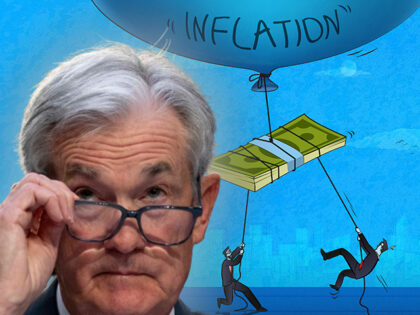

Fed’s Preferred Inflation Gauge Shows Moderate Price Pressures in September

Core PCE inflation holds steady as consumer expectations improve heading into final Fed meeting of 2025.

Core PCE inflation holds steady as consumer expectations improve heading into final Fed meeting of 2025.

Core inflation slowed down in August, the Federal Reserve’s preferred gauge showed Friday, suggesting President Trump’s tariffs are not creating significant price pressures for American households.

Inflation held steady in July, with the Federal Reserve’s preferred price gauge showing a slight deceleration in cost pressures and defying predictions from Fed Chairman Jerome Powell that tariffs would push up consumer prices.

The Federal Reserve’s preferred inflation gauges showed underlying price pressures easing in May, reinforcing the case for interest rate cuts later this year as price growth continues to drift downward. The Personal Consumption Expenditures (PCE) price index, released Friday by

Durable goods prices—the category most directly exposed to international trade—were flat month-over-month, showing zero growth after a 0.5 percent gain in April.

Over the past year, core prices are up 2.5 percent, the smallest year-over-year increase since March of 2021.

100 days into the Trump administration, inflation has come down to zero.

The persistence of inflation above the Fed’s 2 percent target underscores that price pressures are building before the newly announced tariffs on imports have taken effect.

A slightly better than expected report on inflation.

The confidence of the Fed that inflation would move back to its two percent target even with lower rates looks misplaced.

Inflation is not done with us yet.

Core inflation may have become embedded at a high rate, raising questions about further progress on restoring price stability.

Prices are still rising but at a much more comfortable pace.

Spending and income are solid and inflation is still above target, calling into question the arguments for an urgent rate cut.

Inflation took a breather in May, cooling to its lowest annual rate in over three years, according to key data eyed by the Federal Reserve. The core personal consumption expenditures price index, which excludes food and energy prices, nudged up

The PCE index shows that progression on bringing down inflation has stalled.

Super core inflation exploded higher in January.

After a brief respite from rising prices in November, the personal consumption expenditure price index shows inflation picked up in December.

A key gauge of consumer inflation fell on a monthly basis in November, the first decline since April 2020. The personal consumption expenditure (PCE) price index fell 0.1 percent in November, the Commerce Department said Monday. Compared with a year

Consumers were forced to shift spending away from other goods and services because gasoline prices are soaring.

The inflation fight is getting tougher.

It is getting harder and harder to justify not raising rates at the next meeting of the Federal Open Market Committee.

Inflation is on the rise again. Can the Fed afford to pause at the next meeting.

A bit cooler than expected.

Prices surged in January, defying predictions that inflation was on its way out. The Fed’s policies are proving less effective than expected.

At first glance, the Commerce Department’s report on personal income and spending in October looks like what some people have referred to as Goldilocks data.

Remember when Biden said inflation was up just an “inch?” In reality, core PCE inflation in August matched the post-9/11 highs hit in April and June.

The latest estimates of inflation in the first two quarters of the year show prices rose more rapidly than previously believed.

Consumer spending grew by less than expected, helping cool core prices in July.

House Republicans slammed Democrats’ newly unveiled Inflation Reduction Act of 2022 on Friday, saying it is “likely to worsen the economy.”

More bad news on inflation.

The prices of food purchased by American households were up by 10 percent in April, the biggest jump in since 1981. The personal consumption expenditure price index for food consumed off-premises rose one percent compared with the prior month, a

Bidenflation pushes prices up at the fastest pace since 1981.

We haven’t seen prices rise this fast since 1975.

Can’t stop. Won’t stop. The Fed’s favorite inflation gauge shows prices rose at their fastest pace in 40 years last month.

Trimmed mean inflation ran at an annual rate of 5.1 percent in September, the fastest pace since 1990.

Instead of moderating, inflation got worse this summer.

Consumer prices rose at their fastest annual pace since 1991.