Dow Drops 500 Points As Bank Fears Reignite

Fears of financial instability are dragging markets down again on Wednesday.

Fears of financial instability are dragging markets down again on Wednesday.

Investor confidence in the global recovery has been shaken by rising infections.

The worst sell-off since the coronavirus panic of March.

Shares of retailers like Macy’s, Kohl’s, and the Gap rose sharply as investors cheered evidence that the economy is recovering.

The Dow Jones Industrial Average managed to end a chaotic day in positive territory for the week.

U.S. stocks and bond yields dropped Thursday, erasing most of the previous days’ gains and signaling renewed anxiety of the coronavirus outbreak. The Dow Jones Industrial Average plummeted by more than 970 points, or around 3.6 percent. The S&P 500

Healthcare stocks surged higher as Super Tuesday’s results suggest Sanders is less likely to win the Democratic nomination.

The largest percentage gain since 2009 and the largest one-day point gain ever.

Stocks dropped sharply for a second day on heightened fears over the impact of the coronavirus on U.S. companies.

Stocks in the U.S. fell sharply as new coronavirus outbreaks raise fears of deeper economic impact.

Bernie Sanders win in New Hampshire is seen as making a Trump victory in November more likely.

Let the good times roll.

Investors, unbothered by the caucus chaos in the Democratic Party, sent stocks flying high on Tuesday

The market is showing some signs that the coronavirus is taking its toll.

Stocks were down in New York, London, Europe, and Asia amid rising concerns over the spread of the viral infection from China.

The moves in stocks, energy, and bonds show no signs of acute concern following the news of the killing of Iran’s top military leader.

Stocks suffered their biggest sell-off of the year Monday Chinese retaliation against new U.S. tariffs escalated.

Fed chair Jerome Powell’s Capitol Hill testimony sent stocks climbing once again on Thursday, pushing the Dow to a record high close.

U.S. stocks spent most of the day like a well made cocktail: mixed but not too strong. Then things got ugly in the final hour before the close.

Investors were cheered by signs that the Trump administration’s trade policies appear to be producing cooperation and compromise rather than sparking a trade war.

Stocks of the biggest U.S. multinational companies were hit the hardest by a sell-off that accelerated after the Trump administration announced new steel and aluminum tariffs.

Monday’s gains were spread widely through the market with 10 of the 11 S&P sectors up. The energy sector saw the best performance of the day, boosted by rising energy prices.

Just when you thought it was safe to go back into the stock market again, stocks are falling again Thursday.

The Dow is down by around 3.6 percent for the week, making this the worst week for stocks since January 2016.

Not since before World War II has the Dow Jones Industrial Average seen a rise as powerful as what we saw in Donald Trump’s first year.

Markets are off to a roaring start for the year, climbing the wall of worry about frothy valuations to even higher levels.

Opposition party media playbook: ignore the good news, accentuate chaos.

Best Buy soars 21%.

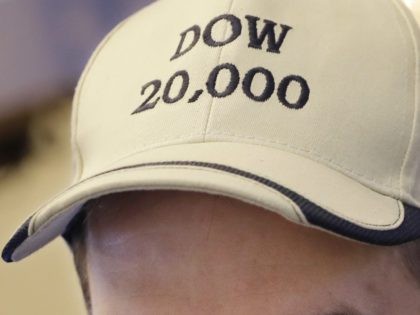

The Dow Jones Industrial Average (DJIA) broke through the historic 20,000 mark to close at 20,007, as the “Trump Trade” rally drove world stock prices higher on January 25.

The Dow Jones Industrial Average broke through 20,000 points for the first time at the start of trading Wednesday morning, reaching a new milestone and continuing an extraordinary run that began on the morning after Donald Trump won the presidential election.