Breitbart Business Digest: Biden’s Incredible Shrinking Economy

Gross domestic product shrank again last quarter, confirming the widespread impression that the economy is lousy.

Gross domestic product shrank again last quarter, confirming the widespread impression that the economy is lousy.

There’s no doubt that the Federal Reserve is going to raise its interest rate target at the end of tomorrow’s meeting of the Federal Open Market Committee. What we do not know is how much they will raise.

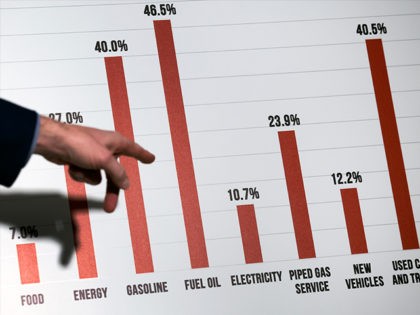

When inflation increases the cost of necessities like food and energy, it draws spending away from other parts of the economy. This dynamic – often referred to as the “inflation tax” – is now expected to take a big bite out of Walmart’s earnings.

G.K. Chesterton once said that he owed his success to having listened respectfully to the very best advice, and then doing the exact opposite.

The recession is calling, but it’s probably not paying its phone bill on time.

Everything is so expensive no one can afford to buy anything anymore.

It increasingly looks like it may take a recession to tame inflation—a recession that may already be underway.

Oil prices plunged on Tuesday ahead of President Joe Biden’s first trip to the Kingdom of Saudi Arabia.

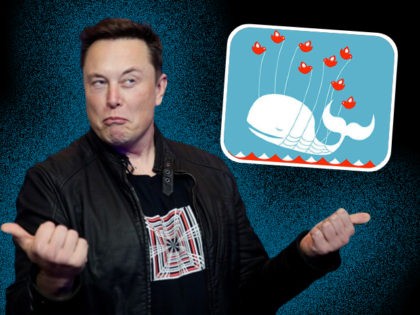

It will surprise absolutely no one that Twitter does not agree with Elon Musk’s announcement that he is terminating his acquisition of the social media company.

Is productivity suffering because so many people are working from home or because so many people are returning to the office?

What if we held a recession and no one lost their job?

The Federal Reserve’s campaign to rein in the worst inflation in decades will end in a recession. But so long as unemployment remains low, it’s likely inflation will remain the top worry for households even if economic growth stalls.

We have put to rest the first half of 2022, and we cannot say we’ll miss it.

If corporate greed was responsible for the inflationary price hikes, we would see corporate profits soaring as inflation rose to 40-year highs this year. Instead, corporate profits fell in the first three months of this year.

These are the times that try men’s souls—and budgets. This year’s Fourth of July celebrations will be hit hard by inflation.

A repeal of the tariffs on goods imported from China would do absolutely nothing to the two most politically salient parts of inflation: gas prices and food prices.

If it takes a recession—or even a period of stagflation—to bring down inflation, so be it. So says Fed Chair Jerome Powell.

Fed Chair Jerome Powell bluntly rejected the Biden administration’s claim that the biggest driver of inflation right now is the war in Ukraine.

Kellogg’s did real damage to its brands when it decided to take sides in American politics by boycotting Breitbart.

The price of gas has risen because demand has far outpaced supply. So, the Biden White House had the brilliant idea of sending people special debit cards to buy gasoline, thereby pumping up the demand while continuing to choke off the supply.

The annual tech and media symposium that Allen & Co. organizes at the Sun Valley Resort has been described as a “summer camp for billionaires.” This year it might seem a bit like a week at Easter Lake, the fictional summer camp repeatedly plagued by a hockey-masked serial killer named Jason.

While the Federal Reserve did the right thing on Thursday by raising its target by three-quarters of a percentage point, the question of whether the central bank will continue to do the right thing remains open.

The Federal Reserve is going to have to play catch up to rein in inflation.

The Federal Reserve Bank of New York’s monthly survey of U.S. households indicates a dramatic turn for the worse in both current conditions and expectations for the year ahead.

The most recent poll from the Economist and YouGov is indicative of just how big of a problem inflation is for Biden and the Democrats.

Cassandra’s forecasts about the destruction of Troy turned out to be as accurate Republican forecasts about our current economic turmoil, but neither were believed by the powers-that-be.

We have to wonder if someone at the White House is thinking that if you’ve lost Cardi B, you’ve lost America.

The cracks that have started to emerge in the post-pandemic recovery grew a bit more visible in the May jobs report.

The Saudis have scored a great diplomatic victory by winning a Biden visit and whatever other favors the administration has promised the kingdom in exchange for more oil. Unfortunately, none of this will help American motorists.

The White House launched a campaign this week to shift the public’s perception away from the idea that inflation is the result of the Biden administration’s policies.

It looks like Federal Reserve Chairman Jerome Powell might be the Biden administration’s next fall guy for inflation now that the corporate greed and Putin Price Hike narratives have failed to work.

After seven weeks of grinding grimness, the stock market found itself in the grip of euphoria as we stumbled toward Memorial Day.

The government said on Thursday that the economy shrunk more in the first quarter than it initially estimated.

No matter which index we use to adjust for inflation, it is clear that durable goods orders actually declined in real terms in April.

The economic data out on Tuesday significantly raised the risk of a recession and moved forward the possible start of an economic slump.

Donald Trump unleashed withering mockery at the news that Elon Musk will now be voting Republican.

Those who can still laugh are saying the stock market has turned their 401(k) into a 301(k).

Walmart might not have lost money on every sale in the first quarter of 2022, but it came much too close to that result for comfort.

The infamous Twitter Fail Whale came to mind today when shares of Twitter fell below where they had closed on the day before Elon Musk announced his acquisition of a big stake in the company.

The bad news is that Thursday’s April producer price inflation figures showed that inflation had not cooled by as much as expected.