Breitbart Business Digest: How Biden’s ‘Rescue Plan’ Wrecked the Economy

It’s now becoming much clearer just how unnecessary the Biden administration’s 2021 spending spree was and why it sparked the worst inflation in decades.

It’s now becoming much clearer just how unnecessary the Biden administration’s 2021 spending spree was and why it sparked the worst inflation in decades.

It was only five months ago that the U.S. trade deficit in goods hit a record high of $125 billion. Now we’re all the way down to $87.4 billion.

While a lot of the commentary on inflation has centered around the idea that we may have passed peak inflation, the more relevant question is whether we have already had peak disinflation.

The Dallas Fed survey showed that payrolls are still growing in Texas, despite the decrease in demand. This does not look like an economy that is reeling from Fed hikes, much less one that is about to see inflation fall.

They are still pursuing stealth regulation of the global economy through financial institutions.

Fed officials have a very wide range of projections for Fed policy two years from now.

Jerome Powell took up arms against a sea of troubles on Wednesday.

The Federal Reserve is convinced that inflation expectations are extremely important. But are they right about which inflation expectations? The consensus view among Fed officials appears to be that longterm inflation expectations deserve the most attention. When Fed officials look

President Joe Biden keeps trying to talk America out of worrying about inflation, but it is not working. One of the reasons Biden has been so ineffective is that he has repeatedly made statement that conflict with the reality Americans

Just for appearance’s sake, you would have thought that one of the homeowners in Martha’s Vineyard would have offered to open his or her house to the migrants shanghaied to the island by Florida governor Rick DeSantis.

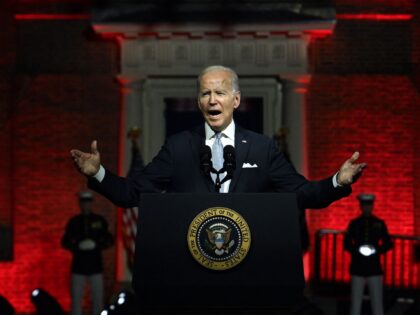

The pageant that played out on the law of the White House on Tuesday may be destined to be the emblematic scene of Joe Biden’s presidency.

Republicans have noticed that many U.S. businesses are hostile not only to their values but also to Republicans and conservatives themselves.

Although it may be somewhat counterintuitive, the prices of oil and food are likely to influence each other in the opposite way than the establishment media assumes.

Just how unbalanced is the labor market? Federal Reserve Chairman Jerome Powell sees it as extremely unbalanced, with demand for workers far outstripping supply.

Fed officials are likely to increase their interest rate target by three-quarters of a percentage point at their policy meeting this month.

Do you believe that business activity in the U.S. services sector contracted or expanded in August?

The morning after President Joe Biden delivered his Dark Brandon at the Gates of Hell speech, the Labor Department delivered a jobs report that was pretty close to perfect.

It appears that Jerome Powell’s speech in Jackson Hole finally convinced investors that they could not fight the Fed.

The number of open jobs in the United States rose in July, defying predictions that vacancies would fall for a fourth straight month and dashing hopes that the Federal Reserve’s monetary policy tightening had already throttled demand for labor.

A solid majority of Americans think we are in a recession, but that consensus conceals some deep divides divide on the economy.

The debate over the Biden administration’s student loan scheme has somehow become even stupider as the week has worn on.

In his Jackson Hole speech, Fed Chair Jerome Powell needs to show the market that he is carrying bear spray—or something stronger—and is not afraid of the bears.

It’s hard to imagine a worse time for the U.S. government to decide to launch a massive student loan forgiveness program than right now.

The idea that the U.S. economy may be in a recession got a boost on Tuesday from the S&P Global survey of purchasing managers.

There was good news for Jerome Powell in the National Association of Business Economist survey released Monday: the Fed’s policy has become a lot more popular.

Next week Jerome Powell will find himself facing down financial markets at the feet of the Teton Mountains in Jackson Hole, Wyoming, each standing in the summer heat daring the other to blink first.

Let us review where we stand on the various channels through which monetary policy is thought to act on inflation.

The market continues to show skepticism about the Fed’s commitment to keep raising rates to fight inflation.

The good economic news about last month or the month before that is bad news for months ahead of us.

After four straight weeks of gains for the stock market, it is time to admit that Jerome Powell has a problem.

Food prices are good indicators of where inflation is headed.

Also: here’s why food inflation matters more than headline or core prices.

Measures of underlying inflation got worse, not better, in July.

The public may be underestimating how hard it will be to bring down inflation.

U.S. employers added a jaw-dropping 528,000 jobs in July, far more than expected, and wages jumped higher than expected—and yet the number of people working or looking for work declined. Where is everyone?

The Manchin-Schumer bill should now be renamed Build Back China.

Like the famous cartoon character Wimpy who promises to pay on Tuesday for a hamburger today, Sen. Joe Manchin’s inflation bill promises to pay for all its extra spending today with savings sometime in the future.

Amazon is not sweating the corporate tax hike in the Joe Manchin-approved climate spending bill.

July was the best month for stocks since 2020 and the best July for the S&P since 1939. It was also the month in which forecasts of recessions went mainstream.

Here’s how much the Inflation Reduction Act will reduce inflation by: zero.