China’s Real Estate Giant Evergrande Backing out of Stock Exchanges

The Hong Kong Stock Exchange posted a notice on Thursday that trading had been suspended for shares of China Evergrande Group.

The Hong Kong Stock Exchange posted a notice on Thursday that trading had been suspended for shares of China Evergrande Group.

Big Blue Banking and the Democrats plan to stay woke. If and when they go broke, they will bail themselves out with other people’s money. That’s how the rich stay rich and get richer.

As of March 15, the level of borrowings from the Federal Reserve’s liquidity and credit facilities had risen nearly 2,000 percent from the prior week.

Credit Suisse shares tumble after forced merger with another bank rejected. Switzerland’s largest party said it was against a guarantee.

Reports this weekend indicated that Lebanese citizens are increasingly turning to sit-in blockades, and outright armed robbery, to pry their savings out of frozen bank accounts as the national economy continues its trajectory toward total collapse.

Most voters say their financial situation is actively “getting worse” under President Biden’s leadership, a recent Harvard-Harris survey found.

Germany is facing a “Lehman Brothers” collapse that could spark a domino effect leading to a severe recession, the economy minister warned.

Chinese officials on Wednesday addressed mounting public outrage over the abuse of the mandatory coronavirus “health code” system to suppress protests against a banking scandal – by improbably claiming the whole affair was just a minor technical glitch.

Chinese officials on Saturday were apparently able to suppress protests against a banking scandal in the central province of Henan by the simple expedient of flipping a switch and turning the “health QR codes” of many protesters red.

The administration of U.S. President Joe Biden presented the government of Sri Lanka — which is currently incapable of purchasing basic goods such as food and fuel due to a dire financial crisis — with an “environmental conservation” workshop this week, Sri Lanka’s News First website reported Tuesday.

During an interview with West Virginia MetroNews’ “Talkline with Hoppy Kercheval” on Monday, Sen. Joe Manchin (D-WV) said that while we avoided a financial crisis, “we’re getting into it because they’re making more of a crisis on the individual person

The Swedish municipality of Härjedalen will be investigating the true costs of asylum migration as other local governments face financial crises.

ATHENS, Greece (AP) – Greek riot police used tear gas Thursday against a small group of left-wing activists protesting the visit of German Chancellor Angela Merkel to Athens.

ATHENS, Greece (AP) – Authorities have banned demonstrations in a large section of central Athens and will shut down streets and subway stations during a visit by German Chancellor Angela Merkel, who arrives in the Greek capital Thursday afternoon for

Federal Reserve Chairman Jerome Powell declared 2018 the “best year since the financial crisis” after revealing a late 2018 quarter percent rate hike Wednesday.

The U.S. economy is about 12 percent smaller than it would have been based on its pre-crisis trend.

A very noticeable increase in security on the streets of Beijing’s financial district was reported on Monday. Chinese social media buzzed with video clips of unhappy investors loaded into buses and carted away by the police.

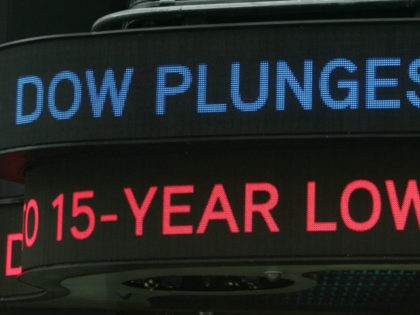

Contents: Champagne corks pop as a ‘Trump rally’ sends Wall Street stocks parabolic; End of debt ceiling suspension on March 15 signals new Washington fiscal crisis; The velocity of money keeps plummeting, indicating no economic growth

A new survey by Ernst & Young and Economic Innovation Group found that “millennials” — those born in the 1980s or later — are a deeply pessimistic generation that is willing to work hard, but is “convinced the economy is failing them,” and is “very uncertain” about the future.

Following the U.S. Justice Department’s demand for $14 billion to settle a mortgage-backed securities probe, several big hedge funds moved their derivative holdings from Deutsche Bank to other firms to avoid the risk of another Lehman Brothers-style liquidity squeeze.

Liberal philanthropist and political financier George Soros asserted that the people of Britain have a genuine sense of regret and shock in the wake of the Brexit vote to leave the European Union.

Abusive executive orders are what most critics have in mind when they accuse President Barack Obama of threatening the constitutional separation of powers and building an “imperial presidency.”

The Federal Reserve has kept a watchful eye on labor markets but as it meets next week to chart interest rate policy, it would do well to recognize that inflation is heating up too.

While promoting his new film “The Big Short” about the 2008 financial crisis, actor Christian Bale says GOP presidential candidate Jeb Bush should “immediately” be disqualified from the race due to his ties to Lehman Brothers.

With Oscar prospects plummeting for the anti-Wall Street film The Big Short, Brad Pitt is rallying Tinseltown progressives to pump up the buzz for his two-hour morality lecture.

Brad Pitt offered up some advice to those about to vote in the 2016 elections — don’t let emotion cloud your judgement.

You might think, as many investors do, that a loss of confidence in Beijing caused the Chinese market rout, but Beijing thinks you’ll find the real culprits along the banks of the Potomac.

Kirk Bostrom at Strategic Preservation Partners LP warns that a global government bond crash is finally under way.

The poll found that UK, France, Germany and the Netherlands appear to view the perception of Greece more negatively due to the current situation. However, the study showed countries that were more impacted by the economic crisis across Europe had a less negative opinion of Greece as a tourist destination.

In the wake of the growing financial crisis, thousands of Greek nationals are fleeing their homeland. Tens of thousands have ended up in Australia. It is the largest wave of migration from Greece to Australia since hundreds of thousands fled the march of fascism in World War II.

David Rosenberg, former Chief Economist for Merrill Lynch, recently made the comment that the current global interest rates, at below 2 percent, have only been this low once or twice in the last 500 years. The globalization cycle over the last two decades pushed up total world debt to $223.3 trillion, over three times the world GDP of about $75 trillion. But the current low rates indicate that individuals and corporations no longer have the moral willingness to take on more debt.

The Office of the Comptroller of the Currency (OCC), which regulates the financial risks posed by the lending activity of American national banks, has officially reported that banks are expanding sub-prime credit by raising borrowing limits for credit card holders. The new concerns follow an OCC report last June that flagged “problematic” recent high-risk corporate takeovers, car loans through auto dealers, and commercial finance lending.

No matter what the expressed intentions of regulators might be, the practical effect of the hyper-State is to keep new upstarts out of established markets, squash small competitors, and fuel the drive toward consolidation. That’s why big business doesn’t favor small government.