Gary Cohn Sold Someone a Bunch of Dying Cows

Just another day in the life of a former commodities trader who is being considered for Fed chairman.

Just another day in the life of a former commodities trader who is being considered for Fed chairman.

Another voice calls out against the idea of appointing the former Goldman Sachs executive to head the Fed.

President Donald Trump is considering nominating economic adviser Gary Cohn to run the Federal Reserve, but the former Goldman Sachs executive’s proximity to several Wall Street scandals could threaten his Senate confirmation.

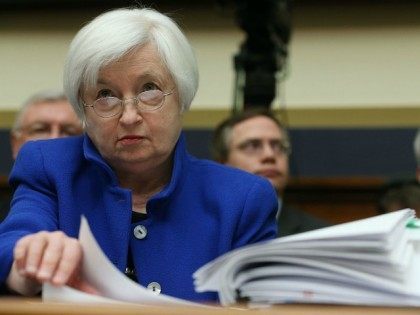

As Janet Yellen’s tenure as the Chairman of the Federal Reserve Bank comes to a close, here are some of the candidates that could replace her at the end of her term next February.

According to a Tuesday report from Politico, National Economic Council Director Gary Cohn is President Trump’s leading candidate to succeed Janet Yellen as chairman of the Federal Reserve.

If there were really a labor shortage, wages would be rising.

Contents: Fed Reserve Chairman Janet Yellen says ‘no financial crisis in our lifetimes’; Examining the stock market bubble; Remembering Alan Greenspan as Fed Chairman; Remembering Ben Bernanke as Fed Chairman

Data points toward lower economic growth.

Fed rate raise signals cautious optimism about economic stability.

Regulation does not reduce risk. It just moves it around.

The Atlanta Fed’s nowcast rose to 4.1 percent.

The Fed doesn’t appear worried about the slow pace of economic growth in the first three months of the year, saying that the slowdown is “likely to be transitory.”

Americans owe a whopping $1 trillion in credit card debt thanks to rising interest rates, according to data from the Federal Reserve.

The possibility that Trump may support the status quo at the Fed has some supporters scratching their heads. On Wall Street, this is widely viewed as the result of the influence of Gary Cohn and other financiers on the president.

Breitbart News Senior Editor-at-Large Peter Schweizer, president of the Government Accountability Institute and author of the best-selling book Clinton Cash, appeared on Thursday’s Breitbart News Daily to give a status report on President Trump’s efforts to “drain the swamp” of Washington corruption.

Far from worrying that the economy is in danger of overheating, the minutes make it clear that Fed officials see the risks to economic growth as “tilted to the downside.”

“I deeply regret the role I may have played in confirming this confidential information and its dissemination,” Lacker said.

It’s been nearly two months since the Federal Reserve said its long-running general counsel Scott Alvarez will retire this year and no replacement has been named.

The House Oversight and Government Reform Committee passed a bill on Tuesday to fully audit the Federal Reserve.

Lending in the U.S. by foreign banks has started to contract.

President Donald Trump’s promises to cut taxes, increase infrastructure spending, and reduce regulatory burdens on businesses have boosted optimism of everyone from CEOs to small businesses to consumers, sent the financial markets soaring, and boosted job creation.

The Federal Reserve increased its key interest rate by 0.25 percent on Wednesday, signaling the Fed’s continued confidence in the improving U.S. economy.

Federal Reserve Chair Janet Yellen speaks at the Federal Open Market Committee press conference on Wednesday, March 15, 2017. Follow Breitbart.tv on Twitter @BreitbartVideo

The Trump White House is weighing its options to fire Consumer Financial Protection Bureau (CFPB) Director Richard Cordray.

Mexico’s central bank was forced to pledge up to 12 percent of the nation’s total foreign exchange reserves to prevent a disastrous run on the peso currency, which has already fallen by 20 percent since the U.S. elections on November 8.

Federal Reserve Chairwoman Janet Yellen will answer questions from a Republican Congress, wary of easy monetary policy and the Fed’s cozy relationship with the Obama administration.

Kentucky’s Sen. Rand Paul appears to be on the cusp of having the Senate and the House pass the “Audit the Fed” legislation that he and his father, former Rep. Ron Paul (R-TX), fought for to stop the Federal Reserve’s “unchecked” and “arguably unconstitutional” meddling in the free market economy.

The Federal Reserve raised interest rates a quarter of a point on Wednesday for only the second time in a decade, and with an improved economic outlook, rates are now predicted to rise three times in 2017.

Federal Reserve policymakers, meeting next week, should provide more clarity about raising interest rates in December.

U.S. employers added 156,000 jobs in September. Job growth has averaged 178,000 a month so far this year, down from last year’s pace of 229,000.

The Fed should start raising interest rates again, but only very gradually and according to a pre-set schedule.

U.S. stocks crashed 2.5 percent on Friday, September 9 as Wall Street woke up to the risk of “Two Bumps and a Stumble” — i.e. when it takes two interest rate hikes to generate a market reaction.

Weak August employment growth of just 151,000 in total non-farm payrolls, along with a 1,000-job downward revision for July, may allow the U.S. Federal Reserve to delay raising interest rates despite inflation concerns.

Despite a forecast of 160,000 new jobs, the Obama Department of Labor announced that job creation in May plunged to 38,000, the worst monthly performance in 6 years.

On Friday, the Labor Department reported that the economy gained just 38k jobs in May, far below economists’ expectations. Worse, the Feds revised estimates of job gains in the previous two months down, wiping 59k jobs off the labor rolls.

All of us loved less-than $2 a gallon at the pump. AAA reports: “Americans paid cheapest quarterly gas prices in 12 years”—which resulted in savings of nearly $10 billion compared to the same period last year. However, oil (and, therefore gasoline) has been creeping upward since the February low—topping $45 a barrel, a high for the year. And that could be a good thing.

The Federal Reserve has kept a watchful eye on labor markets but as it meets next week to chart interest rate policy, it would do well to recognize that inflation is heating up too.

Chairman Janet Yellen says the Federal Reserve is delaying hiking interest rates, so the rapidly inflating real-estate bubble seems headed toward another crisis.

The Federal Reserve is dealing financial drugs and endangering the world economy by creating a bond bubble of epic proportions.

As the presidential race shifts into high gear, college students and recent graduates are still being largely ignored, except by one candidate whose promises of rainbows and unicorns are dreams – not reality.