Breitbart Business Digest: The Fed’s High-Wire Act

As the Federal Reserve prepares for its June Federal Open Market Committee (FOMC) meeting, speculation is rife about its next move.

As the Federal Reserve prepares for its June Federal Open Market Committee (FOMC) meeting, speculation is rife about its next move.

Our view that the Fed would not cut rates this year has gone mainstream.

On Wednesday’s broadcast of NPR’s “Here and Now,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that “the cost of money,” something that isn’t included in

During an interview with CNBC Europe on Tuesday, Minneapolis Federal Reserve Bank President Neel Kashkari stated that right now, inflation is going sideways, we need “many more months of positive inflation data” to get one to two rate cuts and government

One of the last holdouts for an early rate cut has conceded that the Fed will likely hold out for longer.

Inflation is increasingly coming to resemble the old joke about the weather: everyone talks about it, but no one ever does anything about it.

There’s a palpable tension in the air as Wall Street is confronted with the once unthinkable: interest rates may not be at their peak.

The April-May minutes have a much more hawkish tone than the summary of the previous meeting.

One month’s worth of data does not make a trend—unless it fits the consensus narrative that the Fed is going to cut interest rates a few times this year.

Jerome Powell still stubbornly resists the idea that the Fed’s next move may be a hike rather than a cut.

President Joe Biden’s policy of mass migration is forcing up housing inflation, so pushing up interest and mortgage rates, according to a report in the Wall Street Journal.

President Joe Biden’s migration crisis raises the mortgage rates that burden young couples and families, according to the president of the Federal Reserve Bank of Minneapolis.

The strength of the housing market suggests that a lack of housing supply, high levels of immigration, and increased demand from remote work may mean interest rates need to go higher to reduce inflation.

Somebody forgot to tell corporate America that the stance of monetary policy is restrictive.

The Federal Reserve admitted yesterday that progress on inflation has stalled and that it will take longer for the Fed to achieve the confidence it needs to cut interest rates.

President Joe Biden’s mass migration is boosting inflation, chiefly by raising housing prices, according to the Economist, a U.K.-based pro-globalism magazine.

As the evidence keeps pouring in that the U.S. is still mired in an inflationary economy, the possibility that the Federal Reserve will be forced to increase interest rates can no longer be ignored.

It is unlikely that the Fed will cut rates at all this year; and, if inflation stays hot, it may find that it will need to begin a new cycle of rate hikes sometime next year.

The pace of economic growth in the first three months of the year was far more sluggish than anyone expected—and inflation was much higher.

On Wednesday’s broadcast of CNBC’s “Squawk Box,” Professor of the Practice of Economic Policy at Harvard University and the Harvard Kennedy School Jason Furman, who served as Chairman of the Council of Economic Advisers under President Barack Obama and on the

As is so often the case with Bidenomics, even good news is bad news because of the upward inflationary pressure.

Jerome Powell spoke today from our nation’s capital and indicated what we all know to be true: The Fed has no business cutting rates at this time.

Delinquency rates among American credit card holders are at an all-time high, according to a Federal Reserve Bank of Philadelphia report.

The victory over inflation that the Biden administration and many on Wall Street were eager to celebrate last year now seems to have been, well, transitory.

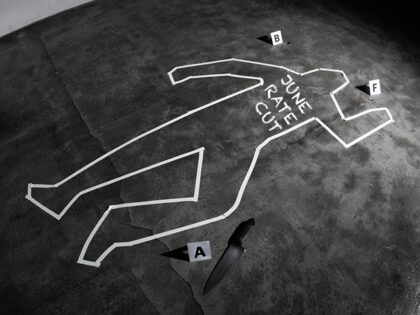

The dream of a June rate cut is dead.

In the economic seas we’re currently navigating, the idea of a Fed rate cut is starting to look like a theoretical exercise detached from the practical realities on the ground.

The Atlanta Fed said inflation is falling much more slowly than expected, so the Fed will probably not cut rates until the end of the year.

The potential that the Fed’s next move is up instead of down is arguably the most underpriced risk in the market.

The job of rebuilding the collapsed Francis Scott Key Bridge in Baltimore is going to take a lot longer than many people initially thought—and cost a lot more money.

During an interview aired on Friday’s edition of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that the “huge set of

The latest dispatch from the Federal Reserve left the expected path of interest rates over the next year unchanged. Yet it hinted at a potentially tumultuous shift beneath the calm facade, a shift to a higher rate of interest over the long term.

Fed officials now expect it will take slightly higher interest rates to get inflation down to their two percent target and to keep it there.

When Jerome Powell steps into the congressional coliseum to deliver his semi-annual testimony to the House and Senate, he is very likely to be met with an aggrieved chorus of Democratic lawmakers arguing that monetary loosening is long overdue.

Raphael Bostic warned on Monday that a premature Fed cut could spark an economic boom that would send inflation higher again.

Fed Governor Christopher Waller argues that there is no reason to fear that we are sailing into a recession, which is the thing that usually prompts rate cuts from the Fed.

New home prices in China slipped again in January, and existing home sales slipped even more, notching the steepest decline in nine years.

The decision of the Fed to start cutting interest rates bears a strong resemblance to the decision to marry. It can be reversed but only with a great deal of awkwardness, some economic difficulty, and often a reputational cost.

The disinflationary forces that convinced so many that we were marching into a period of easing have receded. When Wall Street will recognize the pattern on the wall is still an open question.

The evidence is mounting, as solid and as undeniable as the ground beneath our feet. Inflation is here, it’s real, and it’s time to pay attention.

Inflation, having long since overstayed its welcome, announced on Tuesday that it was just getting comfortable.