The media merger stampede is on.

Comcast on Wednesday offered to buy a big part of 21st Century Fox for roughly $65 billion, initiating a bidding war with Walt Disney. Comcast’s bid is all-cash, compared with Disney’s all-stock offer. Comcast’s offer is about 19 percent higher than Disney’s.

The offer is the first of many expected to follow Tuesday’s federal court ruling giving the go-ahead to AT&T to buy Time Warner.

An earlier bid by Comcast was rejected by the board of Fox because of fears that regulators would cry foul. Now that the AT&T acquisition has been approved, however, the risk that regulators might reject it is viewed as much more remote. Comcast was a cable television operator that bought NBCUniversal several years ago, becoming a vertically integrated behemoth.

“We were disappointed when 21CF decided to enter into a transaction with The Walt Disney Company, even though we had offered a meaningfully higher price,” Comcast CEO Brian Roberts wrote in a letter to Fox’s board. “We are pleased to present a new, all-cash proposal that fully addresses the Board’s stated concerns with our prior proposal.”

Older media companies are racing to achieve unprecedented size and scope to fend off what they see as threats from the likes of Facebook, Netflix, and Amazon. Many believe that the key to coming out on top is merging content, distribution channels, communications technology, and data.

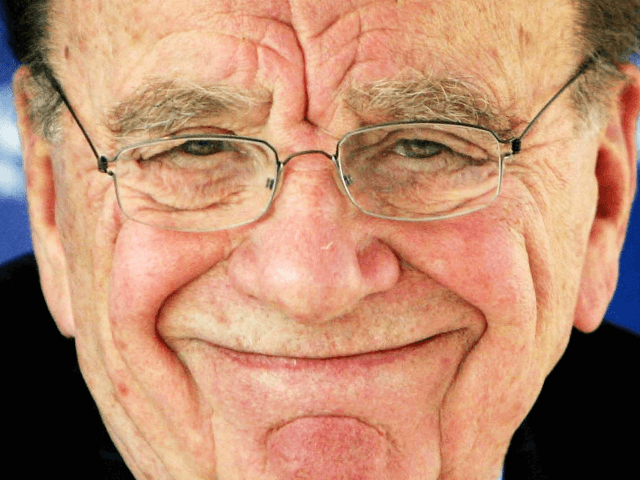

In any case, arguably the biggest winner of Tuesday’s court case was a man who was not directly involved. That would be Rupert Murdoch, the largest shareholder of Fox.