Breitbart Business Digest: Trump Moves to Rein in the Rogue CFPB

The Consumer Financial Protection Bureau (CFPB) has become one of Washington’s most powerful—and least accountable—agencies. But the days of the CFPB’s unchecked power are over.

The Consumer Financial Protection Bureau (CFPB) has become one of Washington’s most powerful—and least accountable—agencies. But the days of the CFPB’s unchecked power are over.

Around 100 Consumer Finance Protection Bureau workers protested outside the agency’s headquarters on Saturday.

Elon Musk’s Department of Government Efficiency (DOGE) has begun its auditing protocols at the Consumer Financial Protection Bureau (CFPB), after he said the agency should be “deleted.”

President Donald Trump has fired the head of the Consumer Financial Protection Bureau (CFPB), Rohit Chopra, in his latest move to push out remnants of the Biden administration.

A bipartisan coalition of unlikely “bedfellows” opposed to financial blacklisting by tech giants and Wall Street behemoths is rising.

Bank of America agreed to part with a total of $250 million in fines and compensation Tuesday to settle claims the bank systematically double-charged customers fees, withheld promised credit card bonuses and opened fake accounts without customer authorization.

Sen. Pat Toomey (R-PA) has asked the Consumer Financial Protection Bureau (CFPB) to turn over documents in an effort to determine if the agency is replacing career senior officials with hand-picked activists, as Biden promised to be nonpolitical with the agency.

The U.S. Supreme Court heard oral arguments on Tuesday in a case challenging the unchecked power of the Consumer Financial Protection Bureau.

Official White House records undercut a claim Joe Biden made during the fourth Democrat presidential primary debate of whipping votes for legislation that created the Consumer Financial Protection Bureau (CFPB).

Rep. Lee Zeldin (R-NY) told Breitbart News in an exclusive statement Friday that Consumer Financial Protection Bureau (CFPB) Director Kathy Kraninger must “reverse” and withdraw from the agency’s consent judgment on the National Collegiate Master Student Loan Trusts (NCMSLTs).

Sen. Thom Tillis’s office told Breitbart News the Consumer Financial Protection Bureau has overstepped its bounds on the consent judgment against the National Collegiate Master Student Loan Trusts.

Rep. Hakeem Jeffries (D-NY) passionately nominated Rep. Nancy Pelosi (D-CA) for the Speaker of the House on Thursday, even proclaiming that Pelosi “rescued our economy” during the Great Recession.

Sen. Elizabeth Warren (D-MA) formed an exploratory committee to run for President of the United States on Monday, becoming the first major Democratic Party contender to do so.

The future direction of the Consumer Financial Protection Bureau (CFPB) is in question after Kathleen Kraninger was confirmed as the new director of the powerful independent agency in a straight party-line vote on Thursday by the United States Senate, 50 to 49.

A David vs. Goliath lawsuit on the constitutionality of the Consumer Financial Protection Bureau (CFPB) has reached the Supreme Court.

A “conventional cast of technocrats and long-time public officials” leads the Democrats’ efforts to strengthen their hold on the midwestern United States, starting with Consumer Financial Protection Bureau head Richard Cordray’s victory over the progressive “leftist firebrand” Dennis Kucinich.

Ohio Democrat gubernatorial candidate Richard Cordray gave a hedge fund manager a sweetheart deal in his final months as director of the Consumer Financial Protection Bureau (CFPB).

Sen. Elizabeth Warren (D-MA) attempted to turn the Senate Banking, Housing, and Urban Affairs Committee’s confirmation hearings on Consumer Financial Protection Bureau (CFPB) nominee Kathy Kraninger on Thursday into a morality play about President Trump’s immigration policies.

A senior White House official defended President Trump’s nomination of Kathy Kraninger, who has no experience in banking regulation or consumer finance regulation, to become director of the Consumer Financial Protection Bureau (CFPB).

President Trump chalked up another win at the CFPB last week when former deputy director Leandra English resigned and dropped her lawsuit against the White House.

Sen. Elizabeth Warren (D-MA) tweeted on Tuesday that she will put a hold on President Trump’s nomination of Kathy Kraninger to head the Consumer Financial Protection Bureau until the OMB staffer “turns over all documents about her role in” the administration’s enforcement of the border crossing child separation law signed by President George W. Bush more than a decade ago, as detailed in the “Zero-Tolerance Policy” announced by Attorney General Sessions in April.

Lawsuits challenging the constitutionality of parts of the Consumer Financial Protection Bureau (CFPB) are likely going to the Supreme Court late this year, as the left-leaning majority of a D.C.-based federal appeals court sided with the powerful agency.

President Donald Trump re-ignited his long-running feud with CNN this past weekend. He tweeted: .@FoxNews is MUCH more important in the United States than CNN, but outside of the U.S., CNN International is still a major source of (Fake) news,

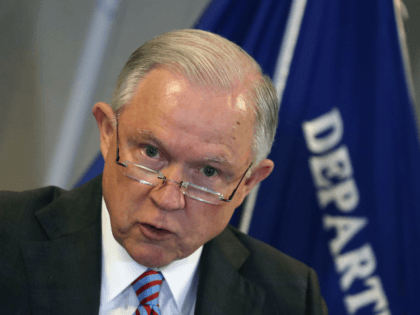

Attorney General Jeff Sessions’ Department of Justice (DOJ) responded late Monday to a lawsuit by Deputy Director Leandra English of the Consumer Financial Protection Bureau (CFPB) to block President Donald Trump’s appointment of Mick Mulvaney as acting director of the CFPB, making a compelling case as to why the president’s appointment is valid, the English’s lawsuit is a frantic attempt by an Obama holdover to keep CFPB under the control of DC’s Swamp.

The Consumer Financial Protection Bureau awarded a $14.7 million contract to a liberal advocacy firm, GMMB, a group that has close ties to 2016 candidate Hillary Clinton and former President Barack Obama.

According to its director Richard Cordray, the Consumer Financial Protection Bureau (CFPB) is “something that has to be kept separate from partisan politics.” Cordray has continuously referred to the Bureau as “an independent agency” and prides himself on working to protect all consumers, regardless of political affiliation. But what he is trying so desperately to hide is that the CFPB is the most political and partisan agency in the federal government.

A district court last Friday dealt a blow against the Consumer Financial Protection Bureau (CFPB) by dismissing the CFPB’s lawsuit against the payment processor, Intercept Corp., arguing that it failed to present sufficient evidence in the case.

The Trump White House is weighing its options to fire Consumer Financial Protection Bureau (CFPB) Director Richard Cordray.

Speaker Paul D. Ryan (R.-Wis.) and Senate Majority Leader Mitch McConnell (R.-Ky.) told reporters Thursday at the Republicans’ policy retreat here that they are committed to a 200-day program to implement the agenda of President Donald J. Trump.

Elaine Chao, Donald Trump’s nominee to head the Department of Transportation, could collect up to $5 million in Wells Fargo preferred stock after assuming her new role in the Trump administration.

President-elect Donald Trump could rescind financial regulations that cost the financial services industry at least $1.7 billion, according to a new analysis from the American Action Forum.

A federal appeals court on Tuesday ruled a key part of Barack Obama’s Dodd-Frank law unconstitutional, calling it a “grave threat to individual liberty.” This tees up yet another case for an evenly divided Supreme Court, the balance of which will be decided by whether Donald Trump or Hillary Clinton is elected in November.

CFPB Director Richard Cordray says the agency is proposing “a rule aimed at ending payday debt traps by requiring lenders to take steps to make sure consumers have the ability to repay their loans rule to end payday debt traps.”

President Barack Obama is bringing the subprime-mortgage crisis back, fueled by the progressives’ political urge to treat borrowed money loans as a “right” that everyone is “entitled,” and by the willingness to dismiss mathematical probability as a racist conspiracy.

Half of America’s children have a parent with a criminal record, creating many “barriers to opportunity” for parents and children, says the liberal Center for American Progress.

One of the unusual aspects of Dodd-Frank is that, in effect, it removed the CFPB from the Congressional appropriations process and gave CFPB what amounts to an unlimited budget.

This foray into the potholes and backroads of Tennessee is a new area of regulatory control, even for the CFPB. But, as American Banker reported, Congress granted the CFPB the authority to do so in an obscure passage of the Consumer Financial Protection Act of 2010, known more commonly as the Dodd-Frank Act.

The federal government aims to “protect” consumers by regulating away a payment option that’s popular with low-income Americans.

Senator Elizabeth Warren (D-Mass) has not commanded much public attention since Hillary Clinton started channeling Warren’s book, Fighting Chance, which claims the “system is rigged” against the middle class because it is controlled by and for the elites who tilt the game in their favor. But in a bold effort to take all the oxygen out of the Clinton campaign, Senator Warren (D-Mass.) laid out a bare-knuckles legislative road map on Wednesday to kick Wall Street in the teeth.

President Obama attacked the GOP budget for weakening financial regulation that is key to “protecting working Americans’ paychecks” during Saturday’s weekly address. Transcript as Follows: “Hi, everybody. Five years ago, after the worst financial crisis in decades, we passed historic