Pritzker: Trump’s Tariffs ‘Are Like Bringing COVID Back,’ Going to Have Long Term Effect

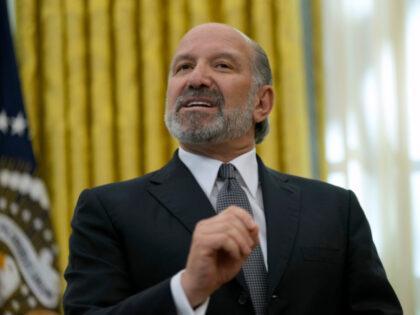

Governor JB Pritzker (D-IL) said Thursday on MSNBC’s “The Beat” that President Donald Trump’s new tariffs are “like bringing COVID back.”

Governor JB Pritzker (D-IL) said Thursday on MSNBC’s “The Beat” that President Donald Trump’s new tariffs are “like bringing COVID back.”

The “Recession That Never Happened” is already over, and the numbers prove it.

Partisan consumer sentiment gaps have been growing for years, but we’ve now entered uncharted territory.

During an interview with CBS on Tuesday, Commerce Secretary Howard Lutnick stated that the Trump economic policies will be “worth it” even if they lead to a recession, but “the only reason there could possibly be a recession is because

Commerce Secretary Howard Lutnick predicted Sunday on NBC’s “Meet the Press” that the United States economy would not experience a recession.

The election of Donald Trump has already sparked a turnaround in sentiment among consumers and businesses, with the vibecession falling away and the rosy-fingered dawn of a new golden age spreading from sea to shining sea.

On Friday’s “PBS NewsHour,” Chicago Federal Reserve Bank President Austan Goolsbee said that if the jobs market just stopped where it is, it “would be fine.” But the Federal Reserve needs to consider that if it doesn’t “start moving apace

Thanks to brutal inflation and equally brutal interest rates, 59 percent of Americans believe this country is in a recession.

The Japanese stock market suffered its worst single-day sell-off in history Monday, losing even more points than on “Black Monday” in 1987.

It looks like the market is finally going to get what it has wanted for over a year—a rate cut from the Federal Reserve.

Sixty percent of the public are skeptical of media reports depicting the economy as doing well.

The British economy bounced back strongly in the first three months of the year, bringing to an end to the technical recession.

Manufacturing and residential construction were key drivers in the unexpected rise in the closely watched index of leading indicators.

When Jerome Powell steps into the congressional coliseum to deliver his semi-annual testimony to the House and Senate, he is very likely to be met with an aggrieved chorus of Democratic lawmakers arguing that monetary loosening is long overdue.

Prime Minister Rishi Sunak and Chancellor Jeremy Hunt are to blame for the UK falling into a recession, seven in ten Britons believe.

Hisatory’s most anticipated recession appears to be over before it even began.

Tories claimed migration is good for the economy, yet after the largest wave of immigration to Britain ever, the economy is contracting. Mystifying.

The Wall Street prognosticators got it all wrong.

The market is slowly coming around to the view that the immediate threat to the economy is sticky or rising inflation and not a recession.

Although the Leading Economic Index is has slowed its decline, the numbers still point to a recession in the second and third quarters of this year.

Germany’s economy shrank 0.3%, struggling with expensive energy, higher interest rates, lack of skilled labor and a homegrown budget crisis.

During an interview with ABC News on Thursday, Denver Mayor Mike Johnston said that if the sanctuary city doesn’t get help from the federal government to deal with the financial impacts of the migrant influx in the city, the budget

Could the housing market finally be cracking under the pressure of higher interest rates?

The stock market does not seem to believe we are headed for a recession next year.

Fifty-two percent of the public says the economy is getting worse, according to the latest poll from the Economist and YouGov.

A key measure of the health of the economy in the near future is once again forecasting a recession.

During an interview with NBC News on Wednesday, Sen. Joe Manchin (D-WV) argued that if the Build Back Better legislation President Joe Biden and Senate Democrats pushed had passed the way it was “it would have basically thrown us into

More than two-thirds of consumers still said recession is ‘somewhat’ or ‘very likely.’

The American economy can stay solvent longer than economists and pundits can stay irrational.

The Federal Reserve is not buying the optimism about the economy that the White House has been marketing under the brand Bidenomics.

“The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024,” said Justyna Zabinska-La Monica.

While there’s been a lot of chatter over the past few days about the September jobs figures being weaker than they looked, the numbers do not really support the negative interpretation.

The recession is back on, baby.

The August job vacancy data is the latest evidence that the economy accelerated in the second half of the year, defying expectations that interest rate hikes would be a drag on growth.

The U.S. manufacturing sector’s worst days appear to be behind it.

By many of the most reliable leading indicators of the U.S. economy, we are long overdue for a recession. Yet the economy stubbornly refuses to cooperate.

The economic tide keeps rising even though the Fed has declared it is time for an ebb

Republican presidential candidate Vivek Ramaswamy predicts a recession in 2024, telling Tucker Carlson on his eponymously named show, “Tucker on Twitter,” that it will lead to frustration among Americans, which he says could trigger either a positive and “creative” revolution for having endured the hardships or a negative and “destructive” one.

But the index of coincident economic indicators say conditions still favor growth.