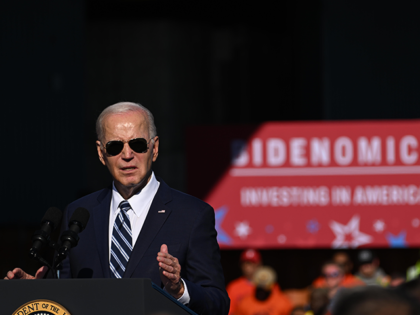

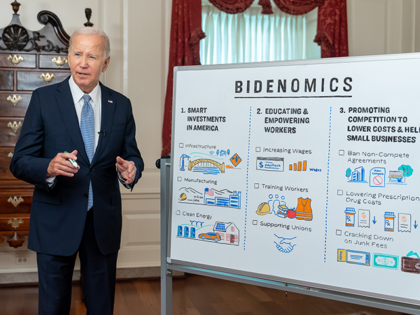

Breitbart Business Digest: Biden’s Inflation Misstep Was a Warning Sign All Along

Biden’s dismissal of inflation concerns wasn’t just a verbal misstep. It was a bizarre signal that Biden wasn’t in touch with the policy discussion going on across the country.