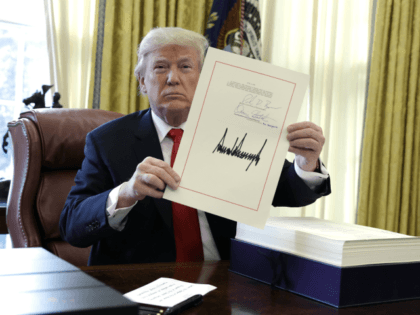

“I’ve endorsed Donald’s 15 percent corporate tax rate many times,” Kudlow told Breitbart News in a brief interview during a commercial break.

I don’t know all the details about his entire tax program, it’s certainly moving in the right direction lowering rates but specifically on the 15 percent corporate tax rate I have argued for it for several years. And by the way, I happen to think it would grow the economy, attack capital from all over the world—China’s at 25, we’d be at 15, it would easily pay for itself. Easily. I believe it would lower the deficit. Again, I can’t speak for the whole plan—I can speak for the 15 percent corporate tax rate. He’s spot on. And I’m honored that he mentioned me. Honored.” Kudlow’s comments to Breitbart News about Trump come after an exchange in the opening part of the CNBC debate here where co-moderator John Harwood asked Trump extraordinarily contentiously about his tax plan.