of 2012.

Fed officials will be banned from owning individual stocks and bonds under the new rules. Nancy Pelosi and others in Congress remain free to trade.

A non-partisan ethics watchdog sent a letter to the Office of Congressional Ethics (OCE) calling for an investigation into another Democrat, Rep. Brian Higgins (D-NY), for allegedly violating the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 and House ethics rules.

A non-partisan ethics watchdog sent a letter to the Office of Congressional Ethics (OCE) calling for an investigation for another Democrat, Rep. Susan Lee (D-NV), for allegedly violating the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 and House ethics rules.

The Republican Party of Iowa has demanded there be an investigation into Rep. Cindy Axne (D-IA) who has been accused of violating the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 and House ethics rules.

A watchdog group with Democrat interests, the Campaign Legal Center (CLC), filed a complaint with the Office of Congressional Ethics calling for an investigation into three Democrats for allegedly violating the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 and House ethics rules.

The Campaign Legal Center filed a complaint with the Office of Congressional Ethics against Rep. Cindy Axne, the lone Iowa Congressional Democrat, for allegedly violating the Stop Trading on Congressional Knowledge (STOCK) Act of 2012.

Scandal-ridden Rep. Tom Malinowski (D-NJ) reportedly lobbied to have the Guantanamo Bay detention camp closed; at the same time, some of the Taliban senior leaders were inmates to have them “released to their home countries” when he was a lobbyist.

Vulnerable Democrat Rep. Susie Lee (NV) reportedly failed to adequately disclose personal stock trades worth up to $3.3 million.

The House Ethics Committee announced on Tuesday, the committee will investigate Rep. Tom Malinowski’s (D-NJ) hundreds of stock transactions that allegedly violated the federal STOCK Act.

The Foundation for Accountability and Civic Trust (FACT), a non-partisan ethics watchdog, will file a complaint with the Office of Congressional Ethics (OCE) calling for an investigation of Democrat Rep. Katherine Clark (MA), the Assistant Speaker of the House and close confidant of House Speaker Speaker Pelosi (D-CA), for failing to disclose stock transactions.

A non-partisan ethics watchdog is requesting the Senate Select Committee on Ethics have an immediate investigation into Democrat Sen. Mark Kelly (AZ) for possibly violating federal law and Senate ethics rules.

Assistant Speaker Katherine Clark (D-MA), seen as a possible replacement for House Speaker Nancy Pelosi (D-CA), reportedly failed to disclose up to $285,000 in stock trades.

Voters will hold Democrats accountable in the midterms and “retire [House Speaker] Nancy Pelosi once and for all” to “stop this socialist lurch to the left,” National Republican Congressional Committee (NRCC) Chairman Rep. Tom Emmer (MN) declared on Breitbart News Saturday.

Paul Pelosi, the husband of House Speaker Nancy Pelosi (D-CA), reportedly made massive bets on stocks in the weeks prior to the antitrust legislation vote in committee, securing large sums of money.

Rep. Tom Malinowski (D-NJ) has paused his stock trading until the House Ethics Committee approves his plans of putting assets into a blind trust, according to a report.

Former Democrat Rep. Harley Rouda (CA), while in office last year, missed federally mandated deadlines that require congressional representatives to report stock trades, according to a report.

A non-partisan ethics watchdog, the Foundation for Accountability and Civic Trust (FACT), sent another letter to the Office of Congressional Ethics (OCE), laying out more information regarding Democrat Rep. Tom Malinowski’s (NJ) alleged violations of federal law after filing their first complaint in March.

Scandal-ridden Democrat Rep. Tom Malinowski (NJ) has claimed that “police officers should be honored, supported, and funded … regardless of politics,” but the Democrat went behind the back of law enforcement to take tens-of-thousands of dollars from and has been endorsed by multiple groups that want to “defund the police.”

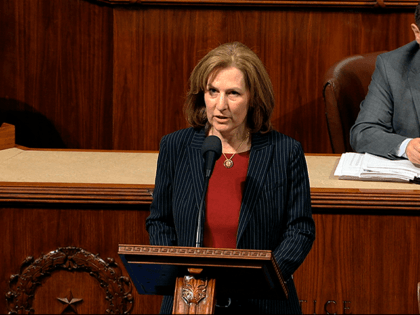

Rep. Elaine Luria’s (D-VA) husband’s recent Tesla investment puts her in a position to personally benefit from Biden’s infrastructure plan.

More financial problems for House Democrats are piling up as Democrat Congressional Campaign Committee (DCCC) chairman Rep. Sean Patrick Maloney (D-NY) failed to report a series of stock trades he made on time, a potential violation of federal law.

Rep. Tom Malinowski (D-NJ), who campaigned on “reforms to limit the role of money in politics,” failed to publicly disclose dozens of personal stock trades in possible violation of the federal STOCK Act. The Foundation for Accountability and Public Trust and the Campaign Legal Center have issued a rebuke of Malinowski’s supposed wrongdoing.

Two ethics watchdogs filed complaints Monday with the Office of Congressional Ethics Monday to investigate allegations that Rep. Tom Malinowski (D-NJ) failed to disclose dozens of stock trades worth at least $671,000.

Rep. Tom Malinowski (D-NJ), who campaigned on “reforms to limit the role of money in politics,” failed to publicly disclose dozens of personal stock trades in violation of the federal STOCK Act, according to a report.

Federal investigators should consider expanding their probe of Sen. Richard Burr (R-NC) to examine his relationship with a South Carolina gambling mogul.

Federal agents questioned Sen. Dianne Feinstein (D-CA) in recent days over her husband’s decision to sell stock ahead of the coronavirus outbreak.

Sen. Richard Burr (R-NC) is temporarily stepping aside as chairman of the Senate Intelligence Committee amid a Department of Justice (DOJ) investigation into his decision to unload upwards of $1.72 million in stock ahead of the coronavirus outbreak.