Existing Home Sales Decline, Home Prices Fall Most in a Decade

Climbing mortgages rates in March held back sales.

Climbing mortgages rates in March held back sales.

The latest sign that the housing recession may be coming to an end.

Home prices have been declining as the Federal Reserve’s interest rate hikes have pushed up rates on home loans.

Sales of new homes in the U.S. moved up in February after a big downward revision to the prior month’s estimate. The Census Bureau said Friday that purchases of new single-family homes rose 1.1 percent to a annualized pace of

There were more green shoots of a recovery in the housing market to be seen on Tuesday.

A much bigger jump in home sales than expected.

Has disinflation in housing already gone dry?

Is the housing recession already over?

New Yorkers living in the suburbs outside of New York City say Gov. Kathy Hochul’s (D) zoning plan to override local laws would effectively demolish their communities, forcing them to accept hundreds of thousands of new housing units.

A new paper says older homeowners dropped out of the labor force when home prices boomed.

Mass migration into Canada is inflating the cost of housing so rapidly that top leaders are calling for a slowdown.

A funny thing happened on the way to the recession.

A record number of British adults are still living at home with their parents as younger generations put off marriage and raising children, the country’s official statistician revealed on Friday.

Sen. J.D. Vance (R-OH) says Americans are being robbed of the dream of owning a home as one of the many negative results of illegal immigration.

President Joe Biden’s massive wave of economic migrants is helping employers cut wages, according to a celebratory article in the New York Times.

Border crossers, who arrived in New York City on buses from Texas, are refusing to leave a luxury Manhattan hotel that city officials had placed them in.

Roughly 1 in 4 millennials say their parents cover their rent, a new poll conducted by OnePoll on behalf of Chartway Credit Union found.

A Belgian couple who offered to provide their home to refugees fleeing the war in Ukraine say they were left with €36,000 ($39k) in damages.

A taxpayer watchdog group is warning that a new tax on certain property sales in the City of Los Angeles to raise funds for dealing with homelessness will hurt middle-class renters by forcing landlords to charge more.

Rents are rising because real estate companies are trying to please investors, says a Washington Post report that ignores the economic impact of President Joe Biden’s open borders policy.

As of January 1st, the Canadian government has enacted a two-year ban on foreign nationals purchasing residential properties.

A big jump in spending on manufacturing facilities fueled an unexpected rise in November. Home building, however, remains in decline.

On Tuesday’s broadcast of “CNN This Morning,” Bank of America CEO Brian Moynihan stated that there was too much COVID stimulus, and “Now, we have to adjust to that decision. And that’s why you’re seeing the Fed tighten quick.” Moynihan

All of the 20 cities tracked by the S&P Dow Jones Indices experienced seasonally-adjusted month-over-month price declines.

Daniel Barber, who represents New York City’s nearly 340,000 public housing tenants, says Democrat city officials are throwing millions in taxpayer money at newly arrived border crossers and illegal aliens while forgetting about poor New Yorkers.

Fed policy of tightening did not transmit to the new homes market last month.

Massachusetts taxpayers are being asked to foot a $139 million bill that would “expand emergency shelter capacity” for border crossers and illegal aliens arriving in the state.

The 30-year fixed mortgage rate reached 7.16 percent, the highest it has ever been since 2001, according to the Mortgage Bankers Association (MBA).

The Fed fight against inflation is battering the housing market.

Single-family housing starts in September were at a rate of 892,000, 4.7 percent below the revised August figure of 936,000. Compared with a year ago, single-family starts are down 18.8 percent.

A much deeper slump in home builder sentiment took hold in October.

The 30-year fixed mortgage rate rose to 6.92 percent on Thursday, higher than at any point during the subprime mortgage crisis of the mid-2000s.

High inflation under Democrat President Joe Biden’s economy is making American consumers anxious about the affordability of basic necessities — such as housing, food, and gasoline.

Mass migration has quickly spiked Canadians’ housing prices and rapidly reduced the share of Canadians who can own homes, admits the pro-migration New York Times.

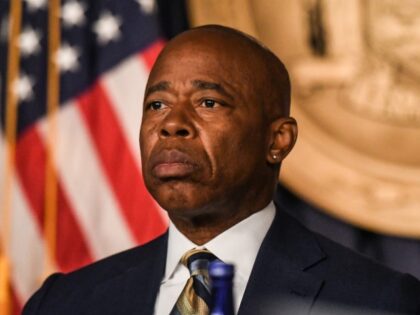

Mayor Eric Adams (D-NY) declared a “state of emergency” Friday due to a surge of illegal immigrants, a situation that he said is “not sustainable.”

Single-family home construction spending dropped 2.9 percent.

People rushed to find a new home before the interest rate deluge washed affordability away.

Home prices are still up a lot compared with a year ago but the housing market is cooling and now seeing month-to-month declines.

More people left the San Francisco metro area than any other metro area in the country in July and August, according to the real estate listing website Redfin, despite a downward trend in departing residents, due to falling prices of housing in the area.

Single-family home sales are down 19.2 percent compared with August of 2021.