Study: Gen Z’s Idea of Financial Success Looks Like $587,797 Salary

A recent study found there is a stark difference in what Gen Z and Boomers think about financial success.

A recent study found there is a stark difference in what Gen Z and Boomers think about financial success.

After taxes, median real income fell 8.8 percent last year.

A growing number of U.S. households are “egalitarian” in that the husband and wife bring home the same amount of money, a Pew Research survey found.

A report revealed 62 percent of United States adults live paycheck to paycheck.

People have been fleeing California since the start of the pandemic and the draconian lockdowns that followed. Now it has been revealed the population loss was the greatest in the country and a lot of those people leaving are the ones making the most money.

A CNN poll released Monday revealed that 75 percent of registered voters believe expenses and the cost of living are the “biggest economic problem facing” families today.

An analysis from WalletHub revealed that Washington, DC, is at the bottom of the list (Number 51) in most equality categories and overall.

More than 33 percent of Americans who earn $250,000 a year report living paycheck to paycheck, a new survey revealed.

Households in Britain are facing the worst decline in their real income in decades, as energy prices cause inflation to soar.

An analysis from a geospatial data company argues the number of trees planted in different neighborhoods nationwide is unequal along racial lines, and says the threat of “tree inequity” is real and growing.

Excess household saving now totals around $2.3 trillion, calling into doubt the need for more government spending to support the economy

Household spending and incomes were down by much more than expected in November, indicating a weakening economy.

The income of American households rose rapidly in 2019 during President Donald Trump’s lower-immigration, higher-growth economy, according to data published Tuesday by the U.S. Census Bureau.

The unusual combination of falling consumer debt use and rising spending is likely a reflection of Trump administration coronavirus relief programs.

A study shows that Utah is the most independent state in America and Kentucky the least independent based on a set of metrics.

Household spending jumped as the U.S. economy reopened in May.

A Boston City Councilor is proposing a parking fine system based on how much money each driver makes per year.

The Constitution requires counting the number of citizens and non-citizens who live in the United States every ten years.

According to the financial website WalletHub, some cities across America are better places than others for veterans to settle down.

Wages and salaries for men and women working full-time, year-round rose last year.

The quintessential American holiday bookends are Memorial Day, kicking off the summer, and Labor Day, marking the back-to-work and school season.

Consumers shrugged off trade tensions and Democrat attempts to talk down the economy in July, pushing confidence higher than expected.

American households

The median U.S. household income rose for the third year in a row in 2017, according to data from the U.S. Census Bureau released Wednesday.

One reason Democrat politicians talk a lot about inequality may be that Democrat-dominated states have much higher levels income disparity.

Thirty-year-old millennials’ fortunes, sex lives, and income are all pitiful compared to what their fathers enjoyed at age 30, according to Axios.

Sen. Bernie Sanders (I-VT), the senator who has spent his career railing against the rich and successful, made more than $1 million for the second year in a row, according to the senator’s most recent financial disclosure.

Americans’ median pay packets have been flat since 1973, even though the vastly expanded federal government has justified its own salaries and its many massive spending and policy programs as a sure-fire way to boost education, productivity, and wages.

A report from the Harvard Business Review suggests that there is increasing trend of financial vulnerability for lower and middle class American households. According to the report, households experienced an average of five months per years in which household income increased or decreased by more or less than 25 percent.

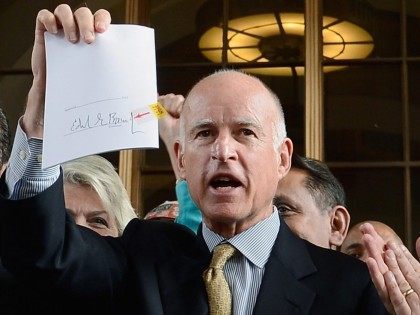

In the first poll, after Gov. Jerry Brown’s asked the California Legislature to raise gas taxes and vehicle registration fees to spend $5.2 billion a year more on transportation, voters solidly oppose paying more taxes to pay for Caltrans bad decision making by 3 to 1.

The probability of American children earning as much as their parents has plunged from 92 percent down to 50 percent during the last seven decades, according to a new study of tax data and the shrinking American Dream of upward mobility.

Presumptive Republican nominee Donald Trump filed his Personal Financial Disclosure (PFD) forms on Monday with the Federal Election Commission (FEC). This is the real estate mogul’s second annual filing, according to his campaign press release.

On Sunday, with Martin Luther King Day right around the corner, George Stephanopoulos of ABC News asked Donald Trump what he would say to Americans, especially African-Americans, who believe Dr. King’s dream has not been achieved.

In a single year the real median income of native-born heads of households declined 2.3 percent while the incomes of foreign-born heads of households increased 4.3 percent, according to newly released government data.

The realistic response to minimum-wage increases involves some combination of making do with less labor – cutting hours, firing people – or passing the cost increase along to consumers. Rarely do we find such a clear-cut example of the latter as the hefty price increase at Chipotle restaurants in San Francisco. As the Chicago Tribune reported, the company was quite direct about raising its prices to cover the cost of local minimum-wage hikes, above and beyond the general price increase imposed on numerous markets to account for the rising cost of food supplies, particularly beef.

Home prices in Washington, D.C. have skyrocketed so high that lower and middle income families are being priced out of the area, a new report finds.

The Federal Reserve has declared economic growth “solid.” But several new reports show most Americans are treading along a dangerous financial tightrope, where one slip could be devastating.