Fed Hikes Key Interest Rate 75 Basis Points

Investors had expected a 75 basis point raise, although markets indicated an outside chance of an even larger hike.

Investors had expected a 75 basis point raise, although markets indicated an outside chance of an even larger hike.

A big jump in multifamily construction boosted starts in August.

The Fed chairman’s responses to a Cato Institute Q&A appeared to confirm that the Fed is planning a jumbo 75 basis point rate hike this month.

Senator Elizabeth Warren (D-MA) said Sunday on CNN’s “State of the Union” that she is “very worried” that the Federal Reserve will “tip this economy into a recession.”

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation,” Powell said.

Home affordability is declining steeply as the Fed hikes rates to cool inflation.

Inflation figures in the U.S. of 8.5 per cent, the United Kingdom of 10.1 per cent and the 19-country euro area of 8.9 per cent come nowhere close to Turkey’s eye-popping rate of nearly 80 per cent, with skyrocketing food, housing and energy prices hitting people hard.

Like the famous cartoon character Wimpy who promises to pay on Tuesday for a hamburger today, Sen. Joe Manchin’s inflation bill promises to pay for all its extra spending today with savings sometime in the future.

Federal Reserve Chairman Jerome Powell said Wednesday that he does not believe the U.S. is currently in a recession, citing the fact that job vacancies are still above 11 million, unemployment is near record lows, and hiring has been brisk.

The Fed pushed rates higher again in an effort to tame four-decade high inflation.

There’s no doubt that the Federal Reserve is going to raise its interest rate target at the end of tomorrow’s meeting of the Federal Open Market Committee. What we do not know is how much they will raise.

Sales of new homes in the U.S. plunged 8.1 percent to a seasonally-adjusted annual rate of 590,000 in June, a far slower pace than expected by economists.

First hike in 11 years.

“Falling housing affordability continues to take a toll on potential home buyers,” said NAR Chief Economist Lawrence Yun. “Both mortgage rates and home prices have risen too sharply in a short span of time.”

It increasingly looks like it may take a recession to tame inflation—a recession that may already be underway.

The hotter-than-expected inflation report has increased expectations for a super-sized Fed hike at the end of this month.

Longer-term Treasury yields fell last week on recession feaers, dragging down mortgage rates.

U.S. central bankers hiked their plans to raise interest rates quickly in June when CPI inflation and consumer expectations for price increases both came in higher than expected.

A reliable recession indicator was flashing red alert on Tuesday as 10-year yields fell below two-year.

The Bank of England has admitted that its inflation predictions were widely off, as the UK is bracing for 11 per cent inflation.

Home builders slammed on the brakes in May as interest rates and inflation soared.

While the Federal Reserve did the right thing on Thursday by raising its target by three-quarters of a percentage point, the question of whether the central bank will continue to do the right thing remains open.

Fed officials revised their views significantly since the March meeting but still seem optimistic about the chances of a soft-landing.

The Fed’s biggest hike since 1994.

The Federal Reserve is going to have to play catch up to rein in inflation.

A week ago, the Fed Funds futures market implied a 4 percent chance of a 75 basis point hike. Now it implies a 90 percent chance.

The Federal Reserve Bank of New York’s monthly survey of U.S. households indicates a dramatic turn for the worse in both current conditions and expectations for the year ahead.

Pending home sales fell by more than twice what was expected.

On Friday’s broadcast of MSNBC’s “Morning Joe,” Steve Rattner, who served as counselor to the Treasury Secretary in the Obama administration, said that the Federal Reserve will have to raise interest rates “to 5, 6%, maybe higher,” to get inflation

The faith of the followers of Fed Chairman Jerome Powell is fickle. Thursday’s massive stock sell-off completely erased all of Wednesday’s Powell-inspired gains and then some.

Economists forecast that the central bank´s Monetary Policy Committee will raise interest rates for a fourth consecutive meeting to 0.75%.

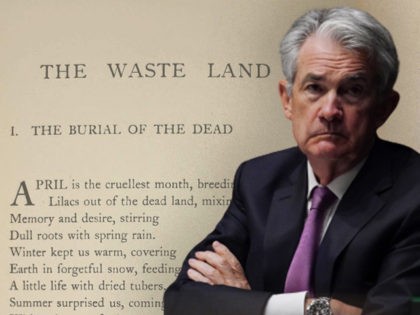

Jerome Powell still believes in immaculate disinflation—and he appears to have won the market over to his view.

The Federal Reserve on Wednesday raised its benchmark interest rate target by half a percentage point, the biggest increase since May 2000.

Fifty-seven percent of the economists, strategists, and fund managers in a recent CNBC poll say they expect the Fed’s interest rate hikes to result in a recession.

What if the problem is not just the nonexistence of a “free lunch” but a shortage of lunches altogether?

If we had not already quoted old Tom Eliot on the alleged cruelty of April, we would certainly be tempted to do so again after Friday brought the April sell-off to such a crescendo.

On Thursday’s broadcast of Newsmax TV’s “Spicer & Co.,” Rep. Brian Mast (R-FL) said that the Biden administration’s economic policies are “doubly hurting the American people” because the price increases due to Biden’s policies are forcing people to put more

For the stock market, April has indeed been the cruelest month in part because it has seen a blossoming awareness that inflation is not going to die of exhaustion after hitting 40-year highs.

Consumers are coping with inflation by piling debt onto their credit cards, but that debt will become more expensive when the Fed hikes interest rates to fight inflation.

The Bank of England has warned that inflation could hit 8 per cent by as early as next month as it raised interest rates on Thursday.