Breitbart Business Digest: Leading Economic Indicators See Us on Cusp of Recession Yet Again

By many of the most reliable leading indicators of the U.S. economy, we are long overdue for a recession. Yet the economy stubbornly refuses to cooperate.

By many of the most reliable leading indicators of the U.S. economy, we are long overdue for a recession. Yet the economy stubbornly refuses to cooperate.

The Federal Reserve appears to expect the softest of landings next year.

The biggest question in economics today is whether the Fed can engineer a soft landing.

The announcement of the Federal Reserve’s interest rate target is likely to be the least interesting thing coming out of this week’s Fed meeting.

The negotiations between the United Auto Workers (UAW) and the Big Three are haunted by the specter of Bidenflation.

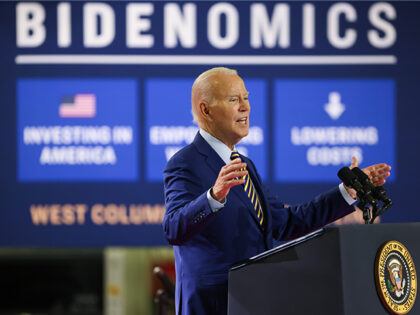

The looming strike by the United Auto Workers is as much a protest against Bidenomics as it is the policies of General Motors, Ford Motor Company, and Stellantis.

The risks of inflation persistence got harder to ignore with Wednesday’s release of the consumer price index for August, and rising energy prices played a big part.

The last time household income suffered a decline as large as it did in the second year of Biden’s presidency was in the second year of Biden’s vice presidency.

If Joe Biden was hoping this would be a hot Bidenomics summer, he has got to be feeling pretty disappointed right now.

The Biden administration’s deficit spending has become a big part of the inflation problem.

The idea that economic growth is faltering received another blow on Wednesday when the Institute for Supply Management reported that the services sector expanded for the eighth straight month in August.

Let’s face it. This is Taylor Swift’s economy. The rest of us just work in it.

Jerome Powell has frequently said that the Federal Reserve sees the stance of monetary policy as “restrictive.” The American consumer, however, begs to disagree.

You have to wonder if Jerome Powell is a bit frustrated that the unbridled enthusiasm of the stock market this week.

Today’s JOLTS data provided reassurance to monetary policymakers that inflationary pressures from the labor market may be retreating.

If Biden’s economic programs really were working to grow the economy “from the bottom up and the middle out,” Foot Locker would be thriving.

What if we had a housing recovery and no one showed up?

How much of our inflation problem is due to output declines and disruptions and how much is due to stimulus-fueled excess demand?

A Hemingway character famously describes his bankruptcy as happening “gradually and then suddenly.” This week, investors began to worry that China has entered the “suddenly” stage of its financial decline.

Bidenflation is not bad for everyone.

The economic data we have seen so far for the third quarter is nothing short of sizzling.

China’s authorities have responded to the inconvenient facts about the country’s burgeoning unemployment problem by suspending the publication of data on youth unemployment.

Climate researchers are among the biggest skeptics of Joe Biden’s claim that he can create jobs while fighting climate change.

A clear sign of a recession for most folks is that the stuff they need is increasingly financially out of reach, and whether that’s because jobs are scarce or prices are soaring probably does not matter that much.

The Federal Reserve probably got what it wanted in the July inflation numbers. The Biden administration was not as lucky.

Barstool Sports co-founder Dave Portnoy announced on Tuesday evening that he had bought back Barstool from Penn Entertainment.

When we elected a self-styled “car guy” as President of the United States, this was not quite what we expected.

The annual monetary policy conference in Jackson Hole, Wyoming, has the potential to produce some explosive results.

The strength of the labor market has made “jobs” a far less important political issue going into the 2024 election.

Someone forgot to tell the Hamptons that monetary policy has become “restrictive.”

Politicians and pundits might delight in aiming their blame-throwers at their rivals over the U.S. credit rating downgrade. For markets and the economy, however, it does not matter.

The Manufacturing Recession May Have Hit Bottom A few months ago, we were among the first to notice that the housing downturn appeared to have ended. Now it looks like manufacturing has hit its cyclical nadir. The purchasing managers’ surveys from

Remember, Goldilocks was sleeping soundly, with her belly full of “just right” porridge, until the bears came home.

The data this week that has inspired such confidence that we are heading for a soft-landing should likely be interpreted as signaling that monetary policy is not yet restrictive enough.

The U.S. economy grew at a 2.4 percent annual rate in the second quarter, the Commerce Department said on Thursday.

Federal Reserve Chairman Jerome Powell said the Fed is no longer forecasting a recession given the latest economic data showing the resilience of the U.S. economy.

Republicans pinning their hopes for 2024 on Bidenomics being a flop should develop a backup plan.

Maybe history will call this week’s move by the Federal Reserve the Barbenheimer Hike.

The so-called “vibecession”—in which people feeling terrible about the economy despite very low employment—appears to be in retreat. Just ask Taylor Swift’s concert-goers.

Even the economists do not believe the Federal Reserve.