Democrat Tax Hikes to Hit Manufacturers Hardest

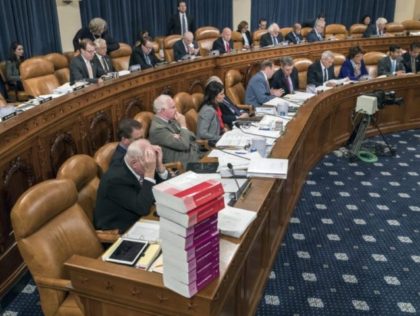

The Joint Committee on Taxation (JCT) found that the Democrats’ inflation reduction bill would hit manufacturers hardest with the legislation’s corporate minimum tax.

The Joint Committee on Taxation (JCT) found that the Democrats’ inflation reduction bill would hit manufacturers hardest with the legislation’s corporate minimum tax.

The bill would raise tax revenue by around $1.5 trillion over the coming decades, not enough to pay for the big-spending plans, social programs, and green new deal schemes in the Build Back bill.

President Joe Biden gave a speech on Thursday about the economy, claiming that Americans making under $400,000 would not see a tax increase despite the ‘infrastructure’ bill raising tax brackets over time if passed.

Sen. Steve Daines (R-MT) told Breitbart News in an exclusive statement Thursday that he will introduce “common sense” legislation to better project the cost of federal budgeting by including the interest cost of government spending.

Middle-class Americans will get $122.6 billion in tax cuts in 2019 under the Republican tax plan likely to win Congressional approval this week, according to an analysis released Monday by the Joint Committee on Taxation.

It is astonishing how American voters have come to be misinformed about tax reform.

Far more Americans will get a tax cut under Republican reform proposals than polls show the public expects.

The Joint Committee on Taxation says the tax bill works! GDP growth is expected to be 38% higher after tax cuts.

Senate Republicans are pushing to pass their tax overhaul legislation this week. On Tuesday, the Senate budget committee will consider the bill.

The Republican tax bill under consideration on Capitol Hill would add $1.7 trillion to budget deficits over the next decade, the Congressional Budget Office said.

Efforts by Republican lawmakers to repeal the Affordable Care Act in recent months have repeatedly collapsed after the Congressional Budget Office scored the various bills using a closely guarded analytic process done entirely behind closed doors.