Breitbart Business Digest: Bank Failure Is Not a Failure of the Banking System

In a system of competitive banking, there will always be banks that misjudge the risks they face, and sometimes this will mean they fail.

In a system of competitive banking, there will always be banks that misjudge the risks they face, and sometimes this will mean they fail.

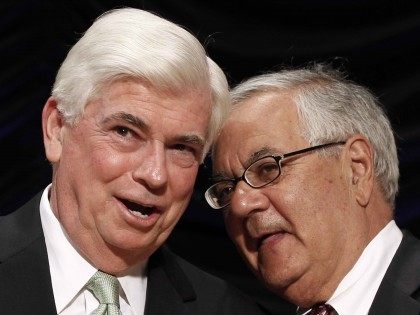

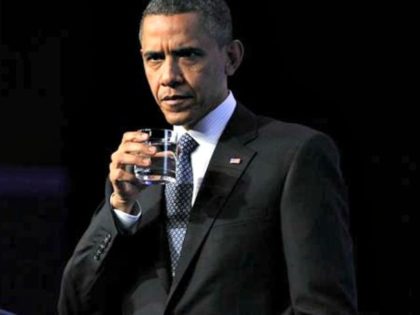

President Joe Biden has nominated the Obama-era Treasury staffer Michael Barr to serve as the vice chair for supervision at the Federal Reserve; Barr has defended Dodd-Frank’s Wall Street bailout mechanism.

Bruce LeVell, the National Diversity Coalition for Trump executive director, said on Sunday evening he predicts President Donald Trump will win even higher levels of support in the black and Hispanic communities in 2020 than he did in 2016.

The Supreme Court on Monday denied review of a major challenge to the constitutionality of the CFPB and Dodd-Frank, resulting from the understandable recusal of Justice Brett Kavanaugh, who was still a judge on the federal appeals court handling the case on its way to the justices when the case was pending before that court.

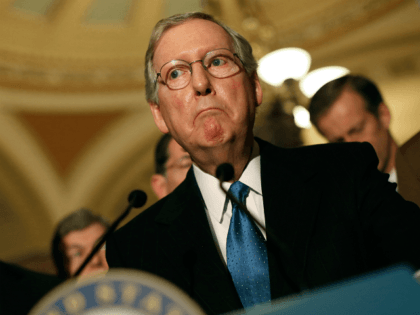

Senate Majority Leader Mitch McConnell said on Friday that he will cancel the August recess because he will not let the Democrats obstruct the president’s agenda.

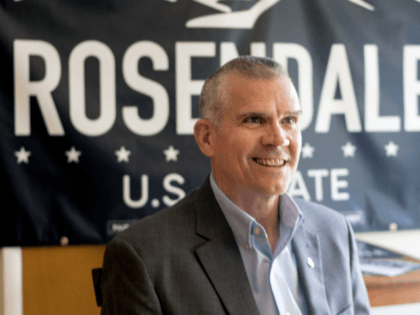

Matt Rosendale told Breitbart News that “Jon Tester’s only campaign strategy is to deny reality” that the president’s agenda is working.

Rep. Jeb Hensarling (R-TX) said he would support a Senate-passed bill to roll back parts of the 2010 Dodd-Frank financial overhaul.

Mitch McConnell pivoted away from gun control towards banking regulation that would loosen rules for community banks and credit unions.

Lawsuits challenging the constitutionality of parts of the Consumer Financial Protection Bureau (CFPB) are likely going to the Supreme Court late this year, as the left-leaning majority of a D.C.-based federal appeals court sided with the powerful agency.

WASHINGTON, DC – Obama holdover Leandra English is claiming to be the acting head of the powerful Consumer Financial Protection Bureau (CFPB) and, on Sunday, filed a lawsuit against the president of the United States, seeking an emergency court order declaring her the lawful director and requiring everyone to treat her as such.

Rep. Ted Budd (R-NC) seemed a lot like Jimmy Stewart’s Mr. Smith as he fought the Republican establishment in the House of Representatives in Washington to include the repeal of the Durbin amendment in the Financial Choice Act of 2017— the legislation designed to reform the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act that’s proven damaging for small businesses and consumers and a financial boon for big businesses and banks.

President Donald Trump will sign an executive order Friday unraveling the 2010 Dodd-Frank financial reform. The move comes as part of a comprehensive plan to rescind regulations set in the wake of the financial crisis.

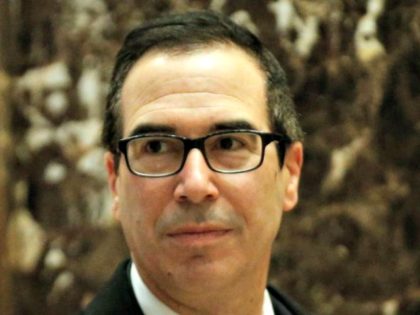

The highlight of Treasury Secretary Steven Mnuchin’s confirmation hearing so far was his rousing defense of community banks against overbearing federal regulations. “Regulation is killing community banks,” he declared, and if the process is not reversed, we could “end up

President-elect Donald Trump could rescind financial regulations that cost the financial services industry at least $1.7 billion, according to a new analysis from the American Action Forum.

The chairman of the House Tea Party Caucus and one of the first men to come out against Speaker John A. Boehner told Breitbart News that he does not think Speaker Paul D. Ryan (R.-Wis.) has the votes to keep his gavel.

During MSNBC’s Election Day coverage, former Clinton Campaign Manager James Carville stated, “Donald Trump now has the authority of an election behind him.” Carville said, “Donald Trump now has the authority of an election behind him. It’s the biggest thing

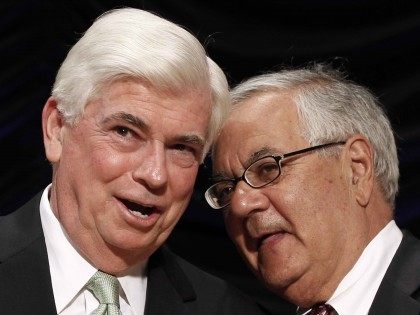

A federal appeals court on Tuesday ruled a key part of Barack Obama’s Dodd-Frank law unconstitutional, calling it a “grave threat to individual liberty.” This tees up yet another case for an evenly divided Supreme Court, the balance of which will be decided by whether Donald Trump or Hillary Clinton is elected in November.

Former Republican candidate for California governor and current Federal Reserve Bank of Minnesota President Neel Kashkari gave a speech Feb. 16 advocating doubling-down on Obama’s disastrous Dodd–Frank law, which has made irresponsible “too big to fail” banks much bigger by crushing well-managed community banks.

Democratic presidential candidate former Secretary of State Hillary Clinton stated she would let banks fail and not bail them out as president on Tuesday’s broadcast of CBS’ “The Late Show with Stephen Colbert.” Hillary was asked, “You put forth a

Texas Governor Greg Abbott was interviewed by Sean Hannity and the nationally syndicated radio talk show host told Abbott – “Good job in Texas, I’ll tell you that!” Hannity commended Abbott for his tough stance on sanctuary cities, his lawsuit against the Obama administration’s amnesty program, and putting a halt to Obama’s amnesty during his tenure as President. The talk show host also asked the Texas Governor who he was supporting as President.

In an interview with The Hill, Donald Trump warned of a stock market bubble on the verge of bursting, and slammed the Dodd-Frank financial regulations, which were roundly praised by the 2016 Democrats during their first primary debate on Tuesday night. Trump called Dodd-Frank “terrible” and said he would “absolutely” repeal it as President.

The Obama Administration’s Dodd-Frank Act, passed early in his first term to supposedly punish Wall Street, has had the adverse effect of actually making billions for Wall Street hedge funds by cutting in half the percentage of Americans that could

One of the unusual aspects of Dodd-Frank is that, in effect, it removed the CFPB from the Congressional appropriations process and gave CFPB what amounts to an unlimited budget.

This foray into the potholes and backroads of Tennessee is a new area of regulatory control, even for the CFPB. But, as American Banker reported, Congress granted the CFPB the authority to do so in an obscure passage of the Consumer Financial Protection Act of 2010, known more commonly as the Dodd-Frank Act.

The federal government aims to “protect” consumers by regulating away a payment option that’s popular with low-income Americans.

In an exclusive interview with Breitbart News just a few days before she is set to enter the 2016 presidential race, former Hewlett-Packard CEO Carly Fiorina discussed her experiences on the campaign trail and her ideas for improving the economy.

Senator Elizabeth Warren (D-Mass) has not commanded much public attention since Hillary Clinton started channeling Warren’s book, Fighting Chance, which claims the “system is rigged” against the middle class because it is controlled by and for the elites who tilt the game in their favor. But in a bold effort to take all the oxygen out of the Clinton campaign, Senator Warren (D-Mass.) laid out a bare-knuckles legislative road map on Wednesday to kick Wall Street in the teeth.

According to the California Realtors’ home ownership affordability report, only 28 percent of Los Angeles residents can afford to buy a home in Los Angeles, due to the combination of low inventory and the fact that the Dodd-Frank Consumer Protection Act made it much harder for immigrants and first-time buyers to qualify for a loan.

No matter what the expressed intentions of regulators might be, the practical effect of the hyper-State is to keep new upstarts out of established markets, squash small competitors, and fuel the drive toward consolidation. That’s why big business doesn’t favor small government.