Dow Drops Below 30,000, Lowest Level Since 2020

Investors rethink the post-Fed rally.

Investors rethink the post-Fed rally.

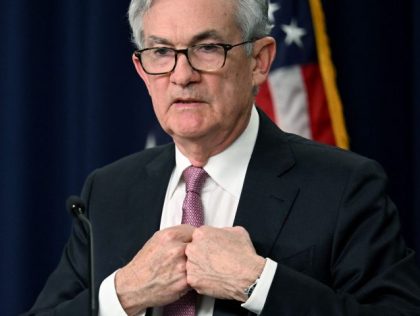

While the Federal Reserve did the right thing on Thursday by raising its target by three-quarters of a percentage point, the question of whether the central bank will continue to do the right thing remains open.

Fed officials revised their views significantly since the March meeting but still seem optimistic about the chances of a soft-landing.

The Fed’s biggest hike since 1994.

The Federal Reserve is going to have to play catch up to rein in inflation.

A week ago, the Fed Funds futures market implied a 4 percent chance of a 75 basis point hike. Now it implies a 90 percent chance.

The Federal Reserve Bank of New York’s monthly survey of U.S. households indicates a dramatic turn for the worse in both current conditions and expectations for the year ahead.

The country’s economy will worsen, warned billionaire businessman, supermarket chain owner, and radio talk show host John Catsimatidis, who claimed a recession is completely avoidable as he blamed the Biden administration for refusing to “open up the spigots” and allow America to power itself.

During an interview aired on Friday’s broadcast of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that even though there’s a

Biden misleadingly cited data from last year, when inflation was much lower, to claim Americans feel comfortable with their personal financial situation.

Recession worries are cited by three of the Fed’s 12 Districts.

We don’t know if it’s a minor one or Superstorm Sandy. You better brace yourself,” the chief of J.P. Morgan Chase said at a conference Wednesday.

Pending home sales fell by more than twice what was expected.

Joe Biden is discovering a political truth that no president has had to confront in decades: Americans hate inflation.

On Thursday’s broadcast of CNN International’s “First Move,” Professor of Public Policy and Professor of Economics at Harvard University Ken Rogoff said that inflation in the United States is “just way too high. It’s not getting under control.” And predicted that

The Senate on Tuesday confirmed Dr. Lisa Cook, who has a history of Black Lives Matter bullying and radical monetary policy beliefs, to the Federal Reserve board of governors.

“Given where inflation is now, I suspect we’re going to have to move above neutral, but I can’t tell you exactly how far above neutral,” said Loretta Mester.

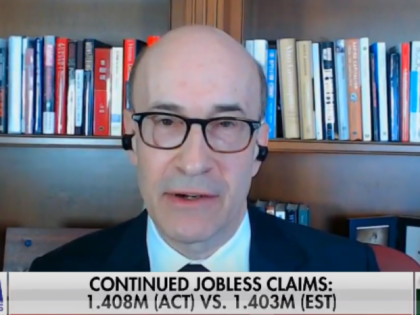

On Friday’s broadcast of the Fox News Channel’s “Your World,” White House Council of Economic Advisers member Jared Bernstein said that inflation will not hit the Federal Reserve’s target of 2% in 2022. Bernstein stated, [relevant remarks begin around 6:20]

Economists forecast that the central bank´s Monetary Policy Committee will raise interest rates for a fourth consecutive meeting to 0.75%.

Jerome Powell still believes in immaculate disinflation—and he appears to have won the market over to his view.

The Federal Reserve on Wednesday raised its benchmark interest rate target by half a percentage point, the biggest increase since May 2000.

Appearing Monday on CNBC, Roger Ferguson, former Federal Reserve vice chairman, warned that a recession is “almost inevitable.”

The recession is expected to start in the second half of 2023.

What if the problem is not just the nonexistence of a “free lunch” but a shortage of lunches altogether?

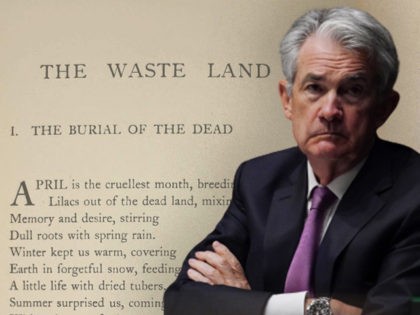

If we had not already quoted old Tom Eliot on the alleged cruelty of April, we would certainly be tempted to do so again after Friday brought the April sell-off to such a crescendo.

Bidenflation pushes prices up at the fastest pace since 1981.

The financial website WalletHub took the pulse of Americans as the Federal Reserve is poised for a rate change.

The Senate on Tuesday voted to block a Democrat motion to invoke cloture on Dr. Lisa Cook to become a member of the Federal Reserve board.

The Michigan State Interim Provost and President promoted in 2020 Dr. Lisa Cook, now a Federal Reserve nominee, to full professorship over colleagues’ objections, raising questions about her qualifications for a post at the nation’s central bank, according to documents obtained by Breitbart News.

For the stock market, April has indeed been the cruelest month in part because it has seen a blossoming awareness that inflation is not going to die of exhaustion after hitting 40-year highs.

Forget the idea that inflation has already peaked.

President Joe Biden has nominated the Obama-era Treasury staffer Michael Barr to serve as the vice chair for supervision at the Federal Reserve; Barr has defended Dodd-Frank’s Wall Street bailout mechanism.

Federal Reserve Bank of St. Louis President James Bullard said Thursday that he would like to see the central bank raise its target rate to 3.5 percent by the second half of this year. “I do think we have to

Sen. Bill Hagerty (R-TN) called for a more “fulsome investigation” into accusations Federal Reserve nominee Dr. Lisa Cook embellished her resume. Cook swore under oath she had not embellished her record.

The Federal Open Market Committee’s March meeting minutes indicate that the Federal Reserve still believes it can bring down inflation painlessly.

Is that a fast enough pace to defeat inflation?

Senate Democrats discharged Biden Federal Reserve nominee Dr. Lisa Cook, who has a history of canceling those critical of Black Lives Matter (BLM), supporting reparations, and advocating for policies that could politicize the Fed.

A new survey shows the extent of the American public’s loss of confidence in the Fed and the Biden administration’s inflation fighting skills.

The market appeared to register a no-confidence vote on the Federal Reserve’s inflation-fighting.

Federal Reserve Chairman Jerome Powell apparently figured out that the market had not quite got the message that he intends to be tough on inflation.