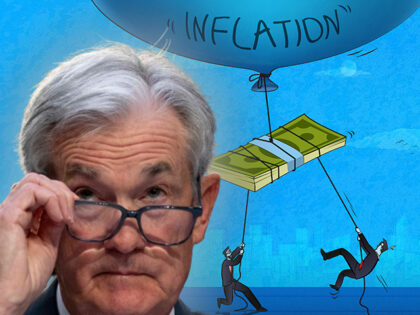

Yellen to Fed: Data ‘Suggests’ Further Rate Cuts Are ‘Appropriate’

During an interview with CNBC on Thursday, Treasury Secretary Janet Yellen responded to a question on if she thinks the Federal Reserve has rates that are too high by stating that the Fed’s members expect rates to be cut and