Moody’s Chief Economist: Inflation Won’t Hit Number ‘Closer to’ Fed Target that Anyone’s ‘Comfortable’ with for Another Year

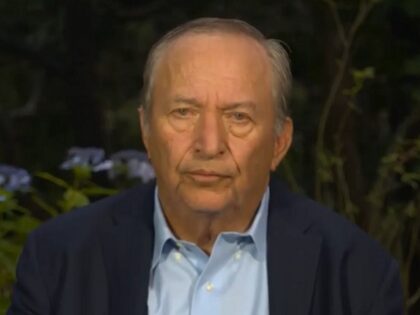

On Monday’s broadcast of CNBC’s “Closing Bell: Overtime,” Moody’s Analytics Chief Economist Mark Zandi stated that inflation getting to a level “anyone feels comfortable with” that is “closer to” the Federal Reserve’s target is “not going to happen before the end