North American Oil Rig Count Falls Again on Canadian Plunge

No sign of relief from the Russian supply shock.

No sign of relief from the Russian supply shock.

Zero new rigs were added this week despite soaring oil prices.

The $34 billion proposed merger between Houston-based oilfield services companies, Halliburton (NYSE: HAL) and Baker Hughes, Inc. (NYSE: BHI), is reported to be facing imminent cancellation.

The Obama Justice Department filed an antitrust lawsuit Wednesday to block the proposed $34.6 billion merger between Houston-based oilfield services companies Halliburton and Baker Hughes, Inc. The DOJ thoroughly objected to two of the three largest of such companies in the world joining for fears of competitive threats and innovation stagnation.

Royal Dutch Shell has announced it will layoff 2,800 more workers.

The continuing weakness in the oil and gas sector has caused the ax to fall on another energy giant. Chevron announced they will lay off 1,500 employees worldwide. Nearly one thousand of those oil bust job losses will come directly from Houston.

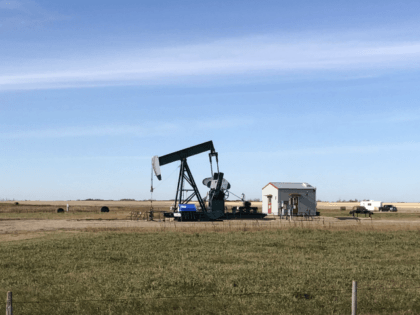

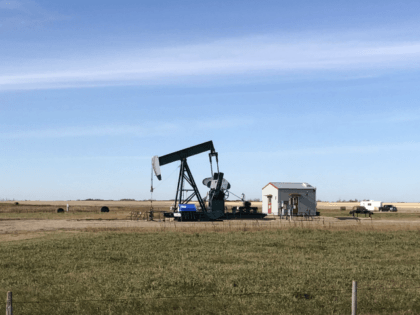

The “Baker Hughes Rig Count” shows the oil & gas drilling rig count has plummeted in the past year. The month April is the first time in 25 years the North American oil and gas drilling rig count has fallen below 1,000 rigs. The price of crude oil in the past year had fallen as much as 50%. Many expensive shale oil wells have become uneconomical at current crude oil prices. Much of the US crude oil increased production comes from shale oil formations with expensive horizontal drilling. Shale oil formations often must be fracked several times; consequently, productions costs are high.

HOUSTON, Texas – Nine thousand workers are set to be laid off by Texas-based oil giant Schlumberger. The oil tool services company said it must fire 9,000 workers because of plummeting crude oil prices and a slow-down in 2015 production and exploration. The employee reduction comprises about 7.5 percent of the company’s 120,000 global labor force.