Oil Prices Crash to Lowest Levels in Decades

Gasoline prices in the U.S. are at the lowest level in decades.

Gasoline prices in the U.S. are at the lowest level in decades.

U.S. Secretary of State Mike Pompeo, in a call with Saudi Crown Prince Mohammed bin Salman (MBS) on Tuesday, called on the Sunni kingdom to “reassure global energy and financial markets” amid the economic downturn caused by the coronavirus pandemic.

Saudi Arabia is evidently very serious about the oil price war it launched this week, signaling that its national oil company Saudi Aramco will hit a record high production level of 12.3 million barrels per day in April.

The moves in stocks, energy, and bonds show no signs of acute concern following the news of the killing of Iran’s top military leader.

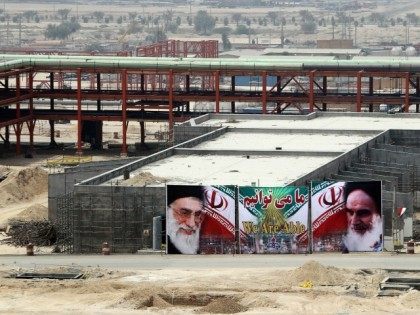

Ali Saeedi, a hardline Iranian cleric close to Supreme Leader Ayatollah Ali Khamenei, admitted on Wednesday that top officials were surprised by the intensity of protests against the recent gasoline tax hike.

The Iranian government published a report on Sunday showing the national Gross Domestic Product (GDP) contracted by 4.9 percent over the fiscal year ending March 21. The announcement revealed Iran’s economy contracted much more sharply than anticipated after U.S. sanctions were reimposed by President Donald Trump.

“Oil prices getting too high. OPEC, please relax and take it easy,” he wrote on Twitter. “World cannot take a price hike – fragile!”

Economic data released by Iran this week indicated oil exports are sharply down and the export of products other than oil has been cut in half by U.S. sanctions.

Contents: Qatar withdraws from Saudi Arabia-led OPEC; The split deepens between Saudi Arabia and Qatar

The Iranian Supreme Court on Tuesday upheld death sentences against financial traders Vahid Mazloumin and Mohammad Esmail Ghasemi on charges of “spreading corruption on earth” because their currency trades were allegedly intended to “disrupt the economy” at a time of “enemy pressure” on Iran, that enemy being the United States.

The New York Times gave President Donald Trump credit for oil sanctions on Iran, which it said had been successful in pressuring the regime without raising oil prices.

The Wall Street Journal noted on Tuesday that the Trump administration’s plan to pressure Iran with renewed sanctions might have one big flaw: China. The Chinese are in a position to buy so much Iranian oil that the effect of isolating Iran from U.S. and European markets will be greatly diminished.

Iranian Vice President Eshaq Jahangiri vowed on Tuesday that the Islamic Republic will “sell as much oil as we can” to protect its banking system, the financial lifeblood of the regime’s Islamic Revolutionary Guard Corps (IRGC), while acknowledging that America-imposed sanctions would hurt Iran’s economy.

Iran’s representative to the Organization of the Petroleum Exporting Countries (OPEC), Hossein Kazempour Ardebili, reportedly pled on Thursday for President Donald Trump to “please stop” tweeting because his doing so has raised oil prices by at least $10.

Donald Trump took to Twitter on Wednesday morning in an apparent attempt to talk down the price of oil.

In advance of President Trump’s statement about the future of the Iran nuclear deal at 2:00 PM Eastern time on Tuesday, most observers believe he will withdraw from the agreement or demand such extensive revisions that it is effectively wiped out.

Saudi oil executives inked multi-billion dollar deals with companies to explore building petrochemical facilities along the Texas Gulf Coast. Essentially, they hope to capitalize on the U.S. oil and gas boom, largely fueled by shale drilling in the Permian Basin.

The average gasoline price nationwide is the cheapest it has been at this point in the year since 2005, according to GasBuddy, a site that monitors gas prices.

Cuba is about to receive its first major Russian oil shipment of the 21st Century, because the collapsing socialist government of Venezuela can no longer meet Cuba’s needs.

CNN Money made no bones about crediting the incredible post-election surge in the stock market to a “Trump rally,” as Wall Street hit the rare “superfecta”: all four major indexes closing at record highs on the same day.

A western Texas oil and natural gas shale formation was labeled the “largest” of its kind by the U.S. Geological Survey on Tuesday.

Saudi Arabia has a “very comfortable” level of foreign reserves, the central bank chairman said on Monday, despite a drawdown in assets to help cover a fall in oil revenue.

The United Nations Economic and Social Commission for Western Asia (ESCWA) has concluded that the 2011 “Arab Spring” uprisings cost the affected countries a total of $614 billion, amounting to 6% of their combined Gross Domestic Product.

Oil prices were mixed in choppy trade on Tuesday as disagreement flared within producer cartel OPEC on who should cut how much production in a planned coordinated reduction to prop up prices.

Oil prices came under pressure on Monday as Iraq said it wanted to be exempt from an OPEC deal to cut production, though losses were capped by Iran saying it would encourage other members to join an output freeze.

Saudi Arabia has signaled that it may accept an oil deal that does not require Iran to scale back production, which is taken by Bloomberg News as a sign that Iran “has the edge” in its oil price war against the Kingdom.

But the improvement in incomes may actually help Republican nominee Donald Trump. The 19th century French philosopher Alexis de Tocqueville observed that revolutions tend to occur in times of rising expectations.

The trade deficit increased because imports rose by $227.7 billion, while exports were up only $183.2 billion, with particularly sluggish oil and new-car exports. The trade gap with China hit its highest mark since last November, thanks to heavy imports of “Chinese-made computers, cell phones, and clothing,” per ABC News.

The growing and unprecedented crisis with U.S. cotton is indicative of the plight of all sectors in American production agriculture. More and more, on the turn rows of western and southern Texas, they grasp for a historical crisis by which to gauge cotton’s present situation in which the industry’s fundamentals are stressed. “The early ‘80s” is often muttered, but quickly dismissed, mainly because interest rates aren’t soaring as they were 35 years ago.

During a visit to Aramco facilities in Houston, the new Saudi Arabian oil minister confirmed a growing sentiment among market analysts in recent months: the global oil glut that crippled American energy producers is now over.

Talk of a production cap to stabilize oil prices seems like a distant memory now, as Iran continues ramping up post-sanctions production and Saudi Arabia cuts oil prices to Europe to compete.

Leading up to a crucial meeting for the global cartel next week, OPEC leadership has made plain that the price of oil is far too low to encourage investment and supply the global market in the longer term. The comments follow a variety of indicators beginning to signal a larger recovery.

It seems like only yesterday that the great hope of the oil market was that oil-producing nations, both inside and outside OPEC, would come together and cap production to bring prices back up. Now the chief executive of the Saudi national oil company says it will increase production, but he expects prices to start rising anyway.

On Monday, Saudi Arabia’s King Salman bin Abdulaziz addressed his nation by television, announcing cabinet approval for the “Saudi Vision 2030” plan — in essence, the Kingdom’s plan to decouple its economy from oil.

The rally in oil prices over the past few weeks was based on hopes that oil-producing nations would agree to freeze production at a pivotal meeting in Doha, Qatar, but the talks collapsed without an agreement on Sunday.

The New York Times offered a new set of clues recently as to how Saudi Arabia is handling the ongoing collapse of global oil prices by looking at the Saudis’ effort to “reformat” their economy, becoming less dependent on oil.

Two Houston-based drilling companies filed for Chapter 11 bankruptcy protection within a 24-hour period ending Friday as the oil slump continues to take its toll on the sector at large. The firms plan to shed a combined $3.2 billion in debts to their creditors.

The oil market is a ticking financial time bomb that can send prices skyrocketing higher with just a small 2 percent reduction in supply.

USA Today reports: Iran is expected to raise the April Official Selling Price (OSP) of its flagship light crude oil to Asia to 25 cents above the Saudi’s similarly graded Arab light. This is the highest premium since 2011 and is

JAFFA, Israel – Saudi Arabia is planning to “nationalize” its economy due to the country’s mounting deficit, which is the result of plummeting oil prices, structural problems in the economy, and the Saudis’ ongoing involvement in the conflict in Yemen. Last year, Riyadh registered a $100