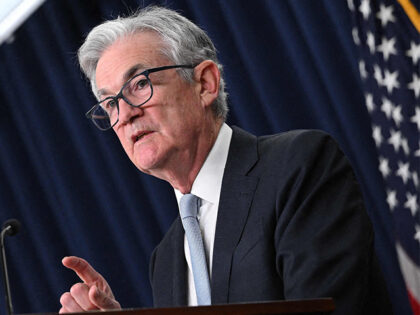

A Dovish Jerome Powell Signals Fed Is Done Hiking Rates—for Now

Powell sent a message that the Fed’s next “move” will be a long pause in interest rate changes.

Powell sent a message that the Fed’s next “move” will be a long pause in interest rate changes.

Federal Reserve Governor Chris Waller on Wednesday drained some of the drama of the coming Halloween meeting of the Federal Open Markets Committee.

Philadelphia Federal Reserve President Patrick Harker said on Monday that he believes it is time for the Fed to stop raising rates.

With so many measures suggesting that disinflation has already nearly run its course, that makes rate hikes next year far more likely than the less-than-zero chance bonds markets currently reflect.

On Thursday’s broadcast of the Fox Business Network’s “Kudlow,” Breitbart Economics Editor John Carney reacted to the September CPI report and stated that the inflation progress over the summer appears to be an outlier and “when the Fed actually gets

The market believed that the Fed might not need to hike again because yields were already doing the work of another hike. And that’s when the bond market started laughing.

“Don’t let them immanentize the eschaton” was an improbably popular slogan among conservatives of the 1960s and ’70s. It now looks like a good maxim for considering inflation and interest rates.

The recession is back on, baby.

During an interview with ABC News on Friday, Rep. Haley Stevens (D-MI) stated that striking auto workers are concerned about whether they can afford to buy homes because “Housing prices are high right now. Interest rates are at a uniquely

The Federal Reserve appears to expect the softest of landings next year.

Applications for refinancing mortgages unexpectedly surged last week despite rising interest rates. The Mortgage Bankers Association (MBA) said that overall mortgage applications rose 5.4 percent last week. Purchase mortgage applications rose 2.3 percent and refinancings jumped 13.2 percent. The burst

The biggest question in economics today is whether the Fed can engineer a soft landing.

The announcement of the Federal Reserve’s interest rate target is likely to be the least interesting thing coming out of this week’s Fed meeting.

Sentiment declined for a second consecutive month in September.

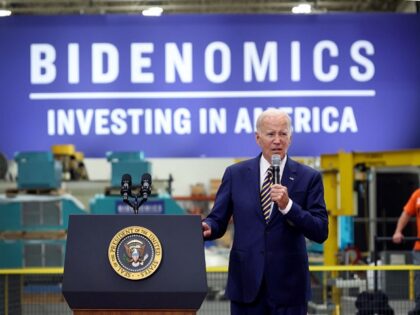

On Wednesday’s broadcast of MSNBC’s “Andrea Mitchell Reports,” NBC Analyst and former Obama White House Press Secretary Robert Gibbs stated that in order for President Joe Biden’s poll numbers on the economy to improve, “the economy is going to have

It’s been more than ten years since we’ve seen figures this high.

Digital mortgage company Better.com, once a beacon of the fintech world, faced a harsh reality check as its stock plummeted 93 percent upon its Wall Street debut this week. Better.com became notorious when bumbling CEO Vishal Garg fired more than 900 employees over Zoom just before Christmas in 2021.

The Fed chairman warned that rate hikes may not be over and rejected the idea of raising the central bank’s inflation target.

The American dream of home ownership is fading into the distant past under the Biden administration with mortgage applications hitting their lowest level in nearly 30 years, the Mortgage Bankers Association (MBA) said Wednesday.

During a portion of an interview aired on Thursday’s broadcast of the Fox Business Network’s “Kudlow,” 2024 Republican presidential candidate former President Donald Trump said that if he is elected president, he would not renominate Federal Reserve Chair Jay Powell

Maybe history will call this week’s move by the Federal Reserve the Barbenheimer Hike.

The so-called “vibecession”—in which people feeling terrible about the economy despite very low employment—appears to be in retreat. Just ask Taylor Swift’s concert-goers.

Even the economists do not believe the Federal Reserve.

Long and variable? Maybe not. Fed Governor Christopher Waller have a speech titled “Big Shocks Travel Fast: Why Policy Lags May Be Shorter Than You Think” on Thursday night in New York.

On Friday’s broadcast of MSNBC’s “Ana Cabrera Reports,” acting Labor Secretary Julie Su acknowledged that the Federal Reserve hiking interest rates to tame inflation is hurting many people and stated that “We should acknowledge some of the pain that Americans

Today’s jobs report data is likely enough to lock-in a Fed rate hike.

The Central Bank of Turkey hiked interest rates for the first time in 27 months on Thursday, reversing a key economic policy that President Recep Tayyip Erdogan stubbornly defended throughout his turbulent reelection campaign.

Stocks and futures dropped across Asia, Europe, and the United States on Tuesday due to growing anxiety about the Chinese economy and the Communist regime’s refusal to deal honestly with its systemic problems.

New Zealand’s government data agency revealed the economy slipped into recession in the first quarter of 2023.

The Federal Reserve on Wednesday announced its decision not to raise the range for its benchmark federal funds rate target, choosing to leave rates alone for the first time in 15 months.

Federal Reserve policymakers left the central bank’s benchmark interest rate unchanged despite inflation that has run above its target for over two years.

Federal Reserve Chairman Jerome Powell will get his pause.

The stage is set for the Federal Reserve to take a breather at its next meeting, probably with the explanation that it wants to assess the effects of the earlier interest rate hikes on the economy.

Just like in the U.S., inflation and labor markets have tested the central bank’s resolve to stay on the sidelines.

The Federal Reserve’s Summary of Economic Projections from March now appear to be seriously outdated.

You could not wish for a better illustration of how hard it is to read the economic signals these days than the dueling services sector purchasing managers indexes released on Monday.

A decline in the self-employed gig economy could be pulling more workers into payroll jobs while also increasing the unemployment rate, Breitbart Economics Editor John Carney explained.

The labor market is putting the Federal Reserve to the test.

On Wednesday’s broadcast of CNBC’s “Squawk Box,” Professor of Economics at Harvard University and former International Monetary Fund Chief Economist Ken Rogoff stated that “the underlying CPI, the underlying core inflation is still pretty strong” and that there will be

The deal to suspend the limit on federal government debt until 2025 removes one of the obstacles to another Federal Reserve rate increase.