Breitbart Business Digest: Is the Fed’s Monetary Policy Still Too Loose?

The Fed meeting minutes released on May 22 mentioned “various officials” worrying that rates might not be as restrictive as thought.

The Fed meeting minutes released on May 22 mentioned “various officials” worrying that rates might not be as restrictive as thought.

The National Rifle Association’s big victory at the Supreme Court on Thursday puts a target on climate change regulations that have put fossil fuel companies under fire.

It is becoming clearer with each passing day that there will be no interest rate cuts in the immediate future—and maybe not even in the distant future.

The Conference Board’s monthly measure of consumer confidence is another piece of evidence suggesting that the economy accelerated in May.

While Wall Street has finally come around to the view that interest rates are likely to stay higher for longer, it may still be underestimating just how high and how long.

Inflation is increasingly coming to resemble the old joke about the weather: everyone talks about it, but no one ever does anything about it.

There’s a palpable tension in the air as Wall Street is confronted with the once unthinkable: interest rates may not be at their peak.

If Donald Trump’s social media venture is going to vindicate the faith of investors who have given it a six billion dollar market value, it must learn a critical lesson from the tech titans of the past: substantial early losses can be a harbinger of long-term success.

You can add the collapse of the U.S. consumer to the list of things that nearly everyone has been expecting but shows no signs of actually occurring.

American progressives are in a state of high dudgeon, gnashing their teeth at the realization that the American people favor Donald Trump’s economy over Joe Biden’s.

Jerome Powell might want to look away from the stock market. It’s making a mockery of the idea that financial conditions are sufficiently restrictive.

One month’s worth of data does not make a trend—unless it fits the consensus narrative that the Fed is going to cut interest rates a few times this year.

Jerome Powell still stubbornly resists the idea that the Fed’s next move may be a hike rather than a cut.

Joe Biden is not a general, but he suffers from the generals’ curse of always fighting the last war.

There’s really no mystery why so many people are unhappy with the Biden economy.

The specter of inflation haunts the corridors of the West Wing, and the Biden administration’s every attempt to exorcise the poltergeist of rising prices only deepens the grip of its possession.

The Fed and many on Wall Street assume that the villain of excess saving has been put to rest. Don’t be so sure.

If you can slow down the housing market, you can probably slow down the economy and reduce inflation.

Somebody forgot to tell corporate America that the stance of monetary policy is restrictive.

Job growth slowed by much more than expected in April, fueling visions of multiple rate cuts this year and sending the stock market soaring.

The Federal Reserve admitted yesterday that progress on inflation has stalled and that it will take longer for the Fed to achieve the confidence it needs to cut interest rates.

Republicans looking out across the chaos that has engulfed American campuses should take Richard Nixon’s advice: “Never murder a man who’s committing suicide.”

As the evidence keeps pouring in that the U.S. is still mired in an inflationary economy, the possibility that the Federal Reserve will be forced to increase interest rates can no longer be ignored.

Can the jobs numbers really be as good as they look?

It is unlikely that the Fed will cut rates at all this year; and, if inflation stays hot, it may find that it will need to begin a new cycle of rate hikes sometime next year.

The pace of economic growth in the first three months of the year was far more sluggish than anyone expected—and inflation was much higher.

The Biden administration’s declaration that it will treat almost all noncompete provisions in employment agreements as illegal should be seen for what it is.

The big driver of General Motors’ great earnings report has been the Detroit automaker’s decision to focus on selling the gas-powered vehicles their customers want to drive instead of the electric vehicles the Green New Deal activists think they should be driving.

Perhaps if we started an Inflation Day movement, more attention could be drawn to the fact that rising price levels are the results of public policy choices.

The country is not moving in the right direction, and the economy is a major a factor. But the legacy media is focused on wall-to-wall coverage of he who is known as “The Bad Orange Man.”

As is so often the case with Bidenomics, even good news is bad news because of the upward inflationary pressure.

The latest edition of the Beige Book provides far more red flags than silver linings.

Jerome Powell spoke today from our nation’s capital and indicated what we all know to be true: The Fed has no business cutting rates at this time.

In this election, we have a tale as old as time: the Democrat wants to confiscate more of what you make for the government’s pleasure, and his Republican challenger does not.

This year’s presidential and congressional elections are unlikely to be decided on the issue of tax policy, but they will very likely determine how much of the tax cuts enacted under President Donald Trump survive.

Someone should let President Biden know that the Federal Reserve is not going to deliver him a politically expedient rate cut.

The victory over inflation that the Biden administration and many on Wall Street were eager to celebrate last year now seems to have been, well, transitory.

There’s a specter haunting Wall Street. The specter of resurgent inflation.

Breitbart’s Jim Pinkerton believes there is a profitable and practical solution to the issue of carbon emissions that doesn’t involve banning gas-powered vehicles.

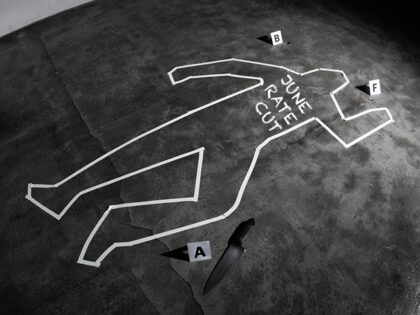

The dream of a June rate cut is dead.