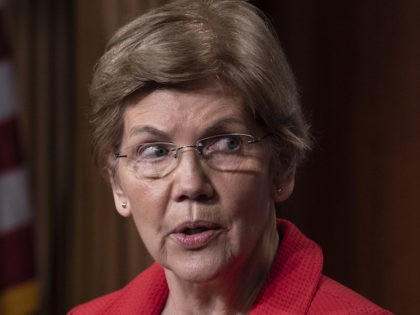

Elizabeth Warren: Fed Chair Powell ‘Took a Flamethrower’ to Bank Regulations

Senator Elizabeth Warren (D-MA) said Sunday on NBC’s “Meet the Press” that Federal Reserve Chair Jerome Powell “took a flamethrower to the regulations” on banks.

Senator Elizabeth Warren (D-MA) said Sunday on NBC’s “Meet the Press” that Federal Reserve Chair Jerome Powell “took a flamethrower to the regulations” on banks.

It seems very unlikely that the Federal Reserve will end its rate hike cycle.

The Federal Reserve on Monday announced plans to conduct an internal review of the oversight of Silicon Valley Bank (SVB) after the bank’s abrupt failure last week.

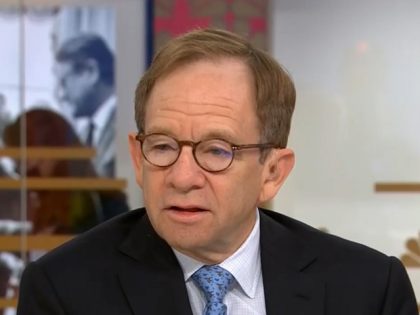

Chris Whalen, chairman of Whalen Global Advisors, blamed Federal Reserve Chair Jerome Powell for the failure of Silicon Valley Bank (SVP) in a Friday interview on Forward Guidance with host Jack Farley.

Federal Reserve Chair Jerome Powell introduced a third dimension to the Fed’s monetary policy: the pace of interest rate hikes.

The most entertaining scene in Tuesday’s Senate hearing on monetary policy was also its most enlightening, highlighting two opposing views of inflation and the underlying mechanics of the U.S. economy.

Hotter than expected data has forced the Fed to rethink the pace and peak of interest rates.

Former Federal Reserve governor and chief executive officer at The Lindsey Group Lawrence Lindsey said Monday on CNBC’s “The Exchange” that Fed Chair Jerome Powell had the “most counterproductive press conference” while announcing the Federal Reserve raised its benchmark interest rate by a quarter point.

Fed chairman Jerome Powell described the labor market as extremely tight. Jobless claims indicate that it may be getting even tighter.

Jerome Powell fumbled his first press conference of the year.

The Federal Reserve’s preferred inflation gauge eased further in December, and consumer spending fell — the latest evidence that the Fed’s series of interest rate hikes are slowing the economy.

On Thursday’s broadcast of the Fox Business Network’s “Kudlow,” Breitbart Economics Editor John Carney praised Federal Reserve Chair Jerome Powell for declaring the Federal Reserve will not try to engage in climate policy and noted that it was particularly bold to

“We are not, and will not be, a ‘climate policymaker,'” Federal Reserve Chair Jerome Powell said during a panel discussion Tuesday hosted by Sweden’s central bank.

Federal Reserve officials have been attempting to convince markets of their commitment to fighting inflation by explicitly talking about the unwelcome costs they are willing to bear and inflict to succeed.

Fed chair says he is going to stand his ground on the inflation target.

Federal Reserve Chair Jerome Powell may lean hawkish in his press conference this week in order to correct the market’s dovish interpretation of his comments last week at the Brookings Institution.

What Jerome Powell giveth, the labor market taketh away.

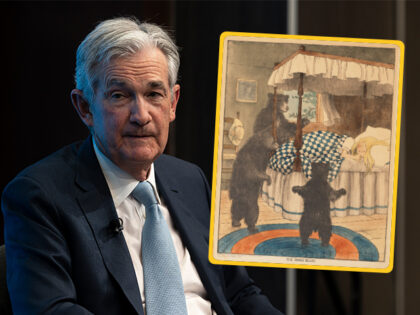

At first glance, the Commerce Department’s report on personal income and spending in October looks like what some people have referred to as Goldilocks data.

Chairman Jerome Powell on Wednesday ruled out the idea that the Fed might raise its benchmark interest rate by 75 basis points.

On Thursday’s broadcast of MSNBC’s “Morning Joe,” Steve Rattner, who served as counselor to the Treasury Secretary in the Obama administration, argued that Federal Reserve Chairman Jerome Powell got inflation wrong in part because “the White House was signaling that they

If you want to figure out where monetary policy is heading next, watch the labor market.

The poet and essayist Ralph Waldo Emerson is often credited with advising that “life is a journey not a destination.” Federal Reserve Chairman Jerome Powell on Wednesday told us that for the Federal Reserve, it is the destination that matters more than the journey.

Fed officials agreed Wednesday to lift the benchmark federal-funds rate by three-quarters of a percentage point to a range between 3.75 and four percent.

Team transitory is gone. Meet team “overcorrection.”

On Friday’s broadcast of CNN’s “At This Hour,” New York Times Federal Reserve and Economy Reporter Jeanna Smialek stated that while the September jobs report is “a baby step in the right direction.” Things are “still too hot” for the Federal Reserve’s liking

Fed officials have a very wide range of projections for Fed policy two years from now.

Jerome Powell took up arms against a sea of troubles on Wednesday.

Sen. Elizabeth Warren (D-MA) issued sharp criticism directed at the Federal Reserve over its decision to once again raise interest rates by 75 basis points.

Just how unbalanced is the labor market? Federal Reserve Chairman Jerome Powell sees it as extremely unbalanced, with demand for workers far outstripping supply.

The Fed chairman’s responses to a Cato Institute Q&A appeared to confirm that the Fed is planning a jumbo 75 basis point rate hike this month.

It appears that Jerome Powell’s speech in Jackson Hole finally convinced investors that they could not fight the Fed.

Senator Elizabeth Warren (D-MA) said Sunday on CNN’s “State of the Union” that she is “very worried” that the Federal Reserve will “tip this economy into a recession.”

(AFP) – European natural gas prices climbed Thursday towards a record peak on heightened fears over Russian supplies, while equities rose on the eve of a key speech from Federal Reserve Chair Jerome Powell.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation,” Powell said.

In his Jackson Hole speech, Fed Chair Jerome Powell needs to show the market that he is carrying bear spray—or something stronger—and is not afraid of the bears.

There was good news for Jerome Powell in the National Association of Business Economist survey released Monday: the Fed’s policy has become a lot more popular.

Next week Jerome Powell will find himself facing down financial markets at the feet of the Teton Mountains in Jackson Hole, Wyoming, each standing in the summer heat daring the other to blink first.

The market continues to show skepticism about the Fed’s commitment to keep raising rates to fight inflation.

After four straight weeks of gains for the stock market, it is time to admit that Jerome Powell has a problem.

The Federal Reserve allegedly withheld key documents that could have severely impacted a Federal Reserve nominee ahead of a potential confirmation vote, leading many to call for increased transparency and reform for the nation’s central bank.