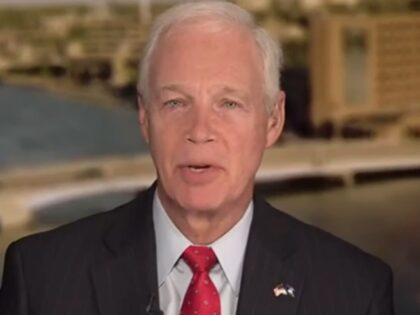

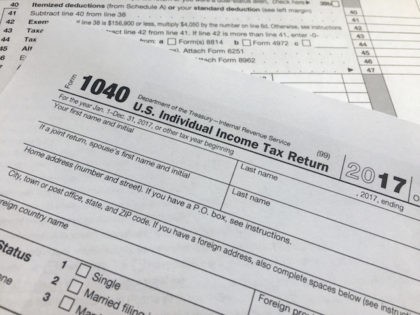

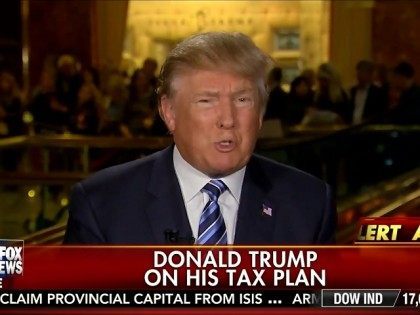

GOP Sen. Johnson: Tariffs As Leverage Are Fine, the Math to Use Them to Replace Income Tax Is Muddled

On Tuesday’s broadcast of the Fox Business Network’s “Bottom Line,” Sen. Ron Johnson (R-WI) stated that using tariffs as leverage to get countries to cooperate on the border is sensible, “I’m not sure how” you use them to replace the