Breitbart Business Digest: Core Inflation Went from Bad to Worse in April

The idea that we might be headed toward a “softish landing” was probably the great victim of the April report on the Consumer Price Index.

The idea that we might be headed toward a “softish landing” was probably the great victim of the April report on the Consumer Price Index.

There is likely to be a lot of discussion around the idea that March was “peak inflation” if the Consumer Price Index for April comes in as expected on Wednesday.

The one hundred and forty-eighth running of the Kentucky Derby produced an excellent reminder that markets do not always get everything right.

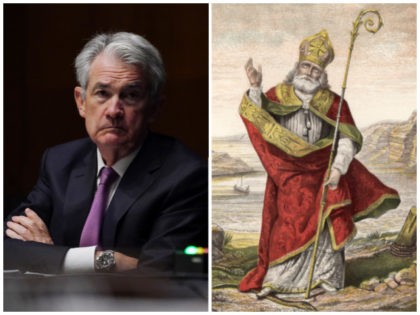

The faith of the followers of Fed Chairman Jerome Powell is fickle. Thursday’s massive stock sell-off completely erased all of Wednesday’s Powell-inspired gains and then some.

Jerome Powell still believes in immaculate disinflation—and he appears to have won the market over to his view.

Fifty-seven percent of the economists, strategists, and fund managers in a recent CNBC poll say they expect the Fed’s interest rate hikes to result in a recession.

What if the problem is not just the nonexistence of a “free lunch” but a shortage of lunches altogether?

If we had not already quoted old Tom Eliot on the alleged cruelty of April, we would certainly be tempted to do so again after Friday brought the April sell-off to such a crescendo.

The experts have been telling us for months that the economy was doing extraordinarily well once you look past the little problem of inflation. The American people weren’t buying it. And today’s Bureau of Economic Analysis revealed that the people were right.

Twitter accepted billionaire Elon Musk’s $44 billion buyout offer, the company announced on Monday.

For the stock market, April has indeed been the cruelest month in part because it has seen a blossoming awareness that inflation is not going to die of exhaustion after hitting 40-year highs.

If you want to know why the supply of oil is responding so sluggishly to demand, direct your attention to the explosive popularity of environmental, social, and governance (ESG) investing.

The notion that the March Consumer Price Index marked peak inflation was dealt a sharp blow by the Federal Reserve’s Beige Book on Wednesday.

In short order we will start to see the effects of China’s COVID “static management” lockdown in global supply chains and the supply of goods in the United States.

Just as Elon Musk made a weed joke with his offer to buy Twitter at $54.20 per share, Twitter’s board responded with their own weed joke.

Elon Musk yet again grabbed headlines across the media universe today by offering to buy Twitter for $43 billion.

Another day, another drop of alarming data for the American economy.

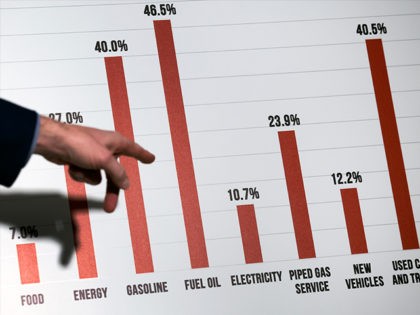

Consumer prices rose 8.5 percent in data released Tuesday, marking the highest spike the United States has seen since 1981.

No one other than Musk truly knows why he didn’t join Twitter’s board, but it is clear that Musk knows what he wants (attention and money) and is getting more of it every day.

We are witnessing the potential destruction of globalization and the fragmentation of the global economy into competitive but somewhat isolated trading groups.

Consumers are coping with inflation by piling debt onto their credit cards, but that debt will become more expensive when the Fed hikes interest rates to fight inflation.

The Federal Open Market Committee’s March meeting minutes indicate that the Federal Reserve still believes it can bring down inflation painlessly.

The yield curve uninverted on Tuesday morning. The proximate cause seems to be the hawkish inflation-fighting rhetoric now coming from typically “dovish” Fed officials.

The world’s richest man became even wealthier on Monday after he disclosed that he had acquired 9.2 percent of Twitter.

The arrival of yet another blowout jobs report sent yields on U.S. government bonds rising on Friday—and inverted the yield curve again.

A key market gauge of the risk of future recessions flashed a warning signal on Thursday afternoon.

While Democrats are accusing oil companies of price gouging, climate activists are demanding that banks stop financing fossil fuel development.

President Biden’s tax proposal would tax the gains now, leaving fewer gains to be taxed in the future.

President Joe Biden’s proposed budget for the coming year uses an inflation estimate that even the White House admits is unrealistically low.

A new survey shows the extent of the American public’s loss of confidence in the Fed and the Biden administration’s inflation fighting skills.

Last week’s unemployment claims were at the lowest level since Richard Nixon’s first year in the White House.

Your suspicion that Wall Street might not have your best interest in mind has some scientific validity, according to a new study.

The market appeared to register a no-confidence vote on the Federal Reserve’s inflation-fighting.

Federal Reserve Chairman Jerome Powell apparently figured out that the market had not quite got the message that he intends to be tough on inflation.

Sarah Bloom Raskin took a bet that America was ready for climate regulation through bank supervision.

Harvard economist Gabriel Chodorow-Reich coined the phrase “immaculate disinflation” to describe Fed Chairman Jerome Powell’s persistent belief that the Fed can bring down inflation painlessly.

The wave of euphoria that washed over the stock market on Wednesday following the long-awaited rate hike should probably be taken as a warning sign.

This week’s drop in the price of oil appears to be related to news that China’s economy may be slowing down due to rising coronavirus infections.

A prolonged shutdown in China could mean higher inflation in the U.S., and that’s likely to weigh on the minds of Fed officials as they meet this week to discuss their interest rate target.

However much you disapprove of the job Biden is doing on inflation, he disapproves of the job you are doing with inflation even more.