Fed Will Likely Cut Rates This Week but No One Knows What Happens Next

The market is all but certain Federal Reserve officials will cut interest rates at the end of their two-day meeting this week. But what comes next is anyone’s guess.

The market is all but certain Federal Reserve officials will cut interest rates at the end of their two-day meeting this week. But what comes next is anyone’s guess.

The “temporary liquidity operations” are looking a lot less temporary with each passing day.

The Fed is back in the business of buying Treasury bills again but it really, really doesn’t want you to call it QE.

The Consumer Price Index was flat for September, vindicating Trump’s claim that there is no inflation in the U.S. economy.

The odds implied by futures markets now favor a cut in October and another in December. Even January is now in play.

Currency and rates markets agree with Trump: the Fed’s policy is too tight and rates need to come down.

The market appeared to be on steadier footing on Tuesday, with demand falling to the lowest level in almost two weeks.

The madness was a bit milder on Monday, perhaps indicating that the Fed’s intervention is working to relieve repo stress

No sign of stability in the short-term funding market.

Demand for short-term cash loans for banks is rising and liquidity crunch rolls on.

New home sales were much better than expected in August, putting the year on pace to be the best since 2007.

The short-term funding market still needs emergency liquidty from the Federal Reserve.

The amount of funds needed to keep the short-term repo market under control is still growing and demand is rising.

The Fed’s intervention in the overnight funding market for banks entered its second week on Monday.

The maturity mismatch in coworking spaces could make losses in commercial realestate much worse in a downturn.

The Fed’s life support for the short-term funding market will continue on Friday.

The Federal Reserve Bank of New York once again stepped into the money market to supply additional liquidity on Thursday morning. The N.Y. Fed injected $75 billion into the market for overnight repurchase agreements, known as repos. The Fed had

Here’s everything you need to know about the repo market but were afraid to ask.

Trump described the Fed’s move to cut rates by only one quarter of a percentage point as a failure of vision.

The Fed moved its benchmark short-term rate target to a range between 1.75 percent and 2 percent Wednesday.

The repo market is still throwing a fit and no one knows why.

A breakdown in the overnight funding market that is key to global finance triggered a massive intervention by the N.Y. Fed.

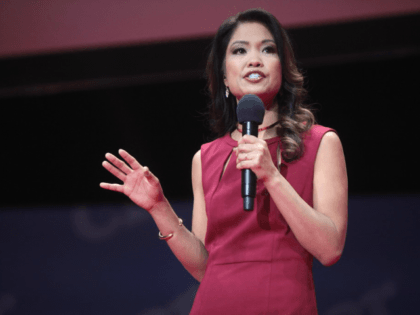

Columnist Michelle Malkin is calling on President Trump to “shut down” a Federal Reserve program that profits off remittances sent to foreign countries by illegal aliens.

Trump says the U.S. is missing out on a once in a lifetime oppoirtunity to borrow cheaply while global rates go negative.

“Political factors play absolutely no role in our process, and my colleagues and I would not tolerate any attempt to include them,” Powell said.

President Donald Trump has been projecting a sense of uncertainty and frustration. He needs to do the opposite, and project reassurance and leadership.

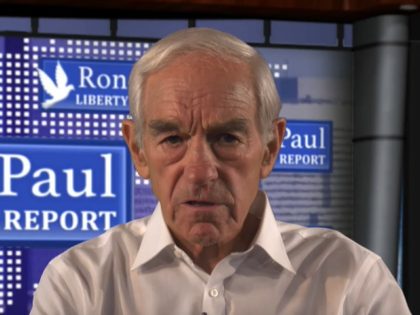

Wednesday during his weekly “Ron Paul Liberty Report,” former Rep. Ron Paul (R-TX) warned it is the Federal Reserve, not the Russians when it comes to entities interfering in U.S. elections. Paul cited a former member of the Federal Reserve

President Donald Trump has launched an unprecedented economic campaign to free America from the world’s most cancerous economy. However, Federal Reserve Chairman Jerome Powell is helping China survive it through policies seemingly designed to undermine Trump and help the left.

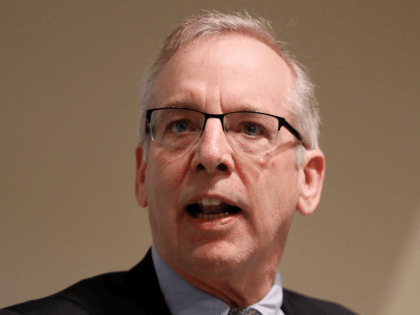

Americans for Limited Government (ALG) President Rick Manning released a statement Tuesday, slamming former New York Federal Reserve President Bill Dudley’s call for the Fed to consider how their policies will impact the 2020 election.

Former New York Federal Reserve President Bill Dudley urged Tuesday his former colleagues not to help President Donald Trump in his trade war against China. He even urged the central bank to consider how its monetary policy might impact the 2020 presidential election.

The chairman of the Federal Reserve said the central bank would take action to fend off economic pressure from the trade war.

President Donald Trump again urged the Federal Reserve to act on Friday after China announced new tariffs on $75 billion of United States products.

The heads of the Kansas City and Philadelphia Federal Reserve banks both said ithat they thought the July rate cut was unnecessary.

“I think the word ‘recession’ is inappropriate because it’s just a word that certain people, I’m going to be kind, certain people in the media are trying to build up because they’d love to see a recession,” Trump said. “We’re very far from a recession.”

President Trump is keeping up the pressure on Fed chair Jerome Powell to cut interest rates.

“Monetary and trade policies have heightened consumer uncertainty—but not pessimism,” Richard Curtin said in a statement.

“Our problem is with the Fed,” Trump tweeted. “Raised too much & too fast. Now too slow to cut.”

Sens. Josh Hawley (R-MO) and Tammy Baldwin (D-WI) introduced legislation Wednesday to “fight back” against foreign currency manipulation and boost American manufacturing and agriculture.

Trump pounced after Powell said that Wednesday’s rate cut should not be viewed as the beginning of a long series of rate cuts

The Federal Reserve on Wednesday cut its benchmark interest rate by one-quarter of a percentage point.