Breitbart Business Digest: Even if Trump Fires Powell, the Fed May Still Defy Him

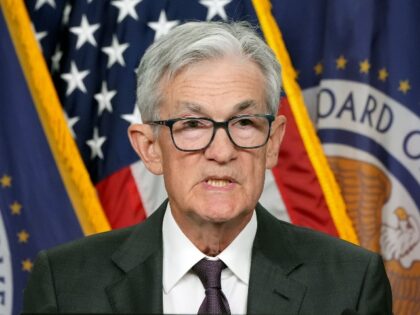

Removing Jerome Powell as Fed chair might not give Trump the interest rate cuts he wants.

Removing Jerome Powell as Fed chair might not give Trump the interest rate cuts he wants.

President Donald Trump has no plans to fire Federal Reserve Chairman Jerome Powell, whom he called a “major loser” in a Truth Social post on Monday.

President Trump has been calling for the Federal Reserve to begin cutting interest rates, arguing that its policy is too tight for a slowing economy. Investors increasingly seem to agree with Trump.

“He’s always been too late,” the president wrote, adding that Powell is a “major loser” whose decisions appear politically motivated.

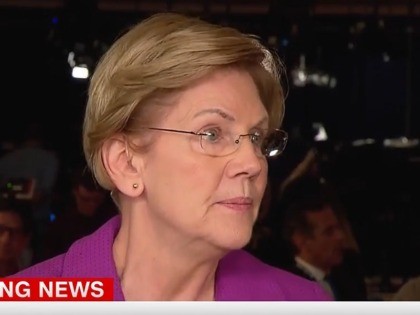

On Thursday’s broadcast of CNBC’s “Squawk on the Street,” Sen. Elizabeth Warren (D-MA) said she is “glad” to publicly blast Federal Reserve Chairman Jerome Powell and say he would be responsible for job losses. But “If Chairman Powell can be

Federal Reserve Chairman Jerome Powell is the latest target of a Donald Trump “Truth Bomb” barrage on his Truth Social platform.

President Donald Trump on Friday called for Federal Reserve Chairman Jerome Powell to lower interest rates, contending it is the “perfect time” to do so.

President Donald Trump is demanding the Federal Reserve cut interest rates, escalating a high-stakes clash between the White House and the central bank as his administration prepares to unleash a new wave of tariffs.

The Fed cut rates three times under Biden, but now that Trump is in office, Powell says there’s ‘no hurry’ to cut further.

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking, Housing, and Urban Development Committee on Tuesday, February 11.

Jerome Powell did a fine job at his press conference Wednesday of staying out of the way of politics despite being peppered with questions from reporters practically begging him to weigh in against President Donald Trump’s policies.

The acceleration of inflation since the Federal Reserve cut interest rates in September suggests that the move was a mistake.

Donald Trump is not going to try to remove Jerome Powell as the head of the Federal Reserve or control monetary policy from the White House.

Breitbart News economics editor John Carney said Friday on Fox Business Network’s “Kudlow” that President-elect Donald Trump will have the power to remove Federal Reserve Chairman Jay Powell once in office.

Breitbart News economics editor John Carney said Wednesday on Fox Business Network’s “Kudlow” that Federal Reserve Chair Jerome Powell may have to resign.

Contrary to the president’s claim, Biden appointed Powell to lead the Fed for a second term in 2021 and has met with the chair multiple times.

Federal Reserve Chairman Jerome Powell says the nation’s unemployment rate is being raised by the inflow of migrants.

With the arrival of thousands of Haitian migrants to Springfield, Ohio, has come more welfare enrollees, higher housing costs for local residents, and a surge in vehicle accidents.

Cutting rates too quickly could lead to a resurgence of inflation, forcing the Fed into a tighter monetary policy stance down the road.

Powell says Fed needs to cut to prevent further weakening of the labor market.

Democrats on Friday urged the nation’s central bank to cut interest rates now as the unemployment rate surged.

Leftists are desperate for the Federal Reserve to cut interest rates because they hamper the “country’s ability to combat the climate crisis.”

A Fed rate cut on the eve of the election would inevitably be seen as a partisan political gift to incumbent Joe Biden and would invite backlash from Republicans.

The U.S. government’s use of immigration raises inflation pressures in some parts of the economy, but also reduces it in other parts of the economy, Federal Reserve Chair Jerome Powell told Sen. JD. Vance (R-OH).

Federal Reserve Chair Jerome Powell explicitly refused to offer forward guidance about interest rate policy in his Capitol Hill testimony this week, which we think is an indication that a rate cut in September is unlikely.

Sen. J.D. Vance (R-OH) grilled Federal Reserve Chair Jerome Powell on the impact that mass immigration has on driving up housing prices while, at the same time, reducing wages for working and middle class Americans.

Powell is working from home while he deals with his second bout of Covid.

The Fed chair does not see a rate hike coming but he acknowledged that recent setbacks on inflation mean the current rate policy will last for longer than anticipated.

Jerome Powell spoke today from our nation’s capital and indicated what we all know to be true: The Fed has no business cutting rates at this time.

The potential that the Fed’s next move is up instead of down is arguably the most underpriced risk in the market.

The job of rebuilding the collapsed Francis Scott Key Bridge in Baltimore is going to take a lot longer than many people initially thought—and cost a lot more money.

The latest dispatch from the Federal Reserve left the expected path of interest rates over the next year unchanged. Yet it hinted at a potentially tumultuous shift beneath the calm facade, a shift to a higher rate of interest over the long term.

Perhaps some of the courage of the patron saint of Ireland will inspire our central bankers.

Fed Chair Jerome Powell pointedly declined to defend the establishment view that immigration is a boon for the economy and more immigration even better.

Super core inflation exploded higher in January.

The decision of the Fed to start cutting interest rates bears a strong resemblance to the decision to marry. It can be reversed but only with a great deal of awkwardness, some economic difficulty, and often a reputational cost.

The Bond Market Is Like a Dog Walking on Two Legs We have it on the authority of James Boswell that in the summer of 1763 Samuel Johnson said that “a woman’s preaching is like a dog’s walking on his

Federal Reserve Chair Jerome Powell admitted that he was wrong to expect inflation would be transitory when it started to rise three years ago. Powell said that “in the fourth quarter of ’21, it became clear that inflation was not

Jerome Powell’s No Cut Thunderbolt Groucho Marx famously said he would not join any club that would have him. What happens, however, when the club joins you? We have been arguing since early December that economic growth was too strong

The Fed Fights Back The Federal Reserve delivered a shock on Wednesday by announcing that it does not anticipate cutting rates until it gets more confident that inflation is moving toward two percent. “The Committee does not expect it will