Empire State Manufacturing Index Unexpectedly Skyrockets

New York’s manufacturing sector expanded in September for the first time in nearly a year.

New York’s manufacturing sector expanded in September for the first time in nearly a year.

The rise in longer-term inflation expectations are likely to add weight to the argument that the Fed should keep its policy rate at current levels rather than cut later this year.

Families racked up credit card debt and went into delinquencies at an increased rate since the pandemic, the New York Fed found Tuesday.

The N.Y. Fed’s “Empire State” manufacturing index sank to -14.5 in December, the lowest level in four months.

The Empire State manufacturing index has turned extremely volatile during the Bidenflation era.

Expectations for one-year inflation dipped, while three-year inflation expectations were unchanged, and five-year expectations ticked up.

A recent paper indicates that excess demand was the biggest driver of inflation.

We regret to inform you that the recession is back on.

The New York Fed’s consumer survey shows that more than half of Americans feel they are financially worse off than they were a year ago.

The Richmond Fed index unexpectedly fell even further into negative territory even as inflation pressures remain extremely high.

The New York Fed’s economic model sees the economy contracting this year and next year.

The Empire State manufacturing survey unexpectedly lurched into negative territory.

Public expectations of household spending rose to a record high in April, data from the Federal Reserve Bank of New York showed Monday. The New York Fed said that households expect their spending to rise by 8 percent over the

Inflationary pressures show no signs of letting up, raising the odds that the Federal Reserve may ratchet up interest rates even faster than anticipated. The Department of Labor’s Producer Price Index showed that prices rose one percent in January, twice

The first decline in expectations since October 2020.

Omicron has brought growth in New York State manufacturing to a halt.

White House economists told America inflation would fade in the later months of 2021. Instead, prices are surging again.

The American public does not believe inflation will prove transitory.

Economic uncertainty has resulted in a series of severe misreadings of the economy during the pandemic.

Record setting price increases did not spur an acceleraton of manufacturing activity in August, a survey from the New York Fed showed Monday.

Business conditions in New York improved more than expected in February, according to a survey released Tuesday by the Federal Reserve Bank of New York.

Business activity increased slightly in New York in early December.

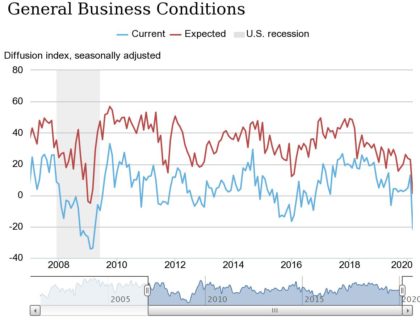

This is the first piece of economic data to reflect the pandemic and it indicates a very heavy drag.

The Fed is attempting to keep the financial system functioning smoothly as banks tighten grip on funding to fend off coronavirus threats.

For the second month in a row, the survey of manufacturing businesses in New York came in better than expected.

Another bullish sign for the economy: manufacturing appears to be regaining its footing and expanding once more.

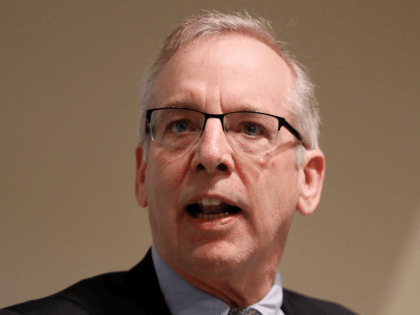

Americans for Limited Government (ALG) President Rick Manning released a statement Tuesday, slamming former New York Federal Reserve President Bill Dudley’s call for the Fed to consider how their policies will impact the 2020 election.

Former New York Federal Reserve President Bill Dudley urged Tuesday his former colleagues not to help President Donald Trump in his trade war against China. He even urged the central bank to consider how its monetary policy might impact the 2020 presidential election.

Falling inflation expectations diminish the risk of prices rising and could pressure Fed to cut rates sooner.

Hard to believe, but we’re almost halfway through the second quarter of the year. That’s the point where it makes sense to start checking in on where the regional Fed banks’ forecasting models see GDP growth for the quarter.