Job Openings Plunge as Employers Pull Back From Hiring

Retail and construction openings crashed in June as the Fed raised interest rates at the fastest pace in decades.

Retail and construction openings crashed in June as the Fed raised interest rates at the fastest pace in decades.

He pivoted to positive economic news.

Federal Reserve Chairman Jerome Powell said Wednesday that he does not believe the U.S. is currently in a recession, citing the fact that job vacancies are still above 11 million, unemployment is near record lows, and hiring has been brisk.

There’s no doubt that the Federal Reserve is going to raise its interest rate target at the end of tomorrow’s meeting of the Federal Open Market Committee. What we do not know is how much they will raise.

The hotter-than-expected inflation report has increased expectations for a super-sized Fed hike at the end of this month.

The facts are changing again. Can the Federal Reserve’s monetary policy keep up?

U.S. central bankers hiked their plans to raise interest rates quickly in June when CPI inflation and consumer expectations for price increases both came in higher than expected.

Federal Reserve Chairman Jerome Powell said that the U.S. economy is “in pretty strong shape” as Americans face record inflation.

If corporate greed was responsible for the inflationary price hikes, we would see corporate profits soaring as inflation rose to 40-year highs this year. Instead, corporate profits fell in the first three months of this year.

Federal Reserve Chairman Jerome Powell stated on Wednesday he realized how little he understands about soaring inflation.

If it takes a recession—or even a period of stagflation—to bring down inflation, so be it. So says Fed Chair Jerome Powell.

On Wednesday’s broadcast of CNN’s “The Lead,” Senior Adviser to President Joe Biden Gene Sperling said that Federal Reserve Chairman Jerome Powell’s comments that high inflation pre-dates Russia’s invasion of Ukraine don’t contradict President Joe Biden’s rhetoric and “the reason we’ve

On Wednesday’s broadcast of CNN’s “The Lead,” Senior Adviser to President Joe Biden Gene Sperling agreed with Federal Reserve Chairman Jerome Powell’s statement that there was high inflation before Russia invaded Ukraine and argued that the inflation that existed prior to the

Fed Chair Jerome Powell bluntly rejected the Biden administration’s claim that the biggest driver of inflation right now is the war in Ukraine.

Powell says the war in Ukraine is not the primary cause of inflation, which started long before Russia’s invastion.

Powell signaled that the Fed is willing to risk a recession in order to tame inflation.

Treasury Secretary Janet Yellen on Tuesday testified before Congress that she expects inflation to remain “high” in the United States.

It looks like Federal Reserve Chairman Jerome Powell might be the Biden administration’s next fall guy for inflation now that the corporate greed and Putin Price Hike narratives have failed to work.

President Joe Biden met with Federal Reserve Chairman Jerome Powell on Tuesday in an attempt to reassure Americans about rising inflation.

The largest tech firms in the world have reportedly lost over $1 trillion in value over just three trading days. Microsoft, Amazon, Tesla, and Google all lost more than $100 billion in a few days, while Facebook lost $70 billion.

The April employment reports released Friday perfectly encapsulated the economic moment: everyone has a job and no one is happy about it because of inflation.

The faith of the followers of Fed Chairman Jerome Powell is fickle. Thursday’s massive stock sell-off completely erased all of Wednesday’s Powell-inspired gains and then some.

Jerome Powell still believes in immaculate disinflation—and he appears to have won the market over to his view.

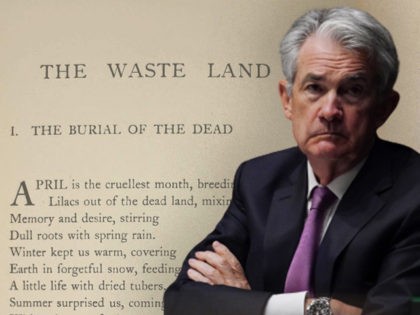

For the stock market, April has indeed been the cruelest month in part because it has seen a blossoming awareness that inflation is not going to die of exhaustion after hitting 40-year highs.

Vulnerable Connecticut Rep. Jahana Hayes claimed that “Democrats single-handedly saved the economy,” during a portion of her remarks at a virtual black caucus town hall uploaded to YouTube.

Is that a fast enough pace to defeat inflation?

The market appeared to register a no-confidence vote on the Federal Reserve’s inflation-fighting.

Federal Reserve Chairman Jerome Powell apparently figured out that the market had not quite got the message that he intends to be tough on inflation.

Harvard economist Gabriel Chodorow-Reich coined the phrase “immaculate disinflation” to describe Fed Chairman Jerome Powell’s persistent belief that the Fed can bring down inflation painlessly.

The wave of euphoria that washed over the stock market on Wednesday following the long-awaited rate hike should probably be taken as a warning sign.

The idea that inflation is caused by the lack of competition was gently dismissed by Fed chair Powell.

A sign that Joe Biden is increasingly viewed as irrelevant and ineffective.

No more stimulus needed.

The Fed realized it was offsides on inflation and the labor market. The reversal of policy may now come even more quickly than signaled at last month’s meeting.

The Fed pivots from pumping up employment to removing accommodation.

It took six or seven months but now everyone agrees that Bidenflation is persistent rather than transitory.

Jerome Powell again focused on the risk of inflation running hotter and longer than many economists expect.

Persistently high inflation would justify the Fed moving faster on winding down its bond purchases, Powell told a Senate panel Tuesday.

Federal Reserve chair Jerome Powell said on Tuesday that the test for reaching the Fed’s two percent target on average over time had been met, signaling that the Fed could taper bond-buying faster and raise rates earlier than previously anticipated.

On Monday’s edition of NPR’s “All Things Considered,” White House Council of Economic Advisers Chair Cecilia Rouse stated that Federal Reserve Chair Jerome Powell has been looking at data to understand the source of inflation, and “one of the things