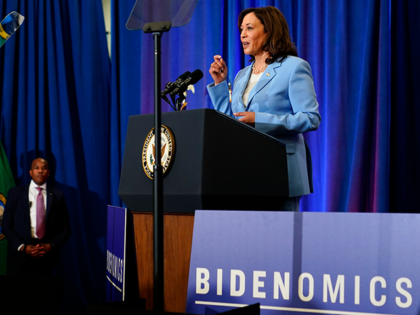

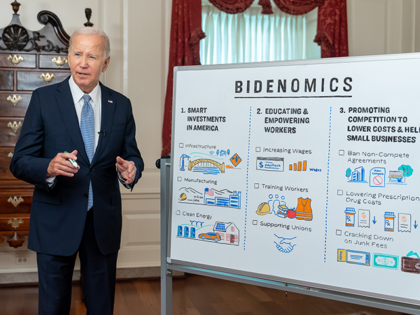

Breitbart Business Digest: Kamala Harris’s Fingerprints Are All Over the Market Plunge

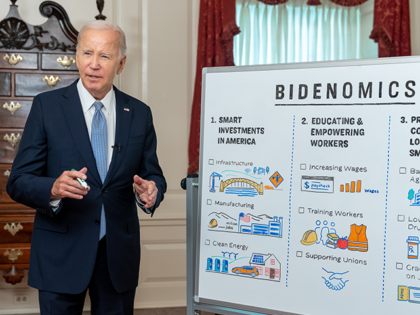

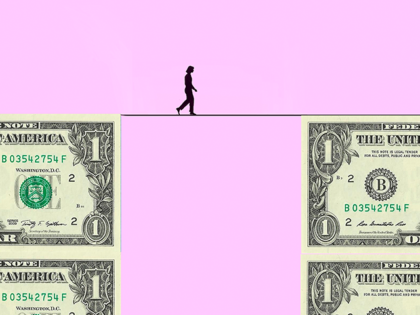

While we cannot say for sure that the death of the soft-landing and the market sell-off was caused by Kamala Harris, surely anyone investigating the matter should consider the vice president a person of interest.