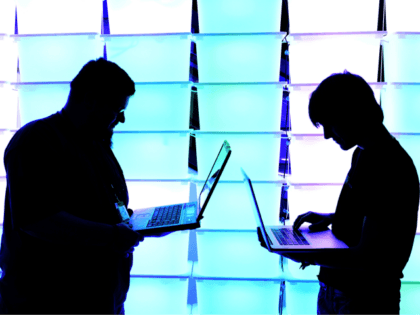

At Least Five Dead After Suspect Opens Fire in Louisville Bank

The Louisville Metropolitan Police Department confirmed that at least five people were killed after a suspect opened fire inside Old National Bank in Louisville, Kentucky, Monday morning.