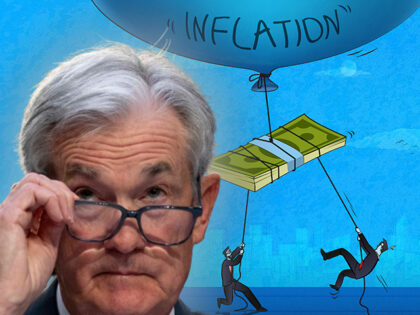

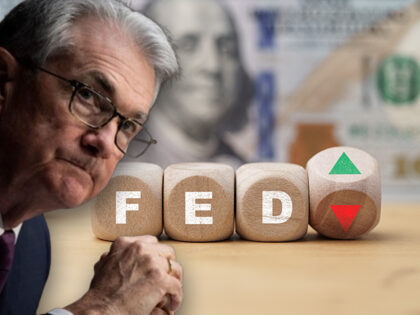

Vivek Ramaswamy to Tucker Carlson: ‘We’re on the Cusp of a Major Economic Downturn” in 2024

Republican presidential candidate Vivek Ramaswamy predicts a recession in 2024, telling Tucker Carlson on his eponymously named show, “Tucker on Twitter,” that it will lead to frustration among Americans, which he says could trigger either a positive and “creative” revolution for having endured the hardships or a negative and “destructive” one.