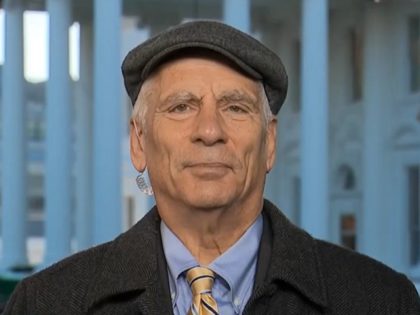

Carney on ‘Kudlow’: Janet Yellen Was More Concerned About Climate Change Than Looming Banking Crisis

Treasury Secretary Janet Yellen was more concerned about climate change than the looming risks to our banking system brought on by the rapid rise of interest rates, Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.