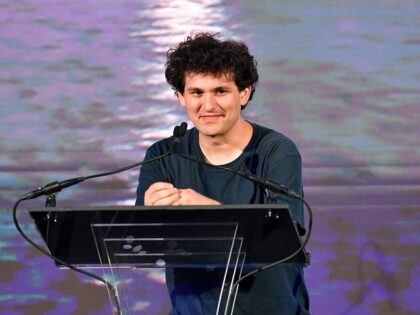

House Financial Services Chair Maxine Waters Does Not Have Plans to Subpoena Sam Bankman-Fried

House Financial Services Committee Chair Maxine Waters reportedly informed a private group of Democrats that she does not plan on subpoenaing Sam Bankman-Fried, the disgraced former CEO of FTX, after the company’s collapse.