Breitbart Business Digest: Even The Fed Doves Sound Hawkish

So, what does it sound like when doves cry?

So, what does it sound like when doves cry?

The most underpriced risk in financial markets right now is a rate hike from the Federal Reserve.

The Bond Market Is Like a Dog Walking on Two Legs We have it on the authority of James Boswell that in the summer of 1763 Samuel Johnson said that “a woman’s preaching is like a dog’s walking on his

The much-better-than-expected jobs data for January demonstrates that the Federal Reserve was absolutely right this week to rule out a March rate cut. Even a May rate cut now looks unlikely.

Jerome Powell’s No Cut Thunderbolt Groucho Marx famously said he would not join any club that would have him. What happens, however, when the club joins you? We have been arguing since early December that economic growth was too strong

The Fed Fights Back The Federal Reserve delivered a shock on Wednesday by announcing that it does not anticipate cutting rates until it gets more confident that inflation is moving toward two percent. “The Committee does not expect it will

The Shaky Edifice of Improved Consumer Confidence Americans are feeling better about the economy than they have in years. Or at least Democrats are. Consumer confidence—as measured by the Conference Board’s monthly survey—surged to a two-year high in January, the

Will the Fed defend the position it staked out in December or capitulate to the view of bond traders?

The Federal Reserve has a lot less influence over business activity than is commonly thought.

The Wall Street prognosticators got it all wrong.

The economy is signaling that it does not need a rate cut to keep growing. The question is whether the Federal Reserve is listening.

The Federal Reserve’s plans to cut interest rates this year have run into a powerful headwind: excessive government spending.

The market is slowly coming around to the view that the immediate threat to the economy is sticky or rising inflation and not a recession.

This week’s economic data very likely pushed the timing of a rate cut further out on the calendar.

The American consumer’s strength may be the force that wrestles the market out of the conviction that the Fed will cut interest rates this March.

The prospects of a soft landing for the economy is no reason for the Federal Reserve to rush into rate cuts.

The financial press once again ignored the details that indicate that the era of disinflation has come to a close and risks of higher inflation are increasing.

The case that the economy is headed for a “soft landing” received a sharp setback on Thursday with the release of data showing inflation accelerated at the end of last year.

The consumer inflation report this week has the potential to upset the consensus view that the Federal Reserve will start cutting rates in the first quarter of this year.

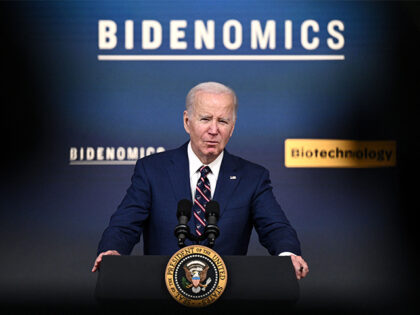

A small army of establishment media types and economists have engaged themselves in the task of unraveling what they take to be the great mysteries of our time: why the public is so unhappy with the state of the economy and why the public is not more grateful to President Joe Biden for the state of the economy.

Pick any measure of consumer sentiment you find and the reading will be the same: the Biden economy stinks.

The dream of a March rate cut has survived the December jobs report.

An election year rate cut followed by a rise in inflation and then a new hiking cycle would cement the view that the Federal Reserve acted on political motives.

The market appears to be losing a bit of its nerve when it comes to the conviction that the Federal Reserve will aggressively cut rates this year.

The Breitbart Business Digest had the opportunity to sit down for an exclusive interview with a tanned, rested, and jovial Donald Trump at Mar-a-Lago last week for more than two hours. The conversation repeatedly returned on the state of the U.S. economy and his predictions for this election year.

The basic premise behind the conviction that the Federal Reserve will start cutting rates in the first quarter of next year is looking shakier.

Could the housing market finally be cracking under the pressure of higher interest rates?

The stock market does not seem to believe we are headed for a recession next year.

The Federal Reserve Chairman’s silence is an implicit endorsement of the market’s view that we’re headed for five or six rate cuts next year.

It’s fun to play with Frosty the Snowman, but eventually he melts.

The market’s reaction to the Fed’s dovish pivot last week is withstanding the pushback from former and current Fed officials.

New York Federal Reserve President John Williams said Friday that rate cuts are not a topic of discussion for the central bank.

The markets are delighted that they heard Powell say, as he drove out of sight, “Rates cuts for all—and to all a good night.”

The inflation report released Tuesday is unlikely to do much to support the idea that Bidenomics has been a boon for the American economy.

The American consumer is rushing into the end of 2023 in high spirits—in part because they like how next year’s election is shaping up.

The November jobs numbers were a kick in the teeth to traders betting that the Federal Reserve would start cutting rates in March.

Christmas came early for many consumers in the U.S. this year, and that may have created an illusory drop in inflation and retail spending.

Buckle up and return to your seats. There’s likely to be some turbulence ahead.

The Federal Reserve may have to get back to work.

Even Taylor Swift may not be able to save the economy from a wokecession in entertainment.