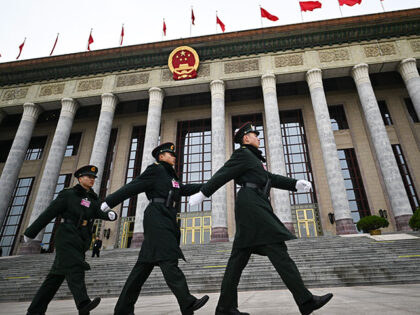

China Announces Military Spending Hike, More Economic Stimulus

Chinese Premier Li Qiang on Wednesday announced a 7.5 percent increase in military spending for 2025, ostensibly due to increasing tensions with the United States and Taiwan.

Chinese Premier Li Qiang on Wednesday announced a 7.5 percent increase in military spending for 2025, ostensibly due to increasing tensions with the United States and Taiwan.

Japan’s economy and currency weakened somewhat more than expected in 2023, causing it to slide behind Germany to become the world’s fourth-largest economy.

On Tuesday’s broadcast of CNBC’s “Squawk on the Street,” White House Council of Economic Advisers Chair Jared Bernstein stated that the White House doesn’t want to see “a broad deflation,” but “in areas where prices went up really a great

China’s communist dictator Xi Jinping has no idea how to fix his country’s youth unemployment problem or deflationary spiral, Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.

China’s faltering economy took another beating in July, as both import and export numbers came far below expectations. Imports fell 12.4 percent instead of the five-percent slide that was expected, while exports dropped 14.5 percent against an expected 12.5 percent.

A bit above expectations but still a signal that there is very little inflation in the U.S. economy.

Despite a record-high federal budget deficit and unprecedented levels of liquidity provided by the Federal Reserve, inflation is dead.

Margins were squeezed in June as the economy grappled with an unsteady reopening, rioting, and widespread social unrest.

The price of chicken crashed while the price of beef soared.

The third Bitcoin “halving” took place Monday afternoon, putting the inflation rate of this populist Internet money below the targeted annual inflation of the U.S. dollar.

Prices for goods in the U.S. dropped 0.4 percent in June even as tariffs on $200 billion of Chinese imports rose.

Americans were paying less for the food they put on their table last year despite the widespread complaints of labor shortages and warnings about crops withering.

With a “predatory” currency devaluation following the Brexit, China is now exporting deflation.

The news is full of stories about deflation and negative interest rates, but take away the $80 a barrel decline in oil prices since March 2014, and the inflation trend appears to have popped up to more than 2 percent.

From The Telegraph: RBS has advised clients to brace for a “cataclysmic year” and a global deflationary crisis, warning that major stock markets could fall by a fifth and oil may plummet to $16 a barrel. The bank’s credit team

Beyond the horrific deaths, injuries, and panic from seven coordinated terror attacks in Paris, the consequences of France’s 9-11 will likely be a serious deflationary recession and right-wing nationalism spreading across Europe.

Lombard Street Research (LSR) has reported that China’s “real” (after-inflation) GDP actually fell -0.2% for the quarter ending March 2015. Despite the official government claim of +1.3 percent growth for the quarter and +7 percent annualized growth. China’s quarterly performance

Farmland prices that had been enjoying a 28-year bull market finally turned down in 2014. Despite real estate, stocks, bonds and commodities crashes over the period, farmland had never had a down year since 1986. However, the Wall Street Journal has reported that farmland suffered a loss of 3 percent last year, “reflecting a cooling in the market driven by two years of bumper crops and sharply lower grain prices, according to Federal Reserve.”

Federal Reserve data published late on February 18 reveals China dumped about $75 billion in US bonds in the last six months of 2014. The action explains why interest rates on US Treasury bonds jumped by 23 percent since January, and economic indicators show the US economy growth is slowing and worldwide deflation is accelerating.

(Reuters) Deflation is close – but don’t worry. That was the message from Bank of England governor Mark Carney, as he explained why UK inflation is at its lowest level in nearly 15 years. Follow Breitbart London on Twitter @BreitbartLondon

Diana Choyleva of Lombard Street Research, who produces an “unmassaged” calculation of China’s true economic growth, just reported that China’s fourth quarter GDP growth plummeted to 1.7 percent, versus the official 7.4 percent rate.

Perhaps Greece’s new far-left government will rethink its plans to shake Europe down for cash to fund its wild spending binges, now that the German economy has officially entered a deflationary cycle, as reported by Business Insider

Something is brewing in Europe now that has the Swiss National Bank worried. If you haven’t been paying attention in the last 24 hours, the currency and equity markets have been rocked by a surprise move to delink the existing currency peg

China’s Producer Price Index (PPI) that measures the price changes for the goods and services produced by the nation has fallen for 32 straight months. As the factory to the world, China has been exporting deflation. The economic impact has been increasing the real burden of debt, driving down worldwide wages and discouraging consumption.

There is already a historic, growing war going on in the Mideast and south Asia, with jihadist Muslims killing thousands of other Muslims every month. This is a growing war, and it’s both ethnic (pitting tribe against tribe) and sectarian (pitting Sunnis against Shias).